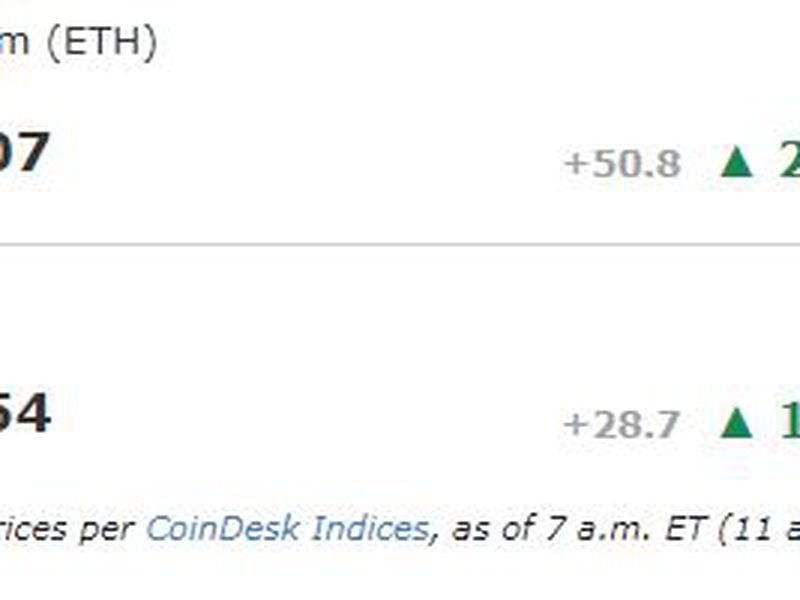

First Mover Americas: Bitcoin Eclipses $43K Having Gained Nearly 10% in a Week

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

Bitcoin has gained nearly 10% in the last week to climb above $43,000 ahead of the Fed's rate decision tomorrow. The U.S. central bank is expected to keep rates unchanged, which could boost appetite for BTC and its related exchange-traded funds, venture capital firm Tagus Capital said in its daily newsletter. Altcoins SOL and AVAX have led the recent crypto rally, gaining 27% and 25% in the last week. "Altcoins' consistent positive performance over the past six days is setting up optimism, setting up bitcoin for a test of $46,000," Alex Kuptsikevich, a senior market analyst at FxPro, said in an email. "The outperformance in major altcoins points to a broadening of participant interest beyond the two largest coins."

Binance now allows larger traders to keep their assets at independent banks, the Financial Times reported on Tuesday. Previously, traders had to hold their assets on the exchange or at its custodial partner, Ceffu, but now they can now use crypto-friendly institutions such as Swiss banks Sygnum or FlowBank. This may reflect users' unease about Binance's regulatory dispute in the U.S., which saw it landed with a $4.3 billion fine in November, heightening concerns brought about by the bankruptcy of rival exchange FTX a year earlier. "I'd much rather park my money with a Swiss bank than Binance," said the head of a crypto trading firm cited by the FT.

Bitcoin-based decentralized exchange Portal has raised $34 million in seed funding as it exits stealth mode. Investors in the round included Coinbase Ventures, Arrington Capital, OKX Ventures and Gate.io. Portal aims to offer a decentralized infrastructure for peer-to-peer swapping of bitcoin across different blockchains without the need for intermediaries such as wrappers, bridges or centralized exchanges, which heighten the risk of hacks. The healthy size of the funding round is an indicator both of the brightening prospects for raising capital in the crypto industry after a tough couple of years and the growing interest in the use of bitcoin in the DeFi world, which is otherwise dominated by altcoins like ETH and SOL.

Chart of The Day

- The chart shows solana's daily price changes and the momentum indicator called the MACD histogram.

- SOL has broken out of a trendline characterizing a minor price pullback, and the MACD has crossed above zero in a sign of renewed bullish momentum.

- "A daily MACD 'buy' signal shows a positive shift in short-term momentum, and there is room to short-term overbought territory, supporting follow-through to the December high," Fairlead Strategies said in a note to clients Monday.

- Source: TradingView

- Omkar Godbole