First Mover Americas: FTX’s First Hearing, Genesis Seeks Help

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Genesis Global Capital hired investment bank Moelis & Co. to explore options including a potential bankruptcy. The New York Times said a final decision hasn’t been made and it is still possible for the company to avoid a bankruptcy filing. Separately, Barry Silbert, founder of Genesis owner DCG, disclosed in a note to shareholders that the company had a roughly $575 million liability to Genesis Global Capital, which is due in May 2023. (DCG is also the parent company of CoinDesk.)

Sam Bankman-Fried, former CEO of FTX, apologized to the crypto exchange’s employees in a new letter sent out over the company’s Slack on Tuesday. He did not address concerns about customers' funds being misappropriated or other recent revelations about the company. Bankman-Fried said he felt "deeply sorry about what happened.” FTX also had its first hearing on Tuesday, letting the company’s lawyers finally get a better sense of just what was going on at the bankrupt crypto exchange.

Singapore’s largest bank by market cap, DBS, completed a fixed income trade on JPMorgan’s blockchain network Onyx. DBS said it is the first Asian bank to use the Onyx network, which is a blockchain-based fixed income trading network, to complete a trade. The Onyx Digital Assets network uses tokens for short-term trading in fixed income markets, enabling investors to lend assets for a period of hours without them leaving their balance sheets.

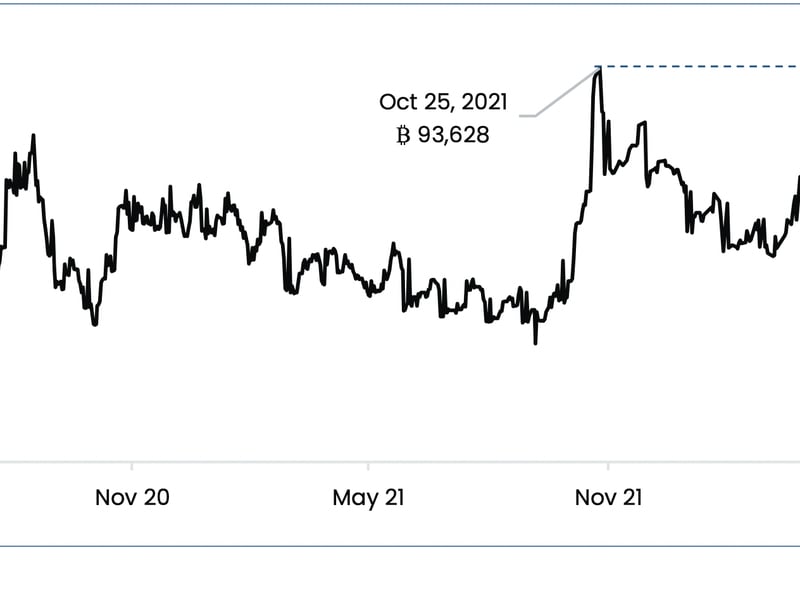

Chart of the Day

- The chart shows the open interest in bitcoin futures traded on the Chicago Mercantile Exchange (CME) has soared to 98,725 BTC, surpassing the peak of 93,628 BTC reached in October last year.

- Institutions have returned to the bitcoin market but on the bearish side.

- Open interest refers to the number of contracts open or active at a given time.