Real Estate-Backed Stablecoin USDR De-Pegs After Treasury Was Drained of Liquid Assets

Polygon-based stablecoin Real USD (USDR), backed by real estate holdings, saw its value drop to nearly $0.51 within a few hours after its treasury was drained of DAI.

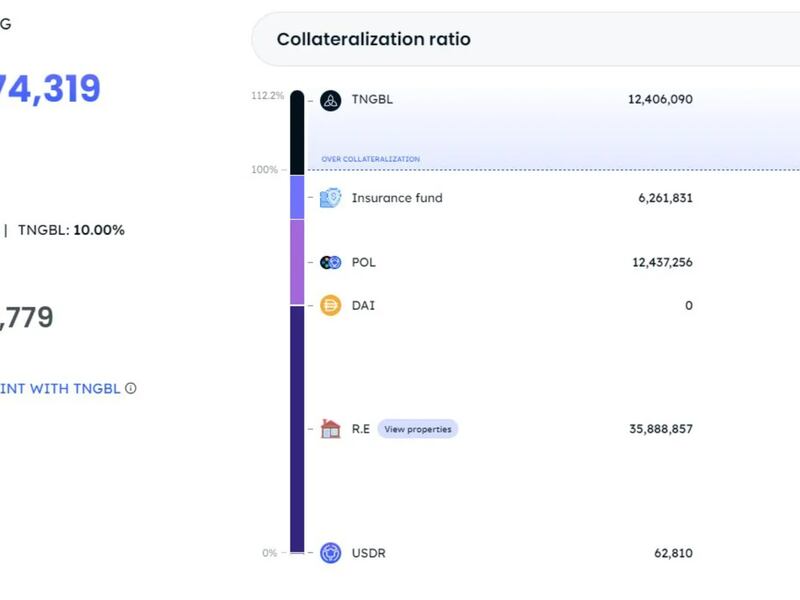

According to on-chain data published by Tangible DAO, the entity behind USDR, the treasury currently holds zero DAI, with the only liquid assets being a roughly $6.2 million insurance fund for a circulating supply of 45 million USDR — worth $45 million when pegged.

The treasury is also backed by the token TNGBL. However, market data from CoinGecko shows that its total 24-hour trading volume is less than $300,000 with a bid depth of less than $5,000 on UniSwap, making it impossible to liquidate large amounts.

Data from a Polygon block explorer shows that some traders are selling USDR in USDC trading pairs for pennies on the dollar.

USDR's website shows that the project is offering a 16% yield.