Solana's Rally Marshalled by Buyers From Coinbase, Data Shows

Solana’s SOL has rallied over 50% in two weeks, with Nasdaq-listed digital assets exchange Coinbase (COIN) proving to be a significant source of bullish pressures for the cryptocurrency, according to data tracked by Paris-based Kaiko.

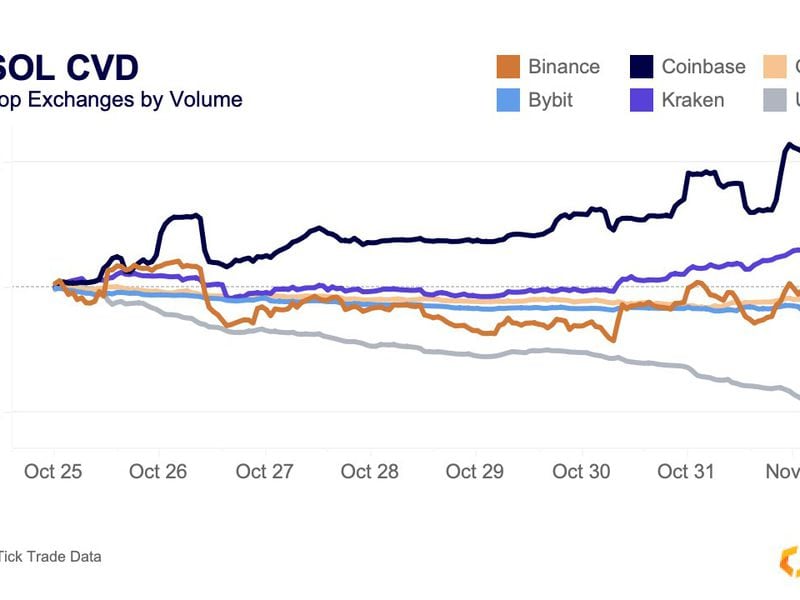

Since Oct. 25, SOL’s cumulative volume delta (CVD) has increased by nearly $1 million on Coinbase, indicating net capital inflows. CVD on Binance and Kraken turned positive early this week, while on the South Korean exchange Upbit, it has been negative and trending south for two weeks.

The CVD metric tracks the net difference between buying and selling volumes over time. It’s a running total of net bullish/bearish pressures in the market, with positive values indicating an excess of purchase volume. Negative values suggest otherwise.

According to Kaiko analyst, Riyad Carey, the median order size on Coinbase has been more significant than other exchanges, perhaps a sign of institutions bidding for SOL through the Nasdaq-listed exchange.

Coinbase’s leadership in the SOL market comes after VanEck, a multi-billion dollar institutional asset manager, published a report detailing a bullish case scenario that could take the cryptocurrency’s price as high as $3,200 by 2030.

The bullish prediction is based on a potential scenario where Solana becomes the first blockchain to accommodate applications with over 100 million users.

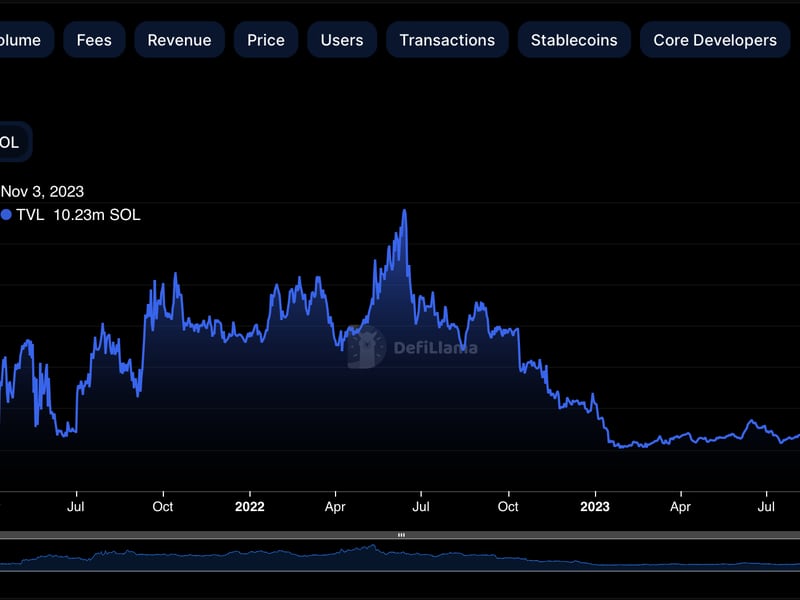

That said, SOL’s recent price gains have yet to galvanize on-chain activity.

In two weeks, the total value of assets locked in Solana-based DeFi protocols has declined from 12.03 million SOL to 10.23 million SOL, the lowest since April 2021, according to DefiLlama. TVL, though an imperfect measure, is widely tracked to gauge the usage of smart contracts.

Volume on Solana-based decentralized exchanges and active addresses on the network has picked up, but not enough to justify the price gains, on chain analyst Patrick Scott noted on X.