First Mover Americas: BlackRock’s ETF Demand Ranks Among Top 5

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

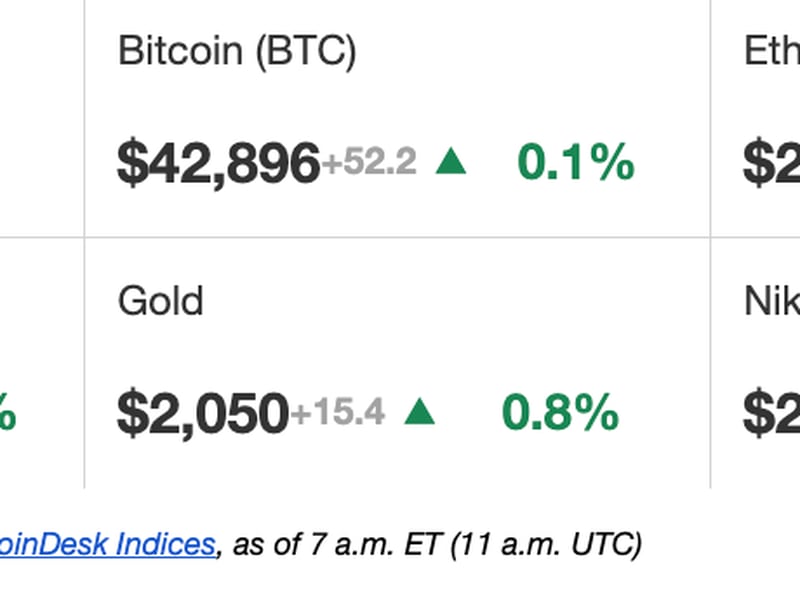

Latest Prices

Top Stories

Only 17 days after its launch, the BlackRock iShares Bitcoin Trust (IBIT) became one of the top five exchange-traded funds (ETFs) of 2024 based on inflows, according to data from Bloomberg Intelligence. The only funds beating IBIT's $3.2 billion of year-to-date inflows are mammoth longstanding index ETFs from iShares and Vanguard that offer exposure to the S&P 500 or the total stock market. In the No. 1 spot, with $13 billion in inflows, is the iShares Core S&P 500 ETF (IVV), which has a whopping $428 billion of assets under management (AUM). No. 2, with $11.1 billion in inflows, is the Vanguard 500 Index Fund ETF (VOO), which has nearly $398 billion in AUM.

Bitcoin continued to trade in a tight range on Wednesday while ether gained around 2% over the past 24 hours. Altcoin Hedera Hashgraph (HBAR) saw the most significant gains, climbing 5%. Hedera announced a five-year partnership with the Saudi Ministry of Investment Association on Tuesday to support local tech startups. The company will launch DeepTech, a $250 million venture studio to support Saudi firms that focus on blockchain, Web3 and AI. Monero’s XRM lost 8% after Tuesday's 30% slump to a 20-month low prompted by crypto exchange Binance saying it will stop listing the privacy token as of Feb. 20.

Liquidity provider B2C2 secured regulatory approval in Luxembourg as a virtual asset service provider (VASP) as the London-based firm looks to expand its presence in the European Union. Approval allows B2C2 to offer over-the-counter (OTC) spot crypto services to institutional clients. It becomes the 12th VASP to be added to Luxembourg's Commission de Surveillance du Secteur Financer’s (CSSF) public register. The company already has a license from France's Autorité des Marchés Financiers (AMF), acquired when it bought Paris-based Woorton in August last year. The moves come as the EU prepares to implement its Markets in Crypto Assets (MiCA) regulation this year. Once it kicks in, the 27-nation trading bloc will be the first major jurisdiction worldwide to introduce comprehensive, tailored rules for the sector.