First Mover Americas: Bitcoin and Ether Stay Stable in Chaotic Week in Markets

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Bitcoin (BTC) and ether (ETH) have traded in a tight range this week and are finishing the week pretty much back where they started. As macroeconomic turbulence continues across the globe, the crypto market appears to have suffered little impact. Both cryptocurrencies are down around 1% over the last seven days.

Laurent Kssis, a crypto trading adviser at CEC Capital, still considers a target below $19,000 for bitcoin as realistic. And “targeting levels at $1,200 for ETH is the trend,” he said.

European markets started Friday lower as political chaos in the United Kingdom continued. On Thursday, Liz Truss resigned as prime minister after just 45 days in office. A leadership contest will now take place over the next week.

Pound volatility nears bitcoin level

Data showed that the pound sterling and bitcoin volatility levels have become almost identical. The 30-day volatility for both shows that the pound is on the verge of becoming more volatile than the cryptocurrency.

Stock futures are down in the U.S. as investors came out of a tumultuous day of wide-ranging corporate earnings.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Alchemy Pay | ACH | +6.0% | Currency |

| Polymath | POLY | +4.83% | DeFi |

| Rally | RLY | +4.58% | Culture & Entertainment |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Axie Infinity | AXS | -8.48% | Culture & Entertainment |

| STEPN | GMT | -7.96% | Culture & Entertainment |

| Ocean Protocol | OCEAN | -5.65% | Computing |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Chart of the Day

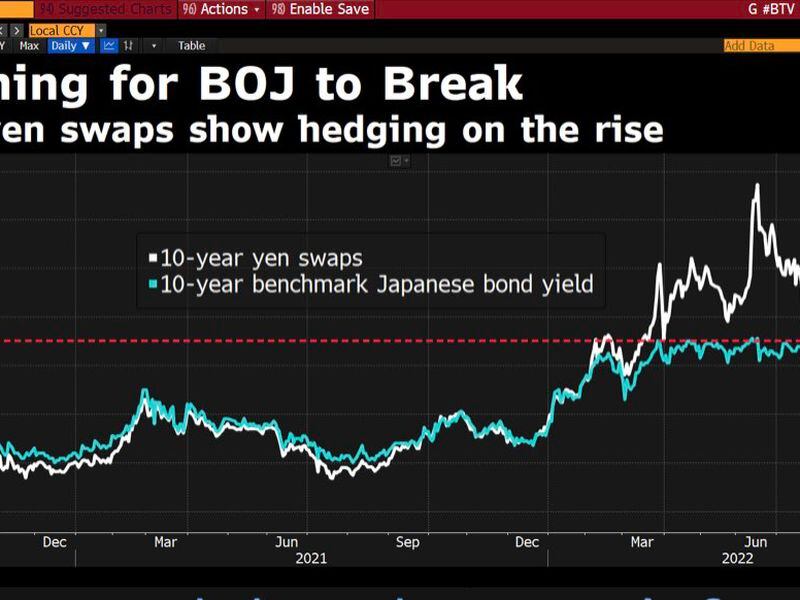

Move Over Fed. Bank of Japan May Be Close to a Breaking Point

By Omkar Godbole

- The Bank of Japan may face a $200 billion loss on its bond holdings if it loses control of the six-year-old yield curve control program to keep the 10-year rate at 0.25%.

- That, coupled with the resulting sharp rally in the yen, may inject volatility into risky assets, including cryptocurrencies.