First Mover Americas: Legal Troubles Brewing at Digital Currency Group

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Three Gemini Earn users have filed a request for class-action arbitration against Genesis Global Capital and Genesis' parent company, Digital Currency Group, in response to Gemini suspending its Earn redemption program because Genesis froze withdrawals. Claimants allege that Genesis breached its master agreement when it became insolvent last summer, while hiding its insolvency from lenders like Gemini. Digital Currency Group, or DCG, owns CoinDesk.

The co-founder of Gemini has accused DCG CEO Barry Silbert of “bad faith stall tactics” as their companies lock horns over a business disagreement precipitated by crypto exchange FTX’s multibillion-dollar implosion late last year. Cameron Winklevoss blasted Silbert in an open letter posted to Twitter, alleging that crypto broker Genesis Global Capital and DCG owe Gemini’s clients $900 million. The letter alleges Gemini has awaited word on a repayment agreement for six weeks to no avail. In response, Silbert said his firm submitted a proposal to Genesis and Gemini’s advisers last Thursday.

The United Kingdom is enforcing a tax exemption for foreign investors purchasing crypto through local investment managers or brokers. The tax break, announced in December, is a part of Prime Minister Rishi Sunak’s plans to turn the U.K. into a crypto hub. “This exemption is an important factor in attracting global investors, meaning foreign investors won’t be brought into U.K. tax simply by appointing U.K.-based investment managers,” the government's tax arm, the HM Revenue and Customs, said in an email to CoinDesk.

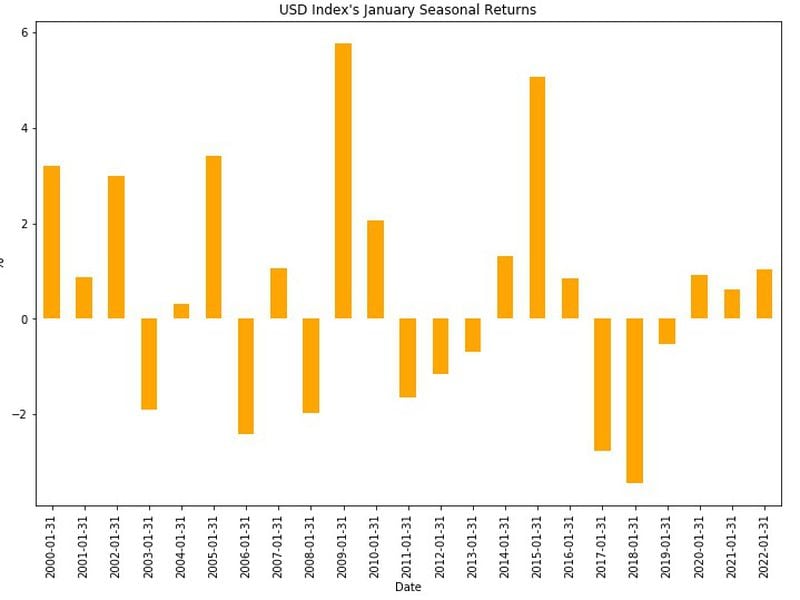

Chart of the Day

- The chart shows the dollar index's (DXY) performance in January going back to 2000.

- The DXY has appreciated 14 out of 22 times in January.

- The bullish seasonality means the battered greenback could rebound this month, adding to the crypto market's woes.

- The DXY declined by 7.7% in the final quarter of 2022. Yet, bitcoin fell nearly 15%, thanks predominantly to FTX contagion fears.