First Mover Americas: Deutsche Bank Trials a SWIFT Alternative for Stablecoins

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

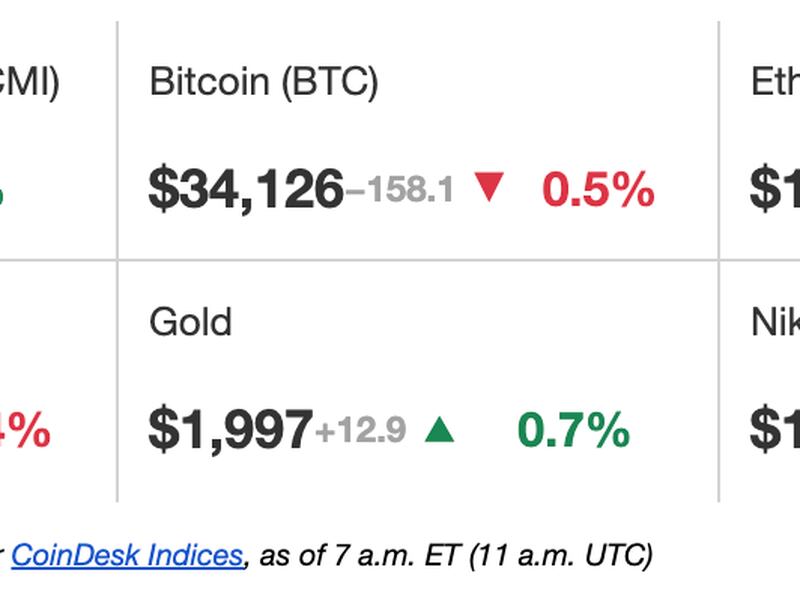

Latest Prices

Top Stories

Deutsche Bank and Standard Chartered’s SC Ventures are testing a system that will allow blockchain-based transactions, stablecoins, and central bank digital currencies (CBDCs) to talk to one another, taking an approach similar to the SWIFT messaging layer in legacy banking infrastructure. The banks are running a series of test cases, including transferring and swapping USDC stablecoins, on the Universal Digital Payments Network (UDPN), a permissioned blockchain system composed of validator nodes run by an alliance of banks, financial institutions and consultancies. The system, created by tech consultancy GFT Group and Red Date Technology, the co-founder of the Chinese Blockchain-Based Service Network (BSN), instructs and allows transactions to occur across a spectrum of networks, ranging from stablecoins on public blockchains to CBDCs.

Sam Bankman-Fried's defense team wants him to testify about his knowledge of whether lawyers were involved in parts of FTX's operation, his understanding of industry practices, his intentions with FTX's funds as his empire collapsed and his knowledge of FTX and Alameda's financials, filings from his attorneys and the Department of Justice (DOJ) suggest. A Wednesday defense filing asked Judge Lewis Kaplan, who's overseeing the case, to grant the defense attorneys permission to ask Bankman-Fried about certain aspects of FTX's operation and how the company's counsel were involved in making those decisions. They include FTX's use of auto-deletion policies for Signal and Slack messages, the opening of North Dimension and its bank accounts, loans made from FTX and Alameda Research to its executives and other issues. The DOJ has tried to argue that some or all of these issues were proof of criminal intent, the filing said. The defense has sought to argue that Bankman-Fried did not intend to defraud his customers or investors and that part of his efforts to run the company depended on advice from his lawyers.

U.S. banking behemoth JPMorgan (JPM) now handles $1 billion worth of transactions in its digital token JPM Coin per day, Bloomberg reported on Thursday. The Wall Street bank has plans to widen the coin's usage, according to the report, citing an interview with the bank’s head of payments, Takis Georgakopoulos. JPM Coin is a settlement token that enables JPMorgan's institutional clients to make blockchain-based wholesale payments between accounts around the world. From its inception in 2019, JPM Coin has been used to make payments denominated in dollars, with support for euros added in June. “JPM Coin gets transacted on a daily basis mostly in U.S. dollars, but we again intend to continue to expand that,” Georgakopoulos said.

Chart of The Day

- The chart shows the number of whale addresses and bitcoin's price since January 2014.

- The whale addresses count remains near bear market lows, contradicting the resurgent bitcoin price.

- "This metric tends to trend up during bull markets and consolidates as we near bull market peaks. The current lack of increase in this metric indicates that as far as whales are concerned, we are yet to start a new bull cycle," IntoTheBlock said.

- Source: IntoTheBlock

- Omkar Godbole