First Mover Americas: SEC Delays Decision on Hashdex’s ETF Application

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

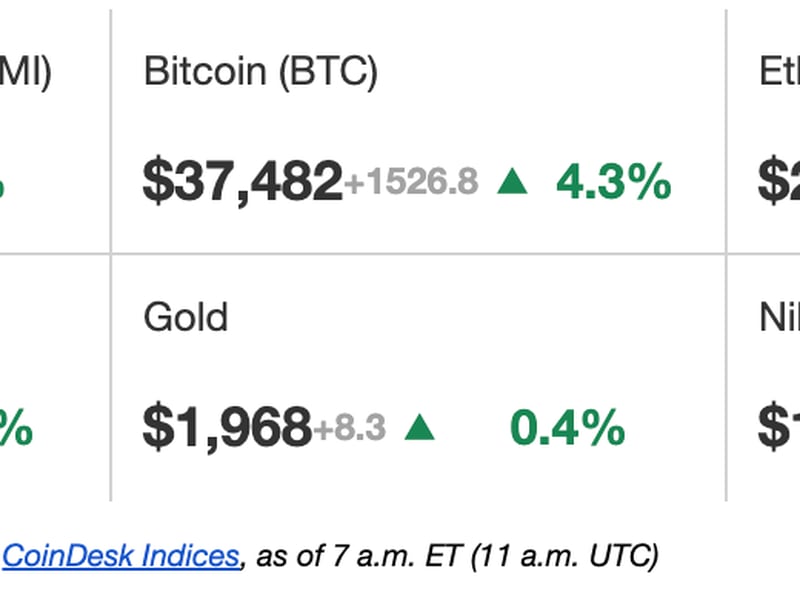

Latest Prices

Top Stories

The U.S. Securities and Exchange Commission (SEC) is delaying a decision on an application by Hashdex to convert its existing bitcoin futures exchange-traded fund (ETF) into a spot vehicle. The agency also delayed action on Grayscale's attempt to launch a new futures-based ether ETF. Hashdex filed to convert its bitcoin futures ETF into a spot bitcoin ETF in September. Grayscale (a subsidiary of CoinDesk parent Digital Currency Group) filed for its ether futures ETF that same month. Both filings faced initial deadlines of Nov. 17 for a decision, but the SEC said it was extending this window, according to a pair of Wednesday filings.

The Philippines government said it plans to raise 10 billion pesos ($180 million) through the sale of a tokenized treasury bond next week, in the latest move by a government to embrace blockchain technology to digitize its domestic debt market. The planned sale follows an offering from Hong Kong, which issued an 800 million-Hong Kong dollar ($103 million) tokenized green bond in February. The Philippines Bureau of the Treasury intends to confirm the interest rate of the one-year bond on Nov. 20, with the issue and settlement date set for Nov. 22. It reserved the right to change the mechanics of the issue.

Bitcoin’s (BTC) bullish momentum will likely remain intact heading into the end of the year, lifting prices to the $40,000 mark, according to Markus Thielen, research head at crypto services provider Matrixport and founder of analytics portal DeFi Research. “Bitcoin will reach $40,000 – if not even $45,000 – by the year’s end,” Thielen said in a note shared with CoinDesk, citing options market positioning and dovish Federal Reserve expectations as catalysts for continued price gains. The cryptocurrency has more than doubled this year, with prices rising nearly 40% in the past four weeks alone. The recent bullish action spurred demand for call options, or derivatives giving the purchaser the right to snap up the underlying asset at a predetermined price later.

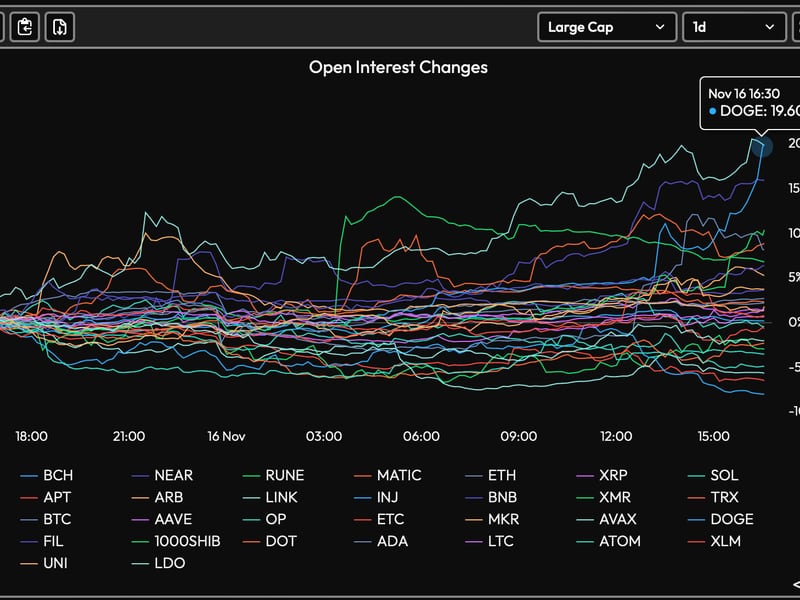

Chart of the Day

- The chart shows the 24-hour change in open interest in futures tied to the top 30 cryptocurrencies by market value.

- Open interest in DOGE and AVAX has increased by nearly 20%, while OI in BTC has declined by 2.5%.

- An influx of new money into non-serious tokens like DOGE and alternative coins suggests an increased risk appetite in the market.

- Source: Velo Data

- Omkar Godbole