'Santa Rally' Could Propel Bitcoin to $56K by Year-End, Matrixport Says

One of the most famous sayings on Wall Street is that a bull market tends to stay in motion unless an external force acts upon it. Bitcoin [BTC] has historically lived up to the adage modeled along Sir Isaac Newton’s third law of motion and could do so again, rising as high as $56,000 by the end of the year, according to crypto services provider Matrixport.

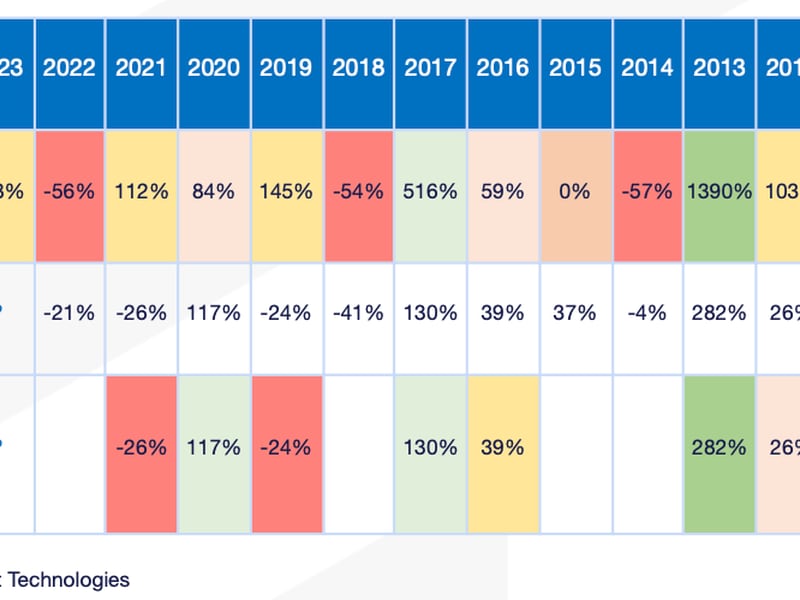

“If bitcoin is up at least +100% by this time of the year, then there is a +71% chance or five in seven that bitcoin would finish the year higher with average year-end rallies of +65%," Markus Thielen, head of research and strategy at Matrixport, said in a note to clients on Thursday. “As bitcoin tends to reach its peak by December 18th, we could call the six to seven weeks from early November to mid-December Bitcoin’s Santa Claus Rally.”

As of writing, bitcoin is trading above $35,000, representing a 114% on a year-to-date basis. The impressive gain could be attributed to several reasons, including spot ETF optimism, speculation the Federal Reserve’s liquidity tightening cycle has peaked and haven demand. The expected 65% price rise means bitcoin could trade above $65,000 by the year-end.

“Based on these statistics, bitcoin continues to offer upside potential, and a +65% year-end rally would lift prices back to $56,000,” Thielen added.

The chart shows the historical performance of bitcoin in the first ten months and the final two months of the year from 2010-2022.

In seven out of the past 12 years, bitcoin scored at least 100% gains in the first 10 months. In these seven years, bitcoin rallied by an average of 65% in the final eight weeks.

“When bitcoin is up at least +50% by the end of October, there is, on average, a 78% chance that bitcoin will advance even more into year-end. Bitcoin rallied another +68% until year-end on seven of nine previous occasions. This analysis is based on thirteen years of bitcoin history,” Thielen noted.

Note that past data is no guarantee of future results. That said, the probability of history repeating itself is high, given the bullish mining reward halving is due early next year.