FTX, a16z-Backed Aptos Blockchain Off to a Rocky Start

Aptos, a new Layer 1 blockchain established by former Meta employees who worked on its Diem platform, is not living up to its expectations according to on-chain data from its first day of transactions.

On-chain data from Aptos’ block explorer shows that the protocol is currently processing four transactions per second. During the development process, the Aptos team said that its parallel execution engine was capable of processing 160,000 transactions per second (far above speed demon Solana’s advertised 65,000 per second).

The vast majority of these, as crypto Twitter personality Paradigm Engineer #420 pointed out, are not actual transactions from users but rather maintenance messages from validators writing metadata to the blockchain.

Aptos is broken.

— Paradigm Engineer #420 (@ParadigmEng420) October 17, 2022

Aptos launched today - October 17, 2022 at 14:22:40

However, Aptos is currently has a lower tps than Bitcoin and a majority of tokens are either staked or ready to be dumped on retail investors.

Curious? Thread Below

👇

“It's hard to see how users can even use Aptos right now, I personally cannot find any rpcs nor connect with any validators to send transactions,” they wrote.

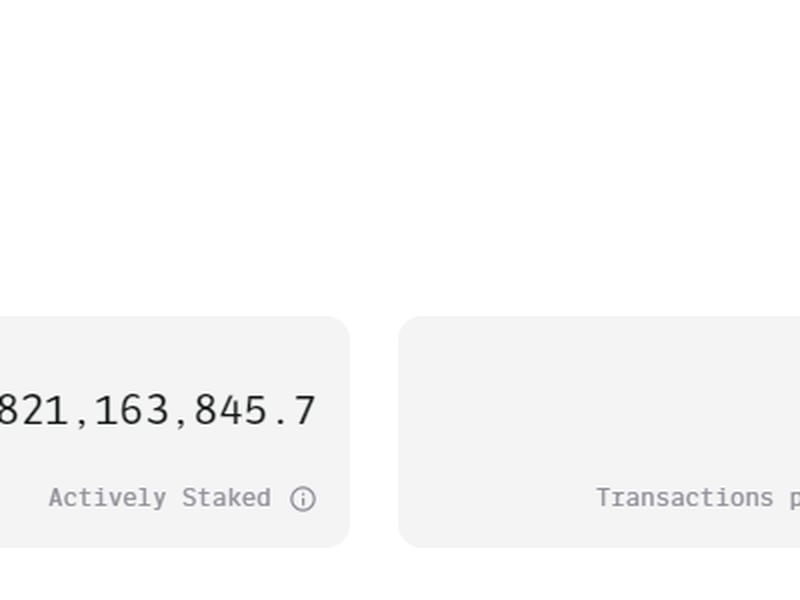

The engineer also pointed out that nearly 80% of the tokens on Aptos are staked, which they said will result in them being dumped on retail users.

The Race for a Faster Blockchain

As institutional interest in digital assets increases, there’s a hunt for infrastructure that can keep up to the demands of real-world finance applications. Right now, Ethereum in its current form can do a maximum of 15 transactions per second, and has done an average of 13 TPS during the past month. Ethereum 2.0, when complete, will have a theoretical ceiling of 100,000 TPS.

Venture Capital has been enthusiastically looking for this nirvana, and hundreds of millions have been deployed to build out faster blockchains.

Jump Capital, as an example, has doubled down on its commitment to Solana, investing in fixing the backend infrastructure of the once-hot protocol that has suffered from a number of high-profile breakdowns during the last year.

Jump has also invested in Aptos, alongside FTX and a16z in Aptos’ $150 million series A round.

Trust From Investors

But Ethereum, despite its sluggishness, still has the trust of investors with 58% of the total value locked in DeFi on that protocol according to aggregator DefiLlama.

After Tron and Binance’s BNB Smart Chain, which has 10.2% and 9.9% respectively, the rest of the TVL is split between protocols that have 1-2% at most, like Solana, which has 1.72%.

Part of this long-tail distribution likely comes from the skepticism about the integrity of platforms.

As CoinDesk reported earlier, Solana has struggled with developers faking the size of the ecosystem and high-profile exploits like the hack of Mango Markets that preyed upon the immaturity of the codebase.

This won’t bode well for Aptos as Ian and Dylan Macalinao, which operated under 11 different pseudonyms while building for Solana, say they are moving on to Aptos next.

And Avraham Eisenberg, part of a group that drained $114 million from Solana-based DeFi platform Mango Markets last week before returning $67 million, recently tweeted, ominously: “So guys are there lending protocols on Aptos?”