Large Crypto Trader's $7M LINK Deposits to Binance Signals Profit-Taking as Token Hits 17-Month High

Chainlink's LINK hit a 17-month high on Monday, but there are signs that investors are taking some profits off the table following its massive surge.

The token's price rallied about 9% in the past 24 hours, hitting $11 after trading sideways within roughly $5 and $9 range since May 2022. It has since given up some of its gains but has still managed to advance 43% over the past month, making it one of the best gainers among the large-cap digital assets, CoinDesk data shows.

The native token of the decentralized oracle network Chainlink is benefitting from the recent hype around the tokenization of real-world assets (RWAs). Tokenization means placing traditional assets such as equity, bonds or real estate on blockchains, and oracles are critical to feeding data from the real world to blockchain-based networks and applications.

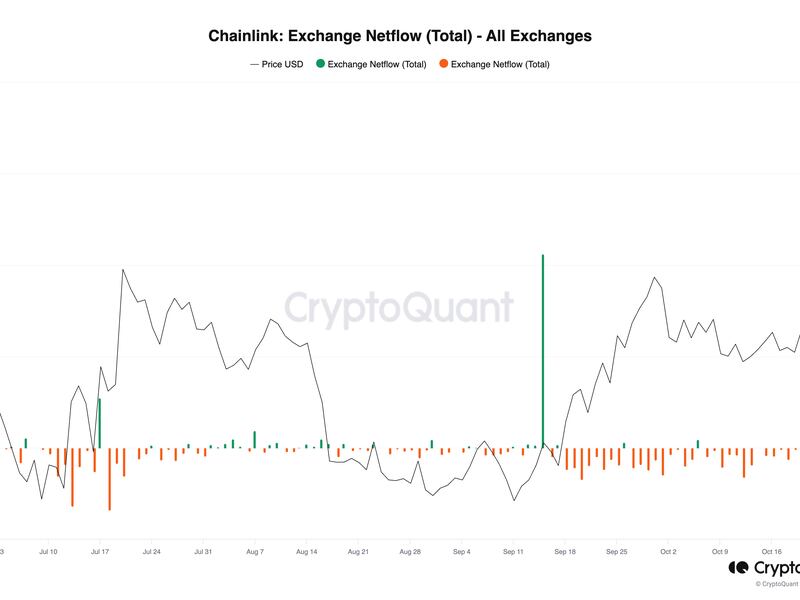

Blockchain data, however, suggests the rally could take a breather as exchange deposits picked up, an indication of investors locking in some profits.

Depositing tokens to an exchange usually signals the intention to sell by an investor, while withdrawing tokens indicates a purchase.

Monday marked the largest net influx of LINK tokens – near 1.4 million – to centralized exchanges, data by digital asset analytics firm CryptoQuant shows, extending to four days of consecutive inflows.

On-chain analytics firm Arkham Intelligence noted in social media platform X (formerly Twitter) post that a large trader and LINK holder deposited 300,000 LINK tokens – worth some $3.1 million at the time – to crypto exchange Binance earlier Monday before withdrawing $3 million in USDT stablecoin.

Later, the entity sent another 380,447 LINK valued at $3.9 million to Binance. The investor still held $3.1 million in LINK after the deposits.

Read more: Banking Giants Abuzz About Tokenization of Real-World Assets as DeFi Craves Collateral