Over $200M in Crypto Futures Bets Liquidated as Bitcoin Slumped Under $36K on Binance Settlement

Binance’s settlement with the U.S. Securities and Exchange Commission (SEC) on multiple charges spurred a market decline, with the impact felt most by futures traders betting on further growth.

Data from CoinGlass show, exchanges have liquidated crypto perpetual futures positions worth $227 million in the past 24 hours. Bullish longs accounted for nearly 80% of the tally. Meanwhile, over $67 million worth of bitcoin longs and shorts, referring to bets on and against price rises, respectively, have been liquidated in the past 24 hours. This was among the highest liquidation events in 2023.

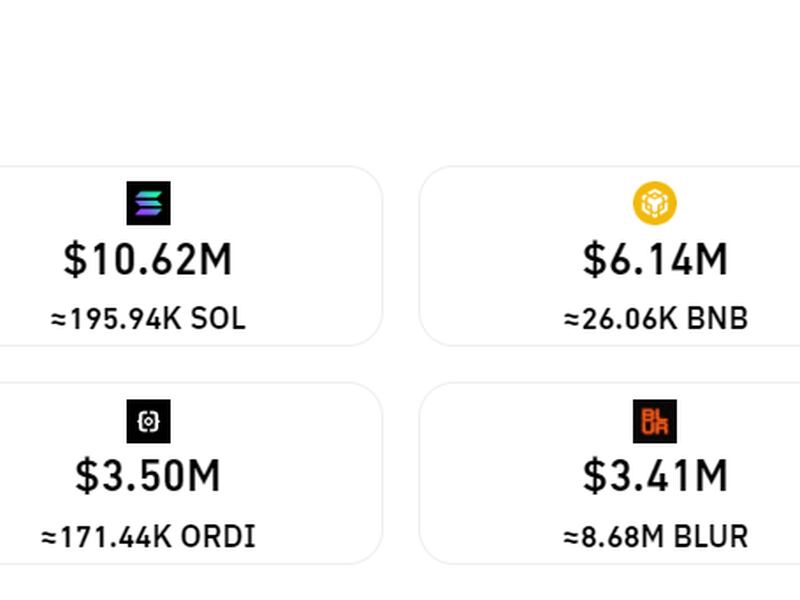

Traders of ether (ETH) futures took on $27 million in losses, while Solana’s SOL traders were hit for $10 million. BNB saw a comparatively smaller $6 million in liquidations. BNB is the token of the BNB ecosystem, which was created by Binance, and traders usually link the token with the exchange's fortunes.

Traders at crypto exchange Binance took on $100 million in liquidations, the most among counterparties, with OKX taking $62 million.

Liquidation refers to when an exchange forcefully closes a trader's leveraged position due to a partial or total loss of the trader's initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Large liquidations can signal the local top or bottom of a steep price move, which may allow traders to position themselves accordingly.

Such data is beneficial for traders as it serves as a signal of leverage being effectively washed out from popular futures products – acting as a short-term indication of a decline in price volatility.

Binance, the world's largest crypto exchange, was criminally charged with breaking sanctions and money-transmitting laws and agreed to pay $4.3 billion to settle the allegations in "one of the largest penalties" the U.S. has ever obtained from a corporate defendant.

Founder Changpeng "CZ" Zhao pleaded guilty in Seattle to charges he personally faced and agreed to pay a $50 million fine and step down from the CEO job. Richard Teng, a former Abu Dhabi regulator and later Binance's regional markets head, will take over as CEO.