First Mover Americas: Bitcoin Hovers Above $62K

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin slid toward $62,000 during the Asian and European mornings on Wednesday as part of a broader dip across the crypto market in which tokens lost more of their gains from the rally at the end of last week. BTC is priced at around $62,200 at the time of writing, down nearly 2.9% in the last 24 hours. The CoinDesk 20 Index (CD20), which measures the performance of the whole digital asset market, has sunk around 3.65%. Solana is one of the worst affected of the leading altcoins, falling 6.5% to $146, while ether has declined by around 3.63% to trade around $3,000.

Bankrupt cryptocurrency exchange FTX proposed a new reorganization plan that would see 98% of its creditors get back 118% of their claims in cash within 60 days of court approval. The proposed payouts are higher than earlier estimates from the FTX estate, which said in October it expected to pay back only 90% of customer funds. The estate said it expects to have between $14.5 billion and $16.3 billion in cash available from scraping together the company's assets and liquidating them. It also denied that the recovery in crypto prices since FTX's collapse in November 2022 is the driving force behind its pile of cash.

Holders of liquid staking tokens on decentralized options platform Lyra Finance can now generate additional yield using automated versions of strategies like basis trade and covered calls. Lyra says holders of rswETH and eETH, the native liquid staking tokens of Swell Network and Ether.Fi respectively, could earn an annual percentage yield of 10%-50%. Liquid staking protocols like Swell and Ether.Fi allow users to deposit their tokens, which are then restaked in EigenLayer, thereby receiving liquid staking tokens that can be exchanged for ether. “We believe that tokenized derivatives yield is a game-changing primitive that will underpin the bootstrapping of networks and the expansion of sustainable crypto economic markets,” Nick Forster, co-founder of Lyra, said.

Chart of the Day

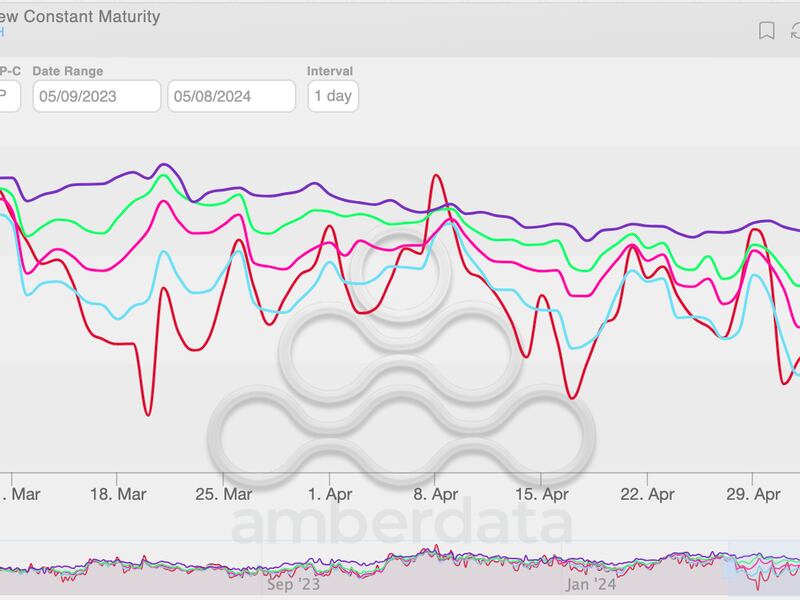

- The chart shows bitcoin call-put skews, which measure demand for calls relative to puts.

- The seven-day (red) and 30-day (light blue) skews remain below zero, indicating persistent demand for put options, offering protection against price drops.

- It likely reflects concerns about the U.S. SEC not approving the spot ether ETF this month.

- Source: Amberdata

- Omkar Godbole