Securing my crypto: What are the options?

Wow, what a year 2022 has been! Another crypto bear market. Multiple bankruptcies within the sector. But the show goes on.

Once again, we were all reminded of old lessons of crypto self-custody. The expression “Not your keys, not your coins” is all over Twitter following the collapse of several cryptocurrency firms.

Does self-custody suit my needs, you ask? Is crypto self-custody actually better than relying on a trusted exchange to hold your coins? You can decide that for yourself after reading our article on the pros and cons of crypto self-custody.

What is a self-custody wallet?

A self-custody wallet is a digital wallet that stores cryptocurrencies and non-fungible tokens (NFT) and gives users full control of their digital assets.

Custodial wallets, on the other hand, are managed by third parties who hold cryptocurrencies on behalf of the user.

How do crypto wallets work? A crypto wallet stores private keys for the user, which represent the control and ownership of cryptocurrencies held in the wallet. Private keys are similar to passwords and are used to authorize cryptocurrency transactions.

Are self-custody wallets secure? Self-custody wallets are considered secure as only the user can access the private keys to the wallet. Self-custody wallet providers cannot access user funds since they do not possess the private keys. However, it is important to note that self-custody wallets are not fool-proof, and users need to protect their private keys from hacks.

What are the different types of self-custody wallets?

Software wallets are free to download and can be used to store, send, and receive cryptocurrencies. These wallets may also have browser features that allow users to use their cryptocurrencies online for staking, blockchain gaming, and more.

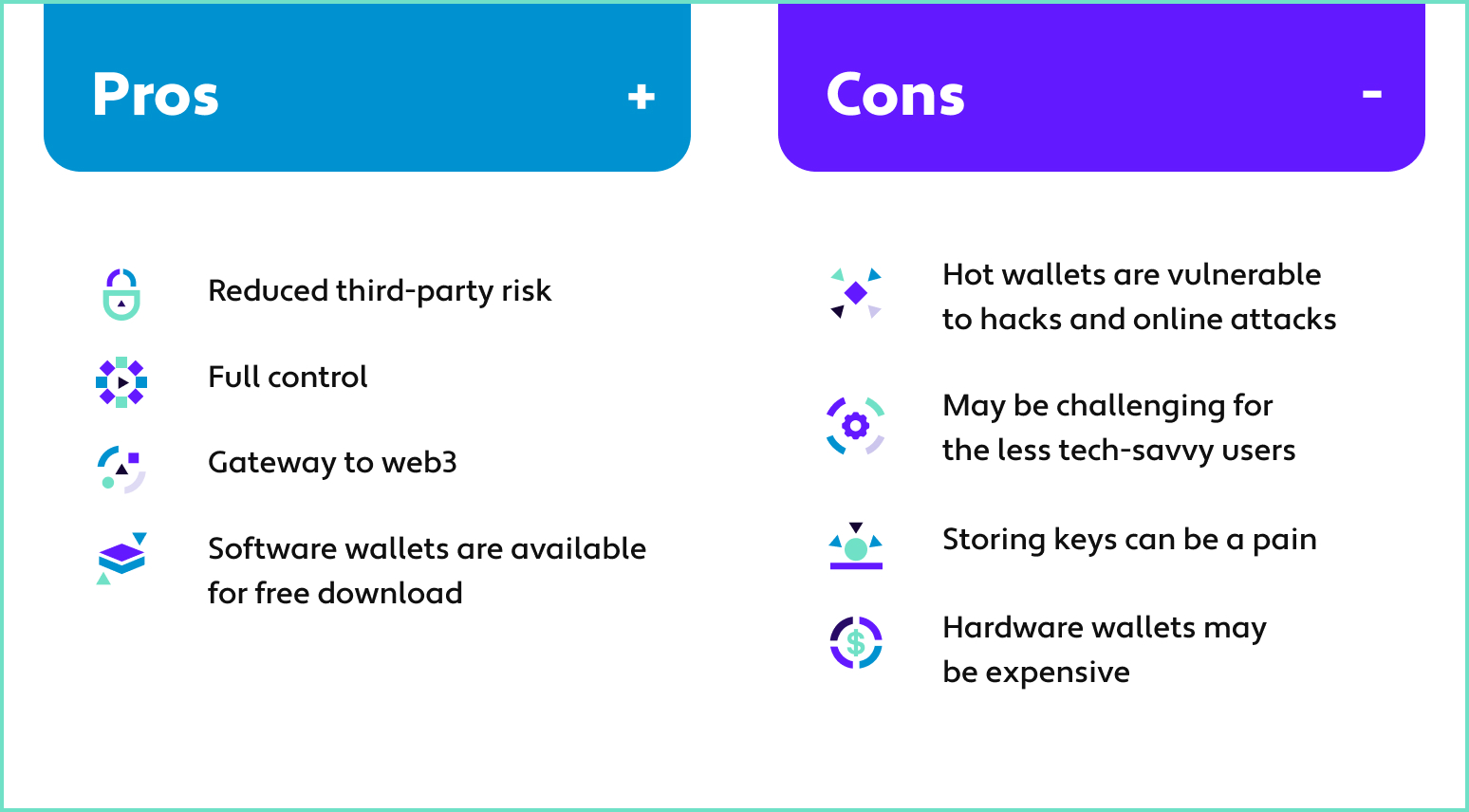

Crypto self-custody: Pros and Cons

Pros

In 2022, the crypto industry saw the bankruptcies of multiple cryptocurrency exchanges and lending firms. Customers at these firms were directly affected as crypto withdrawals were suspended, leaving users uncertain about whether they will ever see their crypto holdings again. This is a significant risk associated with custodial crypto wallets.

Self-custody also reduces the risk of losing cryptocurrencies because of security breaches and hacks at crypto exchanges and other platforms.

From their software wallets, users can swiftly move their cryptocurrencies across decentralized finance (DeFi) protocols for crypto trading, staking, lending, blockchain gaming, and NFT trading.

Users can use software wallets to explore the Web3 universe and learn about its basics, like gas fees.

Therefore, self-custody provides holders with security against government seizures of cryptocurrencies in the event that centralized crypto exchanges are banned.

Cons:

For example, if John wants to send bitcoins to Mary, he will need to do so between two wallet addresses on the Bitcoin network. John cannot send his bitcoins to Mary’s Ethereum address without first converting them into a form that can exist on the Ethereum network, which is known as a “wrapped bitcoin.”

Users also risk losing their cryptocurrencies if they lose their private keys to their software wallets or if they misplace their physical hardware wallets and paper wallets.

What are the benefits of custodial wallets?

Now that we've covered non-custodial wallets in depth, let's move on to custodial wallets.

Custodial wallets are the default wallets that users with accounts on centralized cryptocurrency exchanges use to start their crypto journey.

Convenience and security

The biggest advantage of using custodial wallets is convenience. These wallets are designed to provide users with safe custody of their assets without having to worry about the threat of hacks and theft.

Custodial wallets at reputed crypto exchanges not only have in-app biometric and SMS authentication safety systems but also come with multiple levels of security through partnerships with top internet and encryption technology companies like Cloudflare, SSL, Fireblocks, Ledger, and more.

Trading

Even though custodial wallets are surrounded by fear, doubt, and uncertainty in 2022, they are still the most popular and convenient way to buy cryptocurrencies with fiat currencies.

When investors wish to take a profit, popular exchange-based custodial wallets provide deep liquidity to facilitate fast trades with narrow spreads and low price volatility. Most importantly, crypto investors can transfer their money directly to their bank accounts, depending on their crypto exchange, region, and bank.

Users also have access to tools that record and analyze their trade book and crypto holdings on exchange-based custodial wallets. These tools will come in handy as crypto tax filing requirements are implemented around the world.

Features

Since most custodial wallets are used in centralized crypto exchanges, users have access to educational content, news updates, crypto insights, and market data analytics that can help them make important investment decisions.

Also, exchange-based custodial wallets offer loyalty rewards like free withdrawals, reduced spot-trading fees, crypto rewards, and cashbacks.

Centralized exchanges and custodial wallets are integral to the cryptocurrency sector. They are convenient mediums that connect the new crypto world and the old traditional banking world. The most encouraging part is that these custodial wallets are only going to become safer, more efficient, and more feature-packed with time.

FAQs:

What are the risks associated with custodial crypto wallets?

In 2022, the crypto industry saw the bankruptcies of multiple cryptocurrency exchanges and lending firms. Customers of these companies were directly affected when crypto withdrawals were stopped, leaving users unsure of whether they will ever see their crypto holdings again.

Are self-custody wallets secure?

Self-custody wallets are not foolproof, and users need to protect their private keys from hacks. Users should consider using cold storage options if security is their top priority.

Can a self-custody wallet provider access my funds?

Self-custody wallet providers cannot access user funds since they do not possess the private keys.