First Mover Americas: Coinbase Plans $1B Bond Sale

This article originally appeared in First Mover, CoinDesk's daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

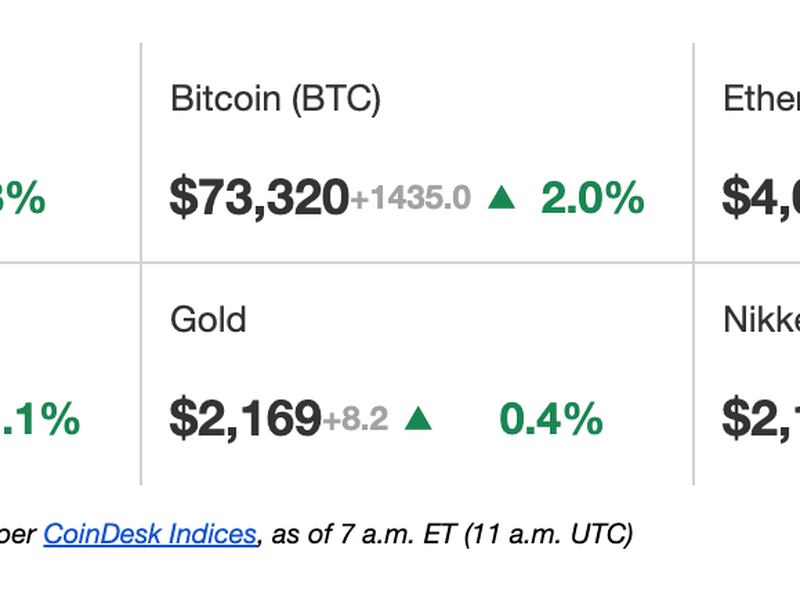

Latest Prices

Top Stories

Coinbase (COIN) announced a plan to cash in on the recent rally in digital assets by raising $1 billion through selling convertible bonds, avoiding an equity sale that could hurt its stock price. The plan also follows the path Michael Saylor's MicroStrategy has taken to fund its crypto aspirations. The crypto exchange said on Tuesday that it will offer the unsecured convertible senior notes through a private offering. Convertible bonds can be turned into shares of the issuing company (or cash) at a certain point, in this case, the conversion year is 2030. Had the company chosen to raise money by selling new shares, that would have diluted the ownership interest of existing shareholders – something they might have viewed unfavorably.

Ether (ETH) prices might see a correction, Singapore-based digital assets trading firm QCP Capital said in a morning note. The trading firm said it is still cautiously optimistic about the long-term potential of ether. Although ether has sailed past $4,000, its highest price in two years, QCP writes that it's observing a shift in market sentiment, marked by negative risk reversals. These reversals measure the difference in implied volatility between call and put options and have turned negative, likely due to the low probability of a spot ether ETF being approved in the near future. QCP also wrote that it is concerned about the amount of leverage currently in the market, but traders will quickly buy back any dips. Excessive leverage is said to have caused the May 2021 crash, where prices fell by 30% over the course of 24 hours, and a 10% correction in bitcoin's price in January.

Current U.S. intellectual property laws are adequate to deal with concerns about copyright and trademark infringement associated with non-fungible tokens (NFTs), a 112-page study by the United States Patent and Trademark Office (USPTO) and the U.S. Copyright Office concluded. The study was requested by the former Democrat senator from Vermont, Patrick Joseph Leahy, and the Democrat senator from North Carolina, Thom Tillis, in June 2022. The USPTO and the Copyright Office conducted three public roundtables and solicited comments from interested stakeholders. The offices found that most stakeholders say the current laws are adequate, even though "trademark misappropriation and infringement are common on NFT platforms."