Crypto Has an Incest Problem

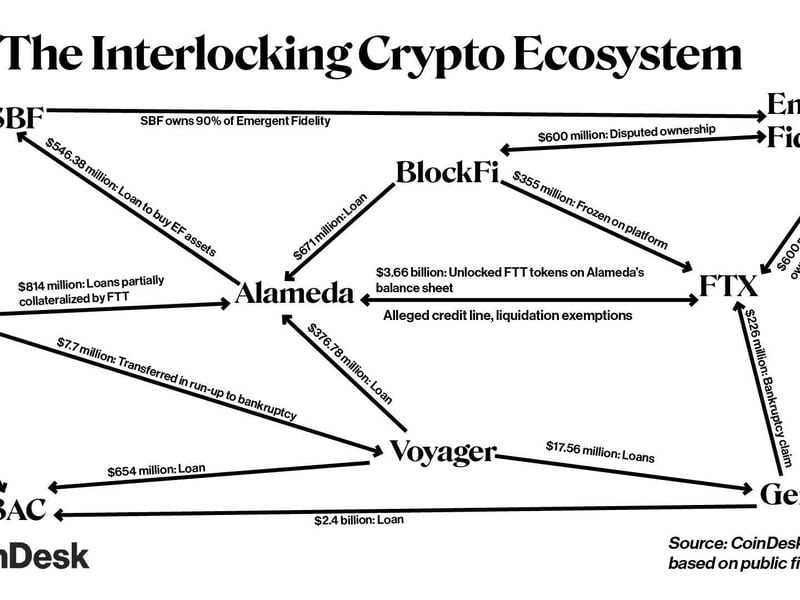

Last year, failings at crypto issuer Terra ricocheted across the crypto ecosystem, ultimately claiming FTX, a giant in the space. This investigation of court records shows how the millions – if not billions – of dollars’ worth of exposures among companies like Three Arrows Capital, Voyager and Celsius allowed a ripple to turn into a tsunami.

It’s well-known that crypto companies are closely intertwined, but privately owned firms like FTX don’t usually have to reveal their financial secrets. That changed when they were placed in the transparent fish tank of Chapter 11 bankruptcy.

The numbers show a network that was interlocking, if not outright incestuous. That made the system overall less resilient. Legally untangling the mess is going to prove a long and costly process, spelling bad news for those hoping for their money back. Regulators are already setting themselves to the task of ensuring that it doesn’t happen again.

On Jan. 30, FTX’s sister trading firm, Alameda Research, sought to regain around $446 million it had transferred to bankrupt lender Voyager Digital. Voyager and its creditors declined, saying Alameda’s “inequitable and fraudulent conduct” had cost them over $114 million.

But that’s just the start of the mapping of finances among crypto companies – including hedge fund Three Arrows Capital (3AC), Genesis, and lenders Celsius and BlockFi – that are now undergoing bankruptcy proceedings. (Genesis, like CoinDesk, is a subsidiary of Digital Currency Group).

3AC contagion begins

After the TerraUSD stablecoin and Luna token collapsed, 3AC suffered some $200 million in losses, and was the first casualty heralding a new crypto winter, a collapse that made further waves.

Voyager, which filed for bankruptcy on July 5, reported a $654 million loan to 3AC which accounted for a massive 57.8% of its loan portfolio. The bankruptcy filing of Genesis Global Holdco included its Asia Pacific unit – which said it had lent $2.4 billion in cash and digital assets to the hedge fund. Celsius claimed loans worth $75 million, of which around only half has been restored by liquidating collateral. Lender BlockFi also says it suffered “material losses” from the bankruptcy of 3AC – one of its largest borrowers.

They all had dealings with the FTX empire too – even before Bankman-Fried rode in to save the sector post-3AC. As of July 5, Voyager was owed $377 million by Alameda. Around the time it filed for bankruptcy in November, BlockFi, also the target of Bankman-Fried’s white-knight deals, said it had $355 million in crypto frozen on FTX, plus $671 million in loans to Alameda.

Celsius too had an FTX exposure of billions. According to an examiner’s report, as of April, the lender had borrowed $1.5 billion in stablecoins from FTX and had over $2.5 billion in assets on the platform. Alameda also posted around $520 million of FTX’s native token FTT to Celsius – which was intended to collateralize $814 million in loans, but whose value collapsed when the exchange did. Owed $226 million, Genesis is reported in FTX’s bankruptcy filings as the biggest unsecured creditor of FTX.com and its affiliates.

The smaller companies were also lending among each other. As of July 5, Voyager has reported an exposure to another bankrupt Genesis unit of $17.5 million. Celsius has also sought to claw back $7.7 million it transferred to Voyager in the three-month window before it itself collapsed on July 13.

All that money lay on unsteady foundations, thanks to FTX’s own murky relationship with Alameda. In November, CoinDesk revealed a blurring between the supposedly separate entities, and regulators have since alleged special lines of credit and inappropriate access to customer funds.

Meanwhile, 56 million shares in Robinhood, purchased by FTX founders Sam Bankman-Fried and Gary Wang using a loan from Alameda, are now sitting in Emergent Fidelity, a shell company created specifically for the purpose, which has filed for bankruptcy in Antigua and the U.S. Around $600 million worth of the assets are now caught in a complex legal tussle between liquidators, the Department of Justice, FTX and BlockFi.

So what?

Regulators care about this kind of interconnectivity in finance, because it makes the overall system less resilient and reliable.

In 2008, the failure of Lehman Brothers spread across the world thanks to complex and opaque transactions. Standard-setters now measure interconnectedness to determine if a bank is too big to fail; too many assets and liabilities within the financial system and you have to issue extra capital.

For the time being, crypto contagion hasn’t spread further; with a few exceptions, such as Silvergate Capital, the sector is pretty well walled off from conventional finance. But the pattern is being used to justify regulation.

“The crypto-asset market is highly interconnected, which may lead to rapid contagion and the spread of stress among crypto-asset market participants,” international standard-setter the Financial Stability Board said in an October consultation, in which it proposed sweeping new standards for the sector.

Banks have tough laws on ownership, capital requirements and re-use of funds; crypto companies, at most, self-imposed norms that appear to be frequently broken. Celsius breached its own credit limits with major clients such as 3AC and Alameda, according to a court-appointed examiner; Bankman-Fried’s declaration that FTX didn’t invest customer funds now doesn’t seem credible. Alameda itself was able to borrow from FTX well beyond FTX’s limit for clients.

But beyond the financial risks, there are practical ones: When the mess hits the fan, intertwined companies are a lot harder to wind up.

If a major company goes bust – such as Enron in 2001 – it’s not unusual for others in the market to feel a second-order ripple, bankruptcy expert Mark Shapiro told CoinDesk – but crypto may be different.

“It doesn't happen very often where you see this level of different companies having connectivity with each other,” said Shapiro, a partner at law firm Shearman’s New York practice.

“All these companies were more interconnected than people probably could have appreciated,” he said, describing the crypto turmoil as the biggest “domino effect” since Lehman Brothers.

U.S. law already views with suspicion any transaction made up to three months before a bankruptcy, and any transactions deemed to be fraudulent conveyances can also be clawed back. Now, multiple judges in separate courts of New York, Delaware and New Jersey will have to sort through the complex web of transactions and decide what belongs to whom.

Tough luck for any customer waiting for their funds, says Shapiro.

“Anything having to do with FTX is going to take a while,” he said. Victims of Bernie Madoff’s Ponzi scheme had to wait around a decade for resolution; this could be similar.

Infographic by Sage D. Young