First Mover Americas: Bitcoin Soars to Highest Level Since August

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

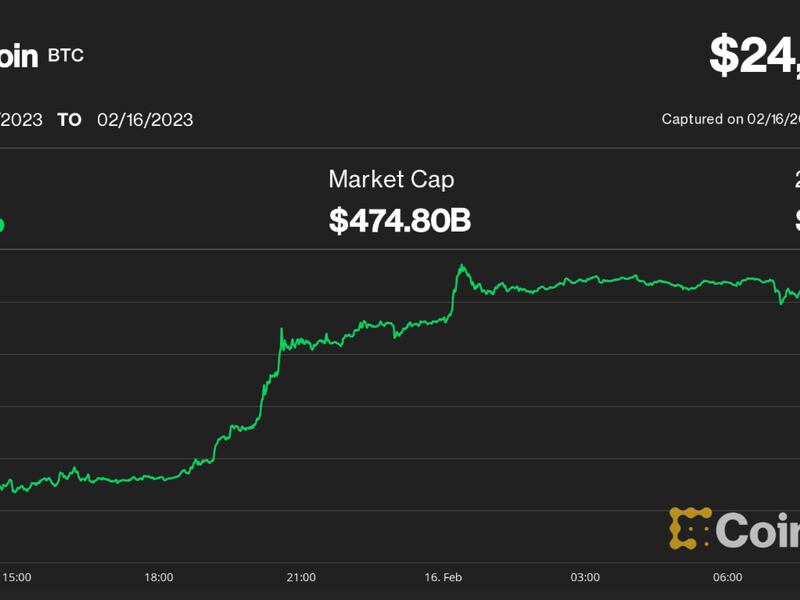

Bitcoin (BTC) surged more than 10% over the past 24 hours, moving to just shy of $25,000. The world’s largest crypto ran to as high as $24,898 early Thursday, its strongest level since Aug. 15. It’s since retreated to just under $24,500. Bitcoin in recent days had dipped below $21,600 amid growing investor concern over regulatory risk teamed with ideas that the U.S. central bank still had a long way to go to tame inflation. Investors, for now, appear to be shrugging off those concerns.

As U.S. regulators continue to sniff around Binance, the world’s largest crypto exchange is prepared to pay monetary penalties to “make amends” for past regulatory violations, according to The Wall Street Journal. The exchange grew quickly and was not initially aware of the myriad laws and regulations designed to prevent money laundering, sanctions evasion, and corruption, Binance Chief Strategy Officer Patrick Hillmann told The Journal on Wednesday. Binance expects to face fines, said Hillman, and is “working with regulators to figure out what are the remediations we have to go through now to make amends for [past violations].”

FTX sent $7.7 billion in assets from the crypto company's Bahamian unit to its U.S. counterparts in the period leading up to its bankruptcy filing last year, a Delaware bankruptcy court was told during a Wednesday hearing. Court-appointed joint provisional liquidators in the Bahamas said that $5.6 billion was transferred from Bahamas unit FTX Digital's custodial accounts to U.S. entity FTX trading, while another $2.1 billion was transferred to FTX's U.S. trading arm, Alameda Research. FTX's new management reached a cooperation agreement in early January with court-appointed liquidators in the Bahamas to iron out disagreements and address the assets in dispute.

Chart of the Day

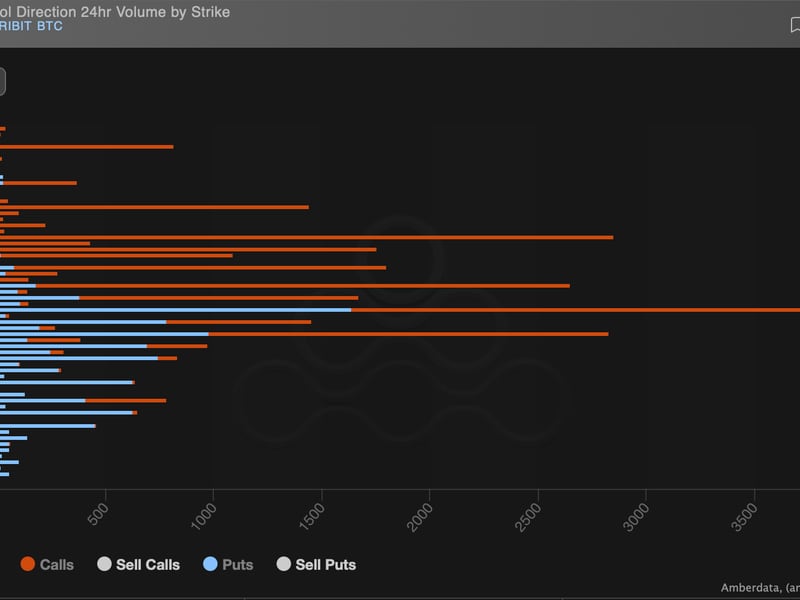

- The chart shows increased activity in bitcoin call options or bullish bets relative to puts or bearish options in the past 24 hours.

- Per Patrick Chu, director of institutional sales and trading at over-the-counter tech platform Paradigm, big call spreads, a bullish strategy, have been traded in the wake of Interactive Brokers' decision to roll out BTC, and ETH trading to professional investors in Hong Kong.

- "Animal spirits waking up in Asia," Chu tweeted while noting the bullish options market flows.

- Omkar Godbole

Trending Posts

- Accused Mango Markets Exploiter Wants to Keep $47M in Disputed Funds: Court Filings

- Short Trades Make up 90% of $200M in Losses as Bitcoin, Ether Surge

- Coinbase, Anchorage Digital Say They'd Be OK Under SEC Custody Proposal, But Risks May Lurk for Others