Previewing Next Week's US Midterm Election

The U.S. election is next week. Control of the Senate and House of Representatives is up for grabs, not to mention state legislatures and governorships. The crypto industry is playing a bigger role in 2022 than it did in 2020, but still not a large enough role to apparently matter overly to the results. Despite that, what happens next week will define crypto legislation in the U.S. for the next two years.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

One week till the elections

The narrative

The U.S. midterm election is next week! There are 435 House seats, 35 Senate seats and, this close to Election Day, still a surprisingly large number of questions about how exactly Congress's divide will shake out next year.

Why it matters

Regulators have increasingly signaled that the only way U.S. crypto companies will see guidelines covering their operations is if Congress acts by passing measures the President can then sign into law. A number of efforts in 2022 are stalling or have stalled, leaving the effort to the 118th Congress.

Breaking it down

There are a few major efforts we might see Congress take up next year.

I wrote about some of the legislative efforts a few weeks ago so I won’t rehash them here. Other legislative efforts include the Lummis-Gillibrand bill, which isn’t so much intended to be passed as a piece of legislation as it is more a compilation of the different issues regulators and industry participants are trying to grapple with. Still, I imagine we’ll see the bill reappear in full or in part next year.

Sen. Pat Toomey (R-Pa.) is set to retire from the Senate at the end of this term. He introduced a stablecoin bill earlier this year, and it’s unclear whether he has a successor who can take up the effort when Congress returns.

Despite this, there's still a ton of interest in trying to influence candidates and the future of legislation. My colleague Jesse Hamilton took a look at campaign donations for this election cycle, noting that the crypto industry poured over $80 million into races over the past few months – a lot of money, even if it’s not that much compared with the billion dollars donated this year.

That being said, these donations don’t seem to have had a widespread influence just yet. Many candidates supported by the industry lost their primary races, while several who won their races have not yet established firm views on crypto regulations.

Those who have shared crypto views include both familiar names – Reps. Josh Gottheimer (D-N.J.), Ted Budd (R-N.C.), Warren Davidson (R-Ohio) and Ro Khanna (D-Calif.) – as well as newcomers, like Katie Britt, a Republican running for the Senate in Alabama, and Jonathan Jackson, a Democrat running for the House in Illinois.

We’ll have more to come on this over the coming week, and a live blog on election night as polls start closing.

Analyzing MiCA's Next Steps

The European Union is set to be the first major jurisdiction in the world to agree how to regulate the digital asset sector, via its Markets in Crypto Assets regulation (MiCA).

Under the recently agreed text, providers of crypto services – which means anything from trading to custody to fiat exchanges – will need a license and be monitored by a financial regulator from one of the EU’s member states (Germany’s BaFin, say). Issuers of stablecoins – crypto assets which claim to maintain their value against assets such as the euro – will be subject to a bunch of other rules to ensure they keep their promise; regulators want them to hold reserves to avoid another Terra-style debacle.

Read the full analysis by Jack Schickler.

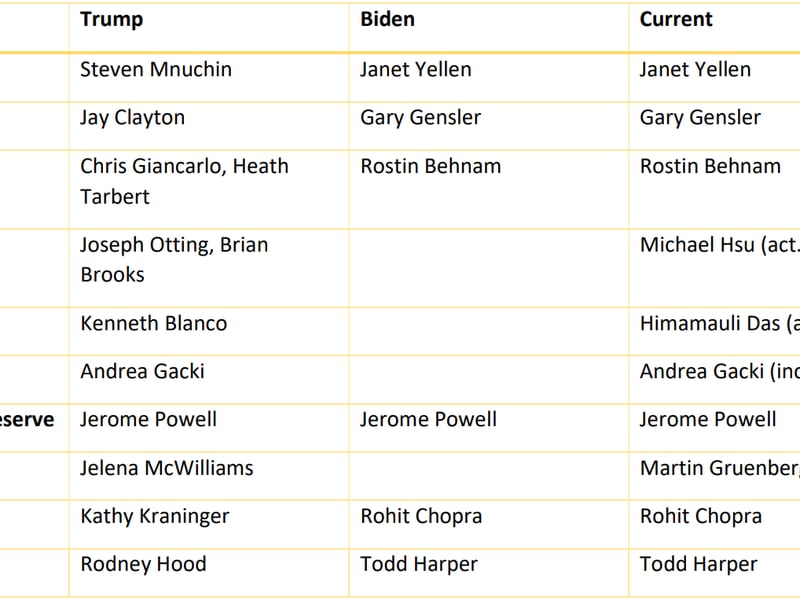

Biden’s rule

Changing of the guard

N/A

Outside CoinDesk:

- (The Verge) There was a time I joked on Twitter that Matt Levine taking a day off from his newsletter meant there would be Elon Musk news. Elizabeth Lopatto at The Verge tracked all of those instances, and spoke to Levine to boot about the Elon Effect.

- (The New York Times) A group of Times reporters have Musk’s pitch deck for Twitter. These are definitely plans. Also, he wants to lay off quite a few of Twitter’s current employees and charge for validation blue checks for those who want to keep them. Apropos of nothing, hit me up on Mastodon sometime.

- (FT) At the risk of Musk fatigue, FT is reporting the banks that covered some of the Twitter acquisition are expecting to take a haircut on the debt.

- (Indian Express) The Wire, an Indian news organization, has lodged a police complaint against a (presumably former) researcher the organization alleged faked emails in its now-debunked and retracted series of articles about Meta. Amit Malviya, an official with the BJP (India’s current leading party), also filed a criminal complaint against The Wire itself and its editors, leading to a police raid that seized electronic devices.

I missed that the day Elon took over this site, his Tesla kids toy was recalled by @USCPSC for safety issues. https://t.co/Vs4RaVRDgE pic.twitter.com/C7BrwV86IN

— Mike Masnick (@mmasnick) October 31, 2022

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!