First Mover Americas: Bitcoin Tops $45K for First Time in 21 Months

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

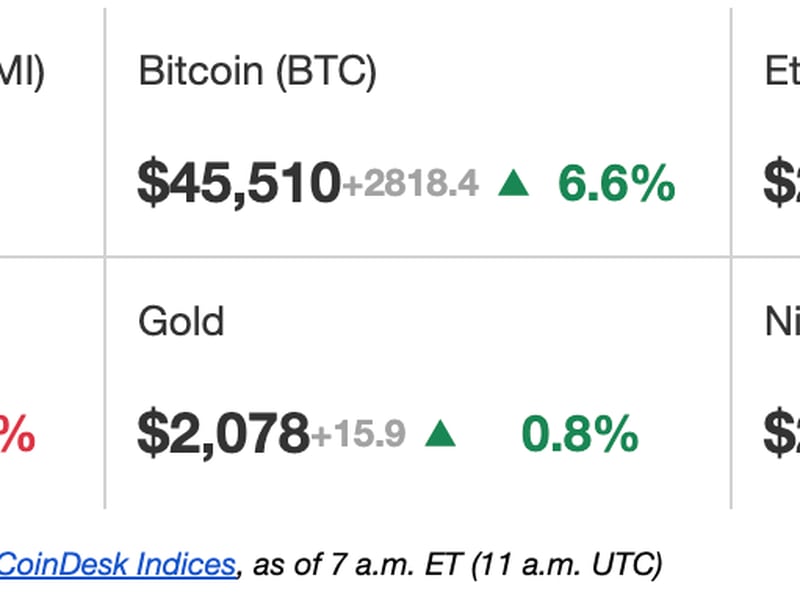

Latest Prices

Top Stories

Shares of prominent bitcoin-adjacent companies rose in pre-market trading on Tuesday as the world's largest cryptocurrency started 2024 by surpassing $45,000 for the first time in 21 months. Bitcoin (BTC) has added more than 7% in the last 24 hours to about $45,600, the highest level since the start of April 2022. U.S.-traded companies such as crypto exchange Coinbase (COIN), software developer MicroStrategy (MSTR) – which owns a large number of bitcoin – and mining firms Marathon Digital (MARA) and Riot Blockchain (RIOT) rode the bullish momentum to show significant gains in pre-market trading. Coinbase is up 3.7% at the time of writing, while MicroStrategy is up 8.1%. Marathon and Riot both added more than 10%. BTC’s latest surge indicates ever-increasing anticipation of a spot BTC exchange-traded fund (ETF) being listed in the U.S. A Reuters report on Dec. 30 suggested that the Securities and Exchange Commission (SEC) could notify ETF sponsors as early as Tuesday that their applications would be approved.

The rise in popularity of EVM-compliant blockchains and the parallelization process is driving the growth of the Sei Network's SEI token, which has gained over 75% in the past week. Sei Network launched in August as a trading-focused blockchain backed by prominent investors Jump Crypto and Multicoin Capital. It was designed with a focus on speed, low fees and other features tuned to support certain kinds of trading apps. The network's SEI tokens reached a $400 million capitalization within the first 24 hours after issuance, but gained little in the next few months as on-chain trading behavior remained subdued. However, the recent token trading frenzy in blockchains such as Solana and Avalanche is driving speculators to bet on blockchains other than Ethereum, the usual favorite, and networks such as Sei are benefiting.

The race to launch a bitcoin ETF reached a bureaucratic climax Friday as some of the biggest Wall Street firms finalized their offerings' paperwork ahead of widely expected – possibly imminent – approval from the U.S. Securities and Exchange Commission. BlackRock, Fidelity and Invesco, as well as crypto-focused firms Valkyrie and Bitwise, revealed key details, including partnerships with vital trading firms and the fees their prospective ETFs will charge customers if the SEC gives the green light. Friday's filing rush suggests the firms aren't willing to take any chances on timing. Bloomberg analysts have said the SEC is likely to approve multiple issuers at once to avoid picking favorites. Thus, the eager issuers are getting all the ducks in a row so that they can be in the first group.

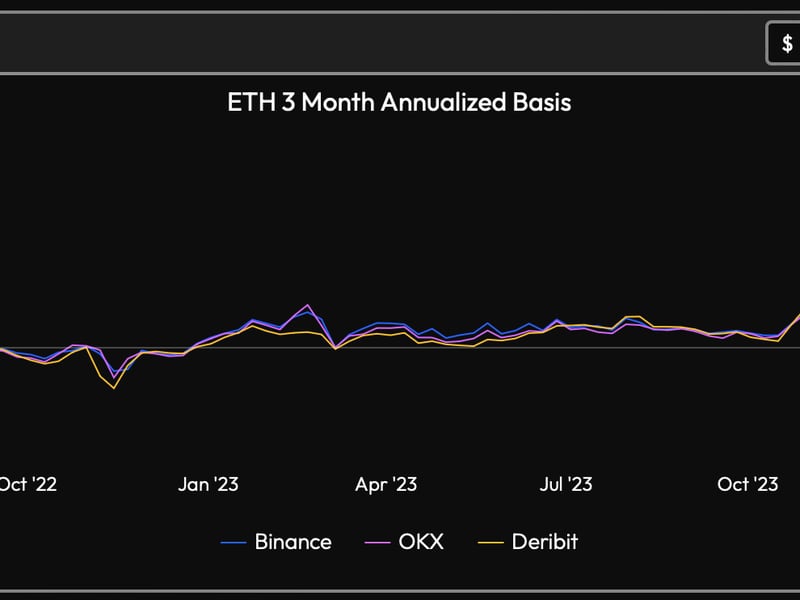

Chart of The Day

- The chart shows three-month annualized ether futures basis on major centralized exchanges – Binance, OKX and Deribit.

- The basis, or the difference between futures and spot prices, has surged to above 20% for the first time since at least June 2022.

- The surge in premium reflects a bullish bias and may entice "carry traders" looking to profit from discrepancies in the two markets.

- Source: Velo Data

- Omkar Godbole