First Mover Americas: Bitcoin Spot ETFs Inch Closer to Reality in U.S.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

On Friday, a person familiar with the matter said the U.S. Securities and Exchange Commission wouldn’t appeal its loss in the Grayscale case. “The SEC’s decision not to appeal against a ruling that it was wrong to reject a spot BTC ETF is a clear testament that regulatory dynamics in crypto are evolving,” said Lucas Kiely, chief investment officer at Yield App in a note to CoinDesk. “While this by no means guarantees that Grayscale will convert its bitcoin trust into an ETF, the move does allow Grayscale’s application to move forward,” Kiely said. “It also opens the door for further spot bitcoin ETFs in the U.S., which could potentially narrow the gap with Europe and Canada, where ETFs have already gained traction with investors.”

Bitcoin (BTC) jumped about 4.5% in Asian morning hours Monday on optimism a bitcoin exchange-traded fund could get approved in the coming months, sparking bullish expectations. Bitcoin traded just under $28,000, reversing all losses over the past week. The jump seemed to be a continuation of Friday’s reaction to the SEC’s decision to not appeal the recent Grayscale ruling. As well as a pump in bitcoin prices following the news, the widely tracked crypto market indicator "GBTC discount" narrowed to its lowest in 22 months on Friday. On Friday, shares in Grayscale Bitcoin Trust (GBTC) traded at a discount of 15.87% to the trust's net asset value, a level not seen since December 2021, according to YCharts. The discount has been steadily narrowing since reaching a record low of nearly 50% during the height of the bear market in December last year.

Australia expects to release draft legislation that covers licensing and custody rules for crypto asset providers by 2024, and once the legislation becomes law, exchanges will have 12 months to transition to the new regime, the country’s Treasury announced on Monday. The timeline indicates it could take until 2025 for an Australian digital asset platform to receive a license under the regime. Still, the development represents a significant step taken by the Australian government towards framing a crypto regulation policy.

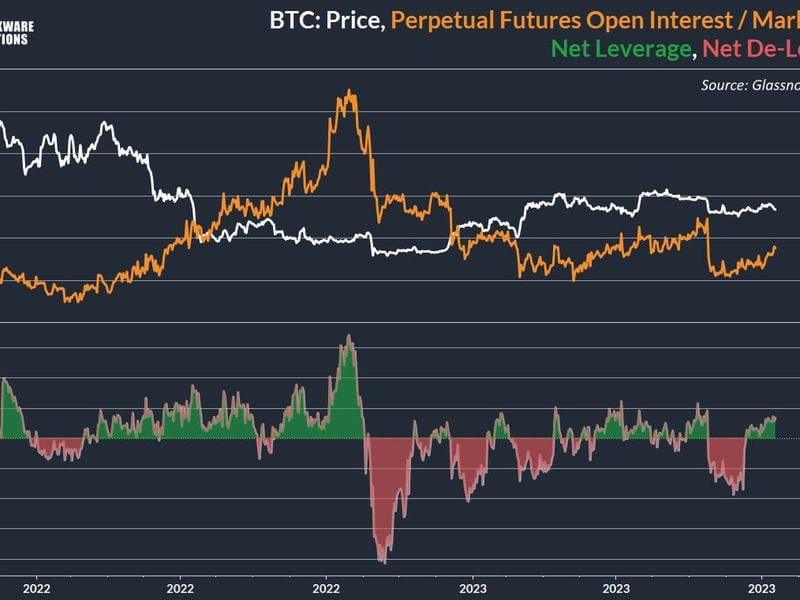

Chart of The Day

- The chart shows bitcoin's price, open interest in perpetual futures and the ratio of perpetual futures open interest to market cap (lower pane) since early 2022.

- The ratio has recently risen in the past two weeks, signaling an increase in the degree of leverage used in the market.

- The increase in leverage may show traders positioning themselves in anticipation of the SEC making an appeal on the Grayscale ruling, Blockware Solutions said. The deadline expired midnight Friday.

- Source: Blockware Solutions

- Omkar Godbole