Ether Surges to 7-Month High, Outshines Bitcoin on BlackRock ETF Plans; Altcoins Plunge

- ETH soared 10% to near $2,100 after a Nasdaq filing confirmed BlackRock's plan to file for an ETH-based ETH.

- BTC recently changed hands at $36,600, up 3% during the day.

- Most of the rest of cryptocurrencies suffered declines as rotation to altcoins halted amid ETH, BTC strength.

Ether [ETH] stole the spotlight from bitcoin [BTC] Thursday as asset management giant BlackRock (BLK) laid the groundwork to list an ETH exchange-traded fund.

ETH surged past $2,000 early U.S. morning hours from below $1,900 after a filing showed a corporate entity named "iShares Ethereum Trust" had been registered in the state of Delaware – the legal home of many U.S. businesses. Something similar happened in June with BlackRock's iShares Bitcoin Trust – the Delaware corporate registration came just before the actual ETF application.

History repeated itself Thursday. Hours after the Delaware filing, a Nasdaq filing confirmed BlackRock's plan for an ether-focused ETF.

UPDATE: BlackRock #Ethereum ETF confirmed. They just submitted a 19b-4 filing with Nasdaq pic.twitter.com/pLhuhhK7jo

— James Seyffart (@JSeyff) November 9, 2023

Bitcoin hit a fresh 18-month high price, soaring to just shy of $38,000 from around $35,000 in a short squeeze early morning BlackRock ETH news, though, BTC saw a sharp reversal, sinking to around $36,300.

ETH was up 10% over the past 24 hours, while BTC advanced 3% over the past 24 hours.

Read more: Wild Bitcoin, Ether Price Swings Spur $400M of Crypto Liquidations, the Most Since August

Altcoins plunge like XRP, DOGE UNI and XLM

While ETH and BTC showed strength, most alternative cryptocurrencies – altcoins – retreated during the day, paring back their gains from the previous days as capital rotation to smaller tokens seemingly halted.

Ripple's XRP, dogecoin [DOGE], uniswap [UNI] and Stellar's XLM declined 6%-7%, while toncoin [TON] pulled back 10% after its over 20% rally over the past week.

Governance tokens of top ETH liquid staking platforms defied the plunge, with Lido's [LDO] and RocketPool's [RPL] rising 18% and 23%, respectively.

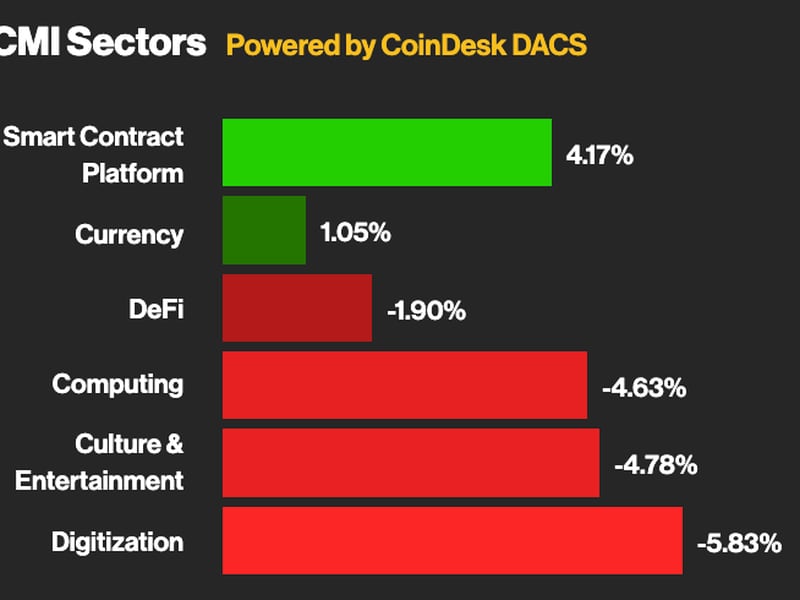

The divergence between the two largest crypto assets and the rest of the market was visible in the performance of the CoinDesk Market Index [CMI] sectors. Only the ETH-heavy Smart Contract Platform sector and BTC-led Currencies sector booked gains during the day as the rest of the crypto sectors plummeted.

The altcoin weakness was perhaps buoyed by a generally risk-off day on traditional markets after Federal Reserve Chair Jerome Powell said the central bank won't hesitate to hike interest rates if necessary, pouring cold water on expectations of a more dovish monetary policy.

U.S. equities tumbled, ending their winning streak with the S&P 500 and Nasdaq indexes down almost 1%.

Why BlackRock's ETH ETF application is important

Market observers opined that a spot BTC ETF, if approved, could attract sophisticated investors who previously couldn't or didn't feel comfortable to buy crypto. While there are several futures-based bitcoin and ether ETFs on the market, they are deemed inferior products due to rollover costs.

"If act one is a spot bitcoin ETF, then act two is a spot ether ETF," said Diogo Monica, president of federally chartered digital asset bank Anchorage Digital.

"A spot ETH ETF would have a similar impact as a BTC counterpart, providing a regulated and accessible wrapper for institutions and consumers to participate in the ETH ecosystem," he explained in an emailed note.

"But Ethereum adds an extra layer of intrigue as a proof-of-stake asset, which means underlying ETH could also be staked for additional rewards," he added.