Ether Options Out of Sync With Bullish Sentiment on Street

Ether [ETH] could be a market leader in the coming months, observers said early this month, adding the native token of Ethereum's blockchain is qualified to be a core holding in a diversified crypto portfolio. As of now, the options market does not share that sentiment.

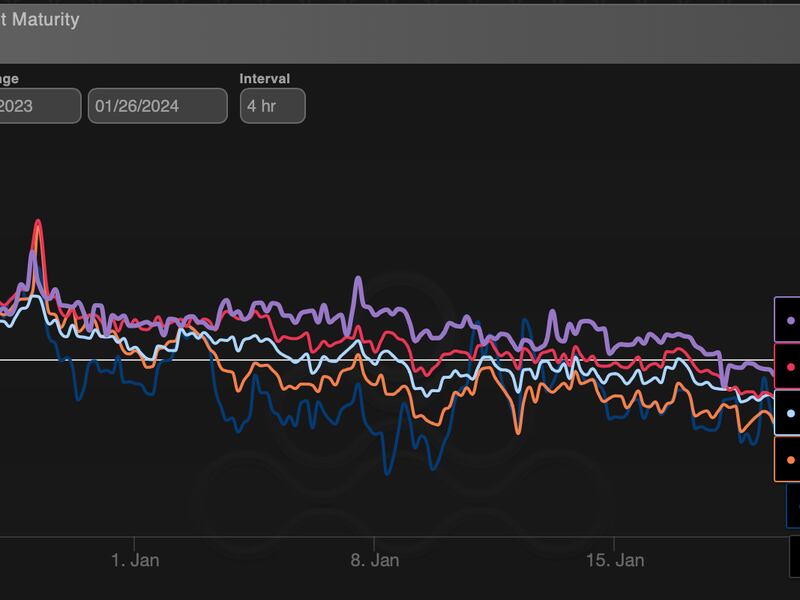

According to Amberdata, options tied to ether show bias for price weakness over three months, with a slight bias for strength in the subsequent months.

Options are derivatives that allow buyers to profit from or hedge against price rallies and price slides. A call option helps profit from price rallies, while a put offers protection from price drops.

Ether's one-week call-put skew, a gauge of demand for calls relative to puts expiring in seven days, fell to nearly -8 on Wednesday, the lowest in over three months, indicating a preference for bets that ether’s price will decline. The gauge stayed negative at press time, with one-, two- and three-month skews exhibiting a negative outlook.

According to observers, the relative richness of ether puts stems from ETH’s move below crucial support and investor interest in selling calls to generate additional yield.

“The sudden increase in ETH skew reflects the influence of call selling flows and the break of key technical support at $2,400, pushing prices towards $2,200," Imran Lakha, founder of Options Insights, said in a blog post on Deribit, the world’s leading crypto options exchange by volumes and open interest.

“A critical level for ETH is $2,150; breaching this could lead to further declines. Recent market movements suggest a cautious short-term outlook for ETH, with increasing demand for hedges," Lakha added.

Ether changed hands at $2210 at press time, representing a 1% drop on the day, according to CoinDesk data.