First Mover Americas: This Year's Top Performers and What Comes Next

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

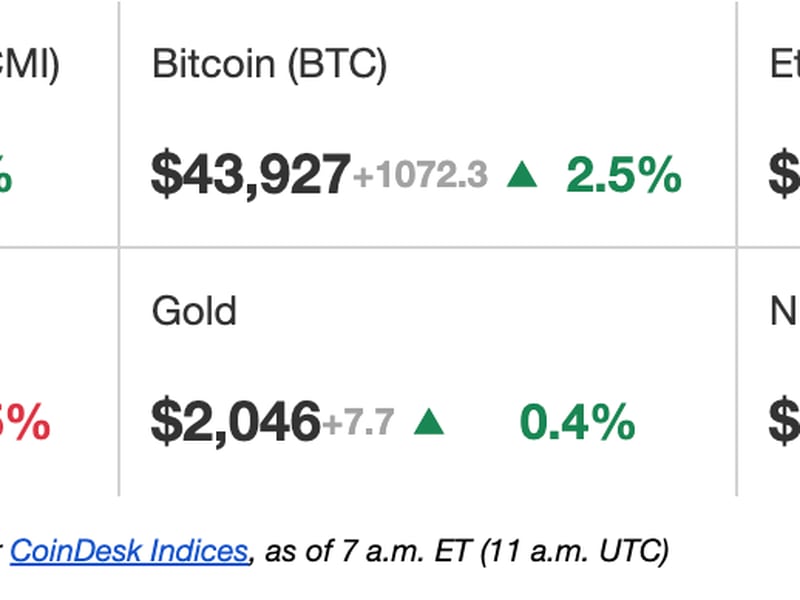

Latest Prices

Top Stories

Layer-1 blockchain Solana (SOL) led the way in 2023 in terms of token price gains, with other altcoins Avalanche (AVAX), Stacks (STX) and Helium’s (HNT) following closely behind. Solana, which began its sharp increase in mid-October, has risen over 700% since the start of the year. HNT also made considerable gains, climbing 500%. Most of the advance came this month, following the company’s move into the mobile space. For Avalanche, there have been a number of institutional partnerships that helped lift the token some 300% year-to-date. Looking forward, analysts pointed to tokenization of real-world assets as a booming segment to watch. Chris Newhouse, a former derivatives trader and the founder of Infiniti Labs, said the “Decentralized Physical Infrastructure (DePIN) narrative” will continue to be a hot topic, with tokens such as RNDR and HNT recently outperforming the market. DePINs use cryptocurrency tokens to incentivize building of real-world infrastructure.

More than $1 billion in assets belonging to the founders of the bankrupt crypto hedge fund Three Arrows Capital (3AC) have been frozen by a British Virgin Islands court, according to the firm's liquidators, Teneo Restructuring. The worldwide court order, issued Monday, applies to founders Su Zhu and Kyle Davies as well as Davies' wife, Kelly Chen, Teneo said in an email. 3AC filed for Chapter 15 bankruptcy in July last year after the collapse of stablecoin issuer Terra caused irrecoverable losses. Teneo has been seeking $1.3 billion and included Chen in the order to use all available avenues to maximize returns to creditors, whose claims total more than $3 billion. Zhu, jailed for four months in Singapore in September for failing to help wind up 3AC, is expected to be released this month for good behavior.

Bitcoin (BTC) neared the $44,000 level early Thursday and reversed some losses, which were caused by the sudden drop in U.S. stocks on Wednesday. The S&P 500 index fell 1.42% Wednesday, hurting riskier assets such as bitcoin. Some analysts pointed out that a correction was overdue as market indications were in overbought territory and the expiry of a certain type of options created selling pressure. Bitcoin and trending tokens such as Solana’s SOL and Avalanche’s AVAX took a hit after the broader market plunge but climbed in early Asian hours on Thursday. SOL extended gains to 15% in the past 24 hours, and the advance from a multiweek rally to over 55%.

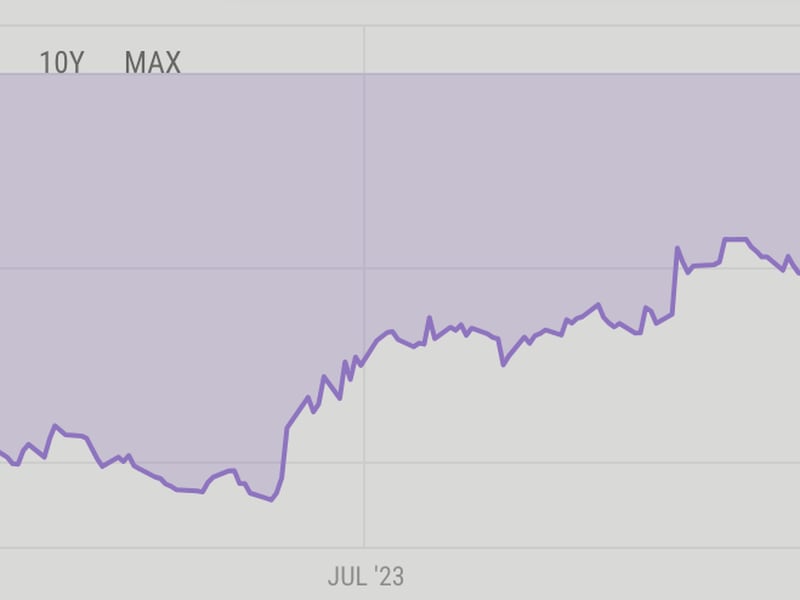

Chart of the Day

- Grayscale’s Bitcoin Trust Fund (GBTC) discount to net asset value (NAV) is holding near the narrowest since August 2021.

- The discount widened slightly to 7.90% on Wednesday

- The discount has been shrinking as a result of optimism that a bitcoin spot exchange-traded fund (ETF) will be approved in the U.S.

- GBTC is the world’s largest bitcoin investment vehicle and has traded at a discount since February 2021 and hit record lows of nearly 50% in December last year.

- Source: ycharts

- Lyllah Ledesma