First Mover Americas: BlackRock, SEC Discuss ETF Listing Rules

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Representatives from BlackRock (BLK), Nasdaq and the Securities and Exchange Commission (SEC) met for the second time in a month to discuss rule changes that are necessary to list the spot bitcoin (BTC) exchange-traded fund (ETF), according to a published memo. “The discussion concerned The NASDAQ Stock Market LLC’s proposed rule change to list and trade shares of the iShares Bitcoin Trust under Nasdaq Rule 5711(d),” the memo reads. The Nasdaq rule establishes specific criteria and regulatory guidelines for the listing and trading of Commodity-Based Trust Shares on the Nasdaq Exchange, and details the requirements for initial and continued listing, along with surveillance and compliance measures to ensure market integrity and protection against fraudulent activities.

A mix of catalysts and historical behavior could catapult bitcoin (BTC) to as high as $160,000 in a widely expected bull market analysts say could take off in 2024. Expected demand for bitcoin from several spot exchange-traded funds (ETFs) in the U.S., the forthcoming reward halving and growth in broader stock markets on the back of lower interest rates could lift bitcoin prices to at least $50,000 in the short-term, on-chain analysis firm CryptoQuant said in a Wednesday report shared with CoinDesk. “We argue that bitcoin and crypto markets could have a positive year in 2024 mostly amid the effects from: 1. The market valuation cycle, 2. Network activity, 3. The bitcoin halving, 4. The macroeconomic perspective, 5. Bitcoin spot ETF approval and 6. Growing stablecoin liquidity,” CryptoQuant analysts said.

Markets shouldn't underestimate the significance of the coming spot bitcoin (BTC) ETFs, said MicroStrategy (MSTR) Executive Chairman Michael Saylor in a Bloomberg TV appearance on Tuesday. "It's not unreasonable to suggest that this might be the biggest development on Wall Street in 30 years," said Saylor, suggesting the last comparable new product was the S&P 500 ETF, which allowed investors one-click exposure to that widely followed index. Mainstream investors – whether at the individual or institutional level – to date have not had a "high bandwidth" compliant channel for putting money into bitcoin, said Saylor, and that's all about to change with the spot ETF.

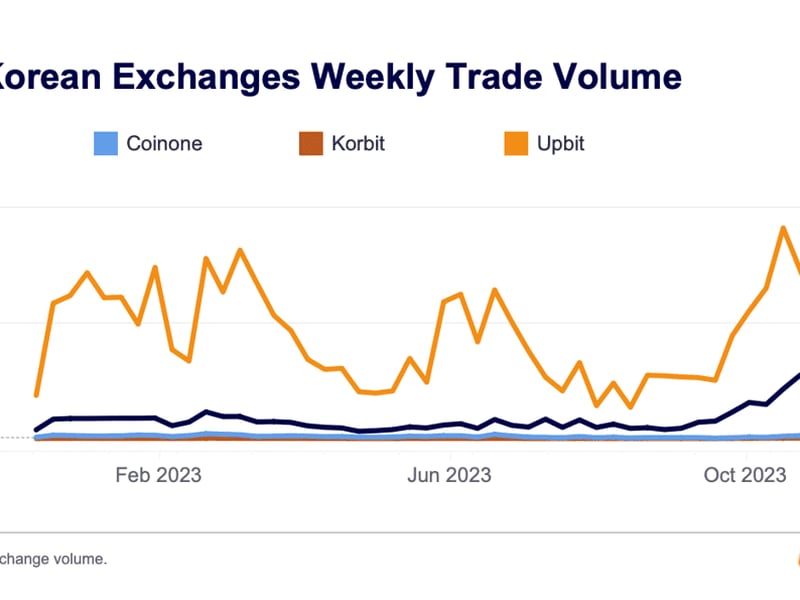

Chart of the Day

- Weekly trading volume on Korean crypto exchanges hit a year-to-date high.

- Korean exchanges Upbit, Coinone, Bithumb and Korbit hit a yearly high of $24 billion in early December.

- This is an eight-fold surge from September.

- “Korean markets are dominated by altcoins, which account for more than 80% of total volume and typically see a greater increase in trading activity in a risk-on market environment,” according to Kaiko.

- Source: Kaiko

- Lyllah Ledesma