Ether Staking Yields Jump Up to 25%; All-Time High Since Merge

Staking vanilla ether (ETH) is generating eye-catching yields for crypto hopefuls amid a broader market crisis with returns on most fixed-income crypto products dropping as low as 0%.

Operations at centralized crypto lending companies such as Genesis and Circle were caught in the contagion risks stemming from the exchange FTX in the past few weeks. Withdrawals have been paused at Genesis, while yields on clients’ stablecoin deposits at Circle have dropped to 0%.

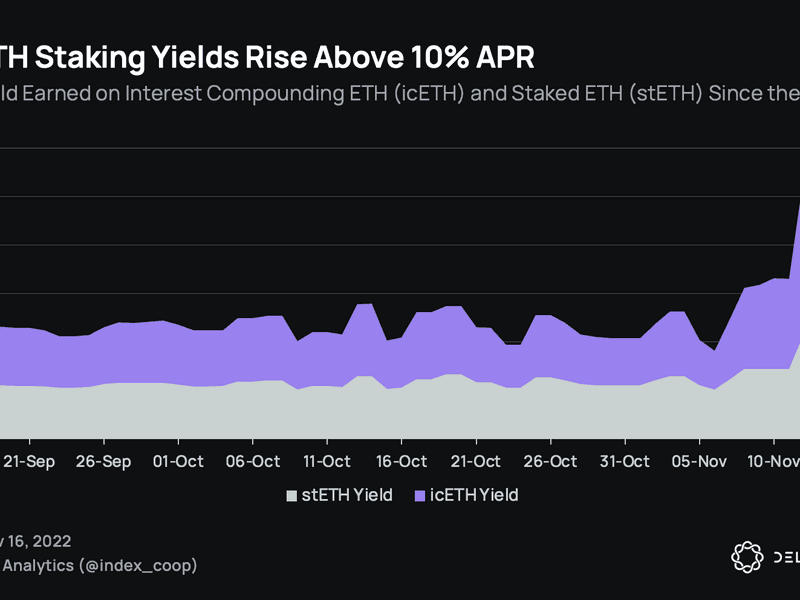

The decentralized finance (DeFi) market is muscling on. Users simply staking staked ether (stETH) at staking service Lido are earning as much as 10.7% – an all-time high since the Merge event – with even higher returns for holders as the value of stETH increases.

stETH is a token representing an equivalent amount of ether that has been staked. Staked tokens are locked up for an extended period to provide liquidity for staked ether.

“Recently, the liquid staking protocol also had to increase rebasing oracle limits from 10% to 17.5% to let the increased rewards flow to stETH token holders,” analysts at Delphi Digital said in a Friday note. Rebasing, or elastic, tokens are cryptocurrencies that automatically adjust supply levels to maintain a constant value.

The increased rewards have led to related borrowing strategies offering yields of as much as 25.5% on the Interest Compounding ether product (icETH) offered by Index Coop.

As a result of the increased rewards, the yield earned by recursive borrowing strategies such as icETH has also reached an all-time high of 25.5% since the Merge. It stands at 24.05% at writing time.

The Interest Compounding ETH Index (icETH) enhances staking returns with a leveraged staking strategy. The strategy uses a user’s stETH tokens as collateral on DeFi lending service Aave to borrow wrapped ether (WETH) – a token that tracks ether – that is in turn used to purchase additional stETH tokens.

This effectively leverages the amount of collateral supplied to Aave, and uses that to increase yield for traders.

Data shows some $21 million worth of icETH tokens are currently on the market, with $12 million put to use on Aave to generate additional yields for holders.

However, there are some caveats to these high yields.

“Apart from smart contract risk, investors in icETH need to consider the liquidation risk from borrowing ETH from Aave,” Delphi analysts said. “And interest rate risk from the spread between borrowing cost and staking return.”