First Mover Americas: Grayscale in Investor's Crosshairs

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Fir Tree Partners is suing Grayscale Investments to obtain details about the Grayscale Bitcoin Trust (GBTC) in order to investigate potential mismanagement and conflicts of interest. The hedge fund said it wants Grayscale to resume redemptions and cut its 2% fees for the trust, which is the largest publicly traded crypto fund in the world. GBTC is trading at a 43% discount to the price of the underlying bitcoin. (Grayscale and CoinDesk are both owned by Digital Currency Group.)

FTX founder Sam Bankman-Fried has hired high-profile defense attorney Mark Cohen, a former federal prosecutor who represented socialite Ghislaine Maxwell in her sex-trafficking trial. Although Bankman-Fried hasn't been formally charged with any wrongdoing, he is reportedly being probed by both U.S. federal prosecutors and the Securities and Exchange Commission for his actions at failed crypto exchange FTX and Alameda Research, FTX’s affiliated trading arm that he also owned.

Crypto exchange Binance generates 90% of its revenue from transaction fees, CEO Changpeng Zhao said in an interview with TechCrunch. Zhao added that Binance had removed all ads from data site CoinMarketCap, which it acquired in 2020, to make for a cleaner experience. "We can turn that back on, that’ll give us $40 million a year. But we don’t need to today," Zhao said. It is estimated that Binance had about $20 billion in revenue in 2021, according to a Bloomberg analysis.

Chart of the Day

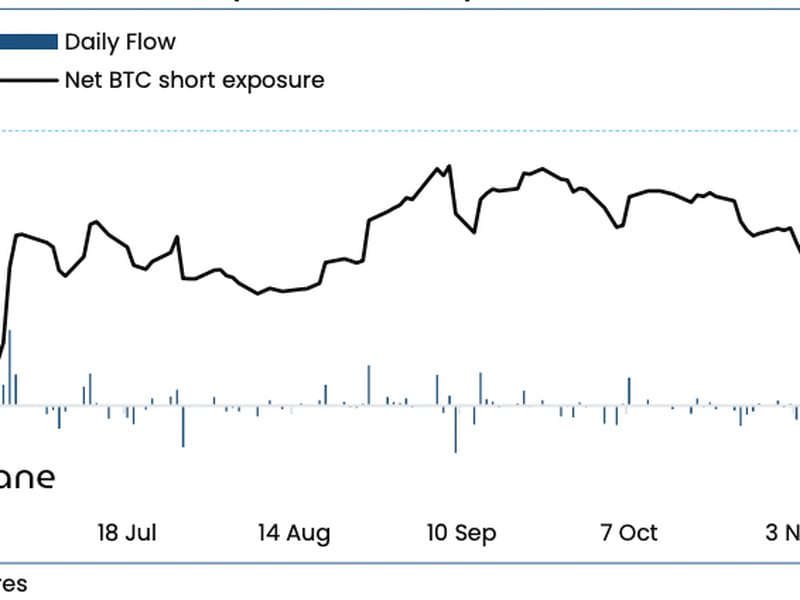

- The chart shows ProShares Short Bitcoin Strategy (BITI) exchange-traded fund has had outflows since late November.

- Yet, the net short exposure remains elevated at equivalent of 6,230 BTC – well above the summer highs.

- According to Arcane Research, the net short exposure in BITI peaks at market depths.

- "Countertrading extreme BITI inflows could be a promising trading strategy," Arcane Research said in the weekly note.

– Omkar Godbole