First Mover Americas: Back in the Green

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

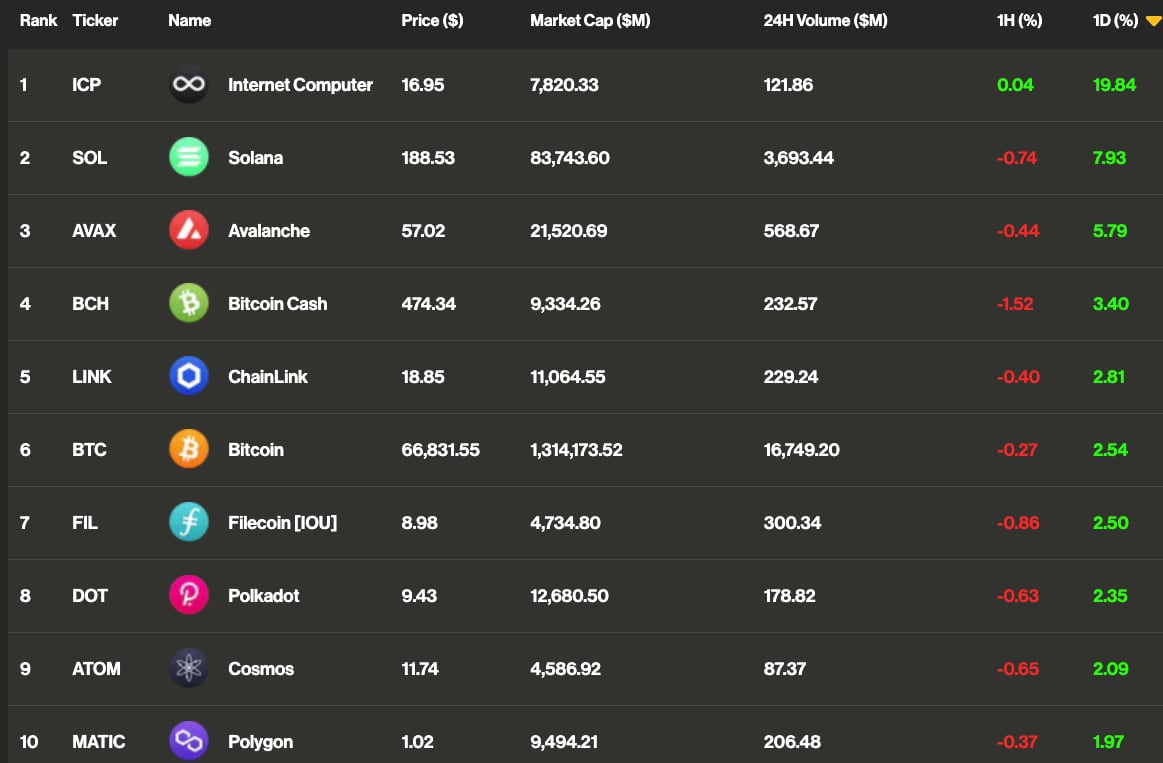

Latest Prices

Top Stories

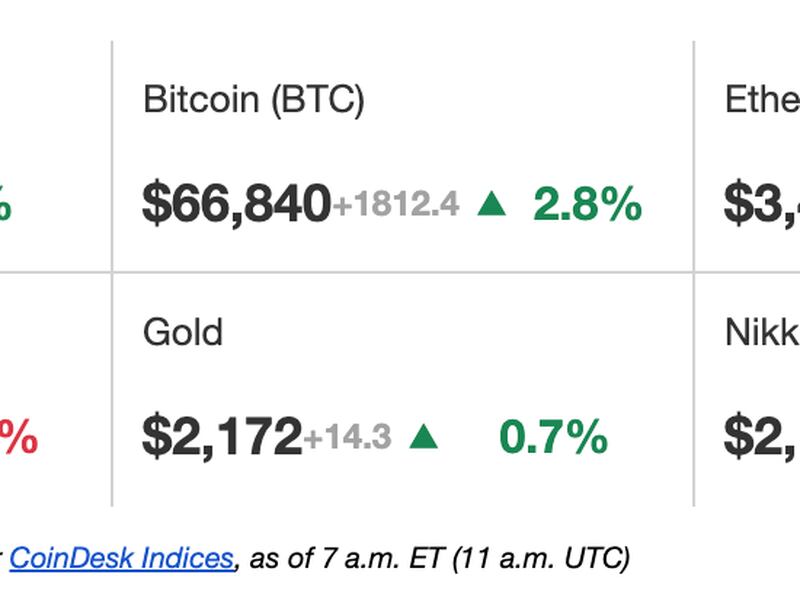

The crypto market began the week in the green as traders cheered BlackRock's foray into asset tokenization and the beginning of the global central bank easing cycle. Bitcoin (BTC), the world's largest digital asset, traded at $67,000, up 3% on a 24-hour basis, and ether traded 2.3% higher above $3,400. The CoinDesk 20 (CD20), a measure of the most liquid cryptocurrencies, was up around 3.2% at press time. Bradley Park, an analyst at CryptoQuant, attributes the gains to the market digesting BlackRock's fund targeting tokenized products (BUIDL) on Ethereum. Other tokens gaining on Monday were Internet Computer (ICP), which added 20%, Ondo Finance’s ONDO, rising 15%, and Near protocol (NEAR), also about 15% higher over 24 hours.

Binance, the world's largest crypto exchange, was charged with tax evasion by Nigerian authorities as a weekslong standoff between the two parties intensified, local media outlets reported Monday, citing a statement from the country's tax watchdog. The charges, which also name two Binance executives detained by the government, were announced by the Federal Inland Revenue Service (FIRS) and filed at the Federal High Court in Abuja, one outlet reported. The exchange is being charged with four counts of tax evasion, including "non-payment of Value-Added Tax (VAT), Company Income Tax, failure to tax returns, and complicity in aiding customers to evade taxes through its platform."

The cryptocurrency market remains fixated on spot bitcoin (BTC) exchange-traded fund (ETF) flows rather than fundamentals, as the recently approved products saw their first week of net outflows in two months, Coinbase (COIN) said in a research report on Friday. Coinbase noted that net outflows amounted to $836 million between March 18 and March 21. Bitcoin slipped below $63,000 last week as the outflows sped up. It was recently trading at around $66,800. There is little insight into what drove the surge in outflows from the Grayscale Bitcoin Trust (GBTC), which reached $1.83 billion in total over four days, the report said.

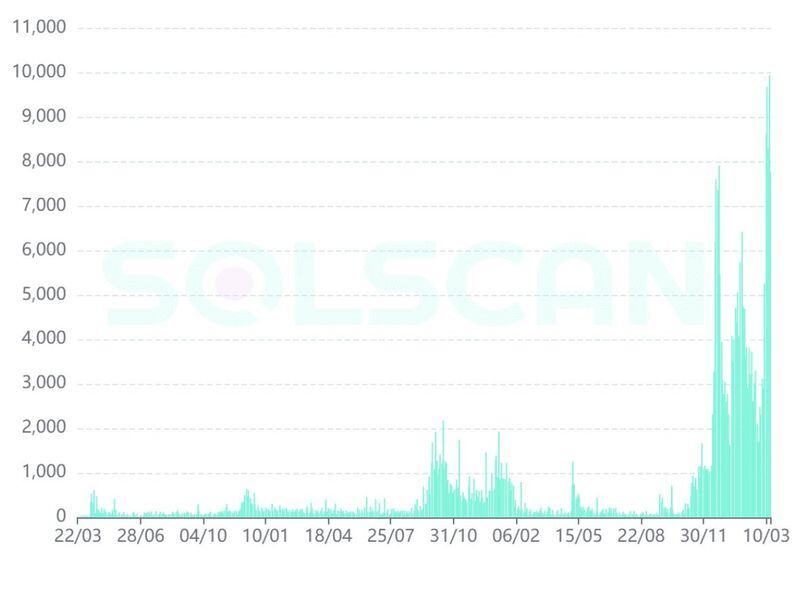

Chart of the Day

- The chart shows the number of new Solana-based tokens created per day.

- The daily count surged to nearly 10,000 early this month.

- The increased network activity, fueled by memecoins and politically-themed tokens, has users rushing to purchase the token to access the Solana ecosystem, 21Shares said.

- That's creating a reflexive demand for Solana's SOL token analogous to the impact on ETH during 2017's ICO craze, 21Shares added.

- Source: Solscan