SHIB, DOGE Top Open Futures Rankings as Bitcoin Rally Spurs Risk-Taking

Bitcoin's October surge seems to have injected life back into the crypto market, causing an increased inflow of money into leading meme cryptocurrencies shiba inu [SHIB] and dogecoin [DOGE].

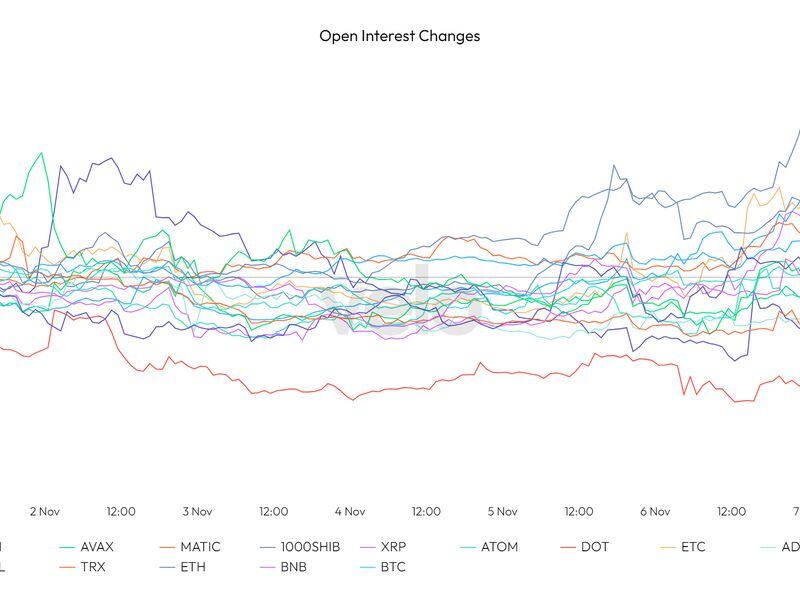

Open interest, or the dollar value locked in the number of active perpetual futures and standard futures contracts, tied to SHIB has increased by 23% to $61.74 million since Nov. 1, the highest percentage growth among top cryptocurrencies, according to Velo Data. Open interest in DOGE has increased 14.6% to $328 million.

Open interest in MATIC, ETH, ETC, and LTC has increased by 6% to 7%, while remaining unchanged in bitcoin [BTC] over the same time period.

An increase in open interest indicates an influx of new capital entering the market. The fact that more money has recently flown into derivatives tied to non-serious coins like DOGE and SHIB suggests increased willingness among investors to take risks. Historically, a continued outperformance of meme cryptocurrencies has signaled greed and marked trend changes in bitcoin's price.

The DOGE and SHIB prices have gained 6.5% and 3.6% in one week, according to CoinDesk data. Bitcoin, meanwhile, has traded flat around $35,000.

Open interest in XRP has increased by a meager 0.76% in seven days, even as the payments-focused cryptocurrency's price has surged by 18.6%, the biggest gain among major cryptocurrencies. The data show XRP's gains have been mainly spot-driven.

Meanwhile, money has been drained from DOT, UNI, TRX, ATOM and BNB.