Search

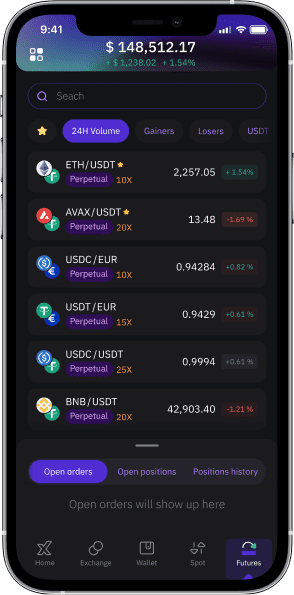

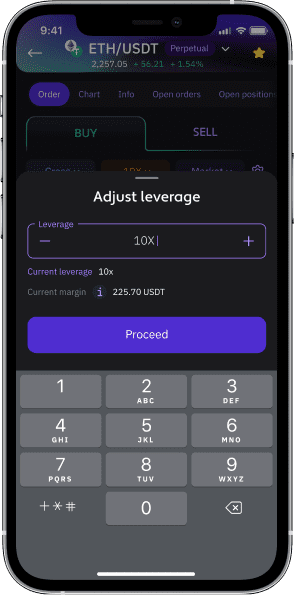

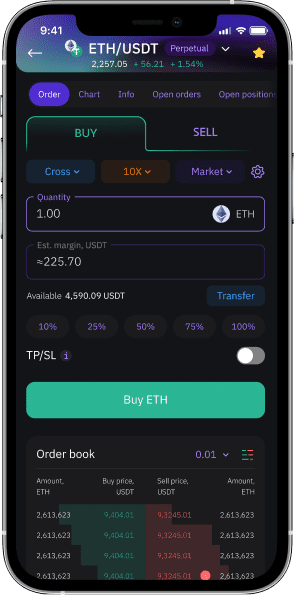

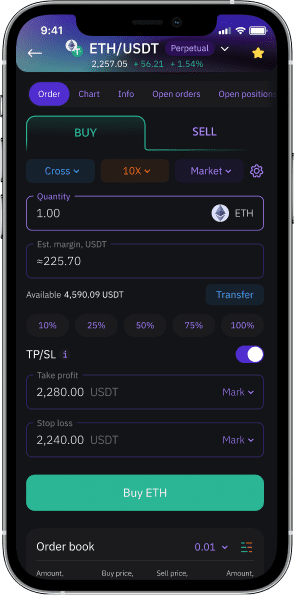

Match market volatility with Futures

Unlock a unique opportunity to use both bearish and bullish market shifts in your trading strategy.

![XBO.com - Image]() Understanding

Understanding

Futures

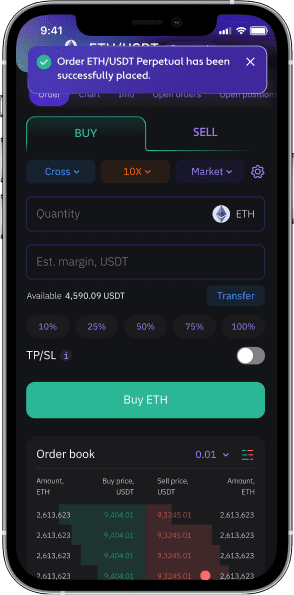

Futures are contractual agreements designed for the purchase or sale of an underlying asset at a predetermined price and a specific future date. These agreements derive their value from the assets they represent, and upon expiration, the trade is resolved through cash settlement. Importantly, traders engaging in Futures contracts are not required to possess the actual underlying asset.

The dynamic nature of Futures trading empowers market participants to capitalize on price surges by going long or profit from downturns by going short. This flexibility proves particularly beneficial in navigating the often volatile landscape of the cryptocurrency market.

Digital assets are complex instruments and involve high risk. Please ensure that you fully understand the risks involved before entering into any transactions.

Contact us: [email protected]