First Mover Americas: Ether ETFs Struggle to Gain Traction in First Week

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

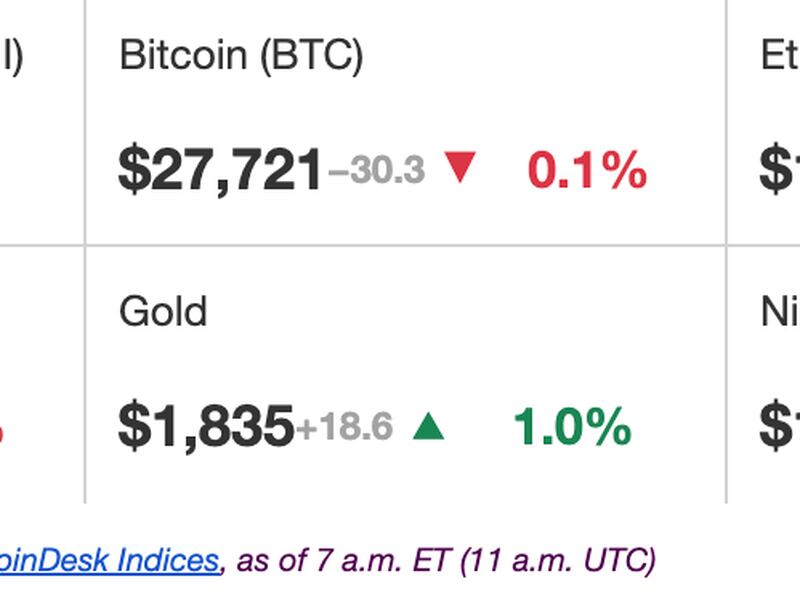

Latest Prices

Top Stories

Ether (ETH) and bitcoin (BTC) were buoyed to one-month highs last week as six ether futures ETFs went live in the U.S. on Monday, with traders expecting high demand for the products. However, their performance was pretty muted. Less than $2 million were traded across the various ETFs on Monday, with poor volumes throughout the week prompting analysts to write down their bullish outlook and pivot to bitcoin investments instead. The ether futures ETFs had 0.2% of trading volume compared to BTC futures day 1 of trading. Some analysts pointed to a lack of institutional demand for ether and others said it’s due to the macroeconomic environment. “Interest rates are at 5.5%, if you list any kind of ETF in this environment you are going to see low volumes,” said Sui Chung, CEO of CF Benchmarks, in an interview with CoinDesk. “It's the same with equities ETF volumes this week," added Chung. "There might be more interest in ether futures ETFs as the macroeconomic situation changes but right now investors are too busy putting money into bank accounts.”

Blackbird Labs, an app and loyalty program that's attempting to connect restaurants and their customers via its crypto-powered app, announced on Wednesday it had raised a $24 million Series A led by the venture capital firm Andreessen Horowitz (a16z). Through Blackbird, which is built on Coinbase's Layer-2 Base blockchain, customers tap their phone on a near field communication (NFC) reader (the devices which allow smartphones to connect to payment readers) and create a non-fungible token (NFT) membership. The NFT is then minted when users “tap in” to the restaurant.

FTX’s Sam Bankman-Fried committed financial crimes, co-founder Gary Wang said after taking the stand late Thursday. Wang, the fourth witness called by the U.S. Department of Justice in Bankman-Fried’s trial, said he committed wire fraud, securities fraud and commodities fraud alongside Bankman-Fried and Caroline Ellison, who ran Bankman-Fried's Alameda Research hedge fund, and former FTX executive Nishad Singh. (Wang, Ellison and Singh all pleaded guilty to charges shortly after Bankman-Fried was arrested.) “We gave special privileges to Alameda Research to allow it to withdraw unlimited funds from FTX and lied about it,” Wang said.