First Mover Americas: Robinhood Shares Jump, Layer 2s Become Cheaper

This article originally appeared in First Mover, CoinDesk's daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

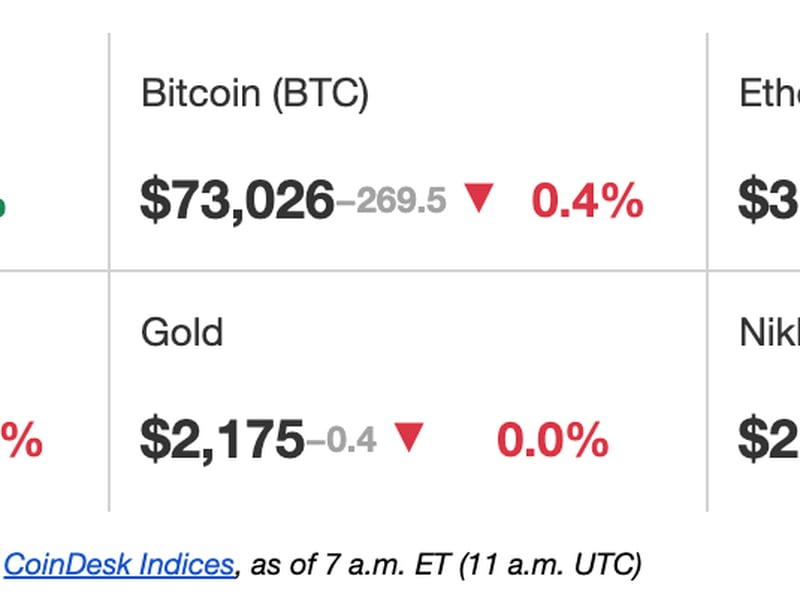

Latest Prices

Top Stories

Shares of Robinhood rose over 11% in premarket trading on Thursday after the online platform reported a large increase in volumes during February. In an update after the market closed on Wednesday, the company said activity increased across all asset classes compared with January. Equity trading volume jumped 36% to $80.9 billion, options contracts traded increased 12% to $119.1 million and crypto volumes grew 10% to $6.5 billion. Total assets under custody rose 16% from January to $118.7 billion at the end of February.

Ethereum’s Dencun upgrade went live on Wednesday, introducing a mechanism to reduce costs associated with transactions on layer-2 platforms that batch and compress transactions before sending them to the mainnet. The latest information shows the upgrade is living up to expectations. According to blockchain analyst Marcov’s Dune-based tracker, the average cost of transactions on Optimism has dropped to nearly 4 cents, down from the recent average of around $1.40 The average fee on Coinbase’s layer 2 blockchain, Base, fell to 3 cents from roughly $1.50 while Arbitrum’s fee declined to 40 cents. Average fees on zkSync and Zora also fell.

Fireblocks, a platform offering infrastructure for moving, storing and issuing digital assets, is working with U.K.-based institutional crypto exchange Zodia Markets to improve corporate cross-border payments. The collaboration will allow corporations to transfer funds faster through the use of stablecoins rather than through traditional fiat currency methods, according to a press release. The integration will use Zodia Markets’ digital asset execution and Fireblocks’ platform for peer-to-peer stablecoin transactions.

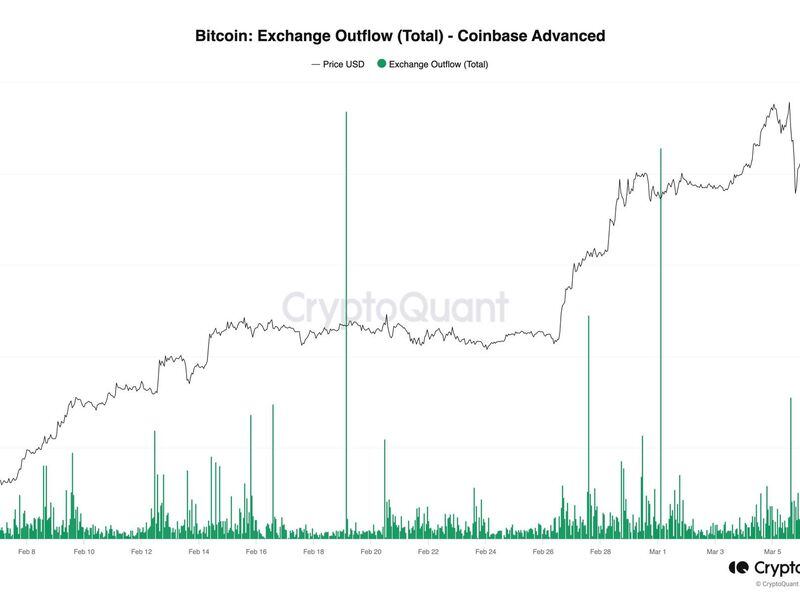

Chart of the Day

- The chart shows daily bitcoin outflows from Coinbase since early February.

- Outflows have picked up since spot bitcoin ETFs went live in the U.S. two months ago.

- "More Bitcoin leaving than entering exchanges could tighten supply, which can lead to a supply shock and potentially drive up prices," CryptoQuant said.

- Source: CryptoQuant