Ethena’s Prelaunch Futures Surge 22% as ENA Token Is Set To Go Live Next Week

- Decentralized finance protocol Ethena will airdrop 750 million ENA tokens to USDe holders on April 2.

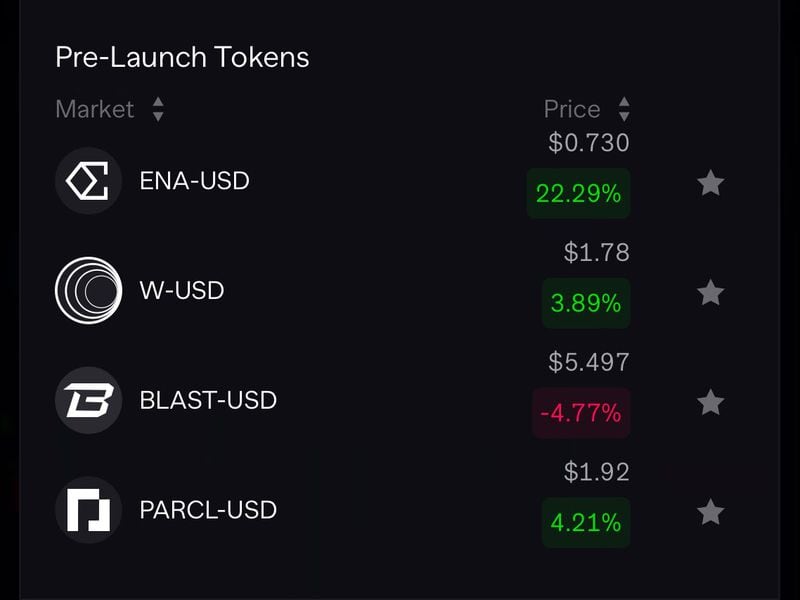

- Aevo's prelaunch futures tied to ENA surged over 20% early Friday.

Prelaunch futures tied to decentralized finance protocol Ethena’s impending governance token ENA surged on Friday, implying a market capitalization of over $500 million at inception.

The ENA/USD pre-debut futures listed on the decentralized exchange Aevo changed hands at 73 cents during the Asian trading hours, representing a 22.29% gain on a 24-hour basis.

Ethena, home to the $1.3 billion USDe token, will airdrop 750 million ENA, equating to 5% of the total supply, to USDe holders on April 2. Traders who unlock, unstake, or sell their USDe before April 1 will not be eligible for the airdrop.

The stated airdrop figure and the going market price implied by prelaunch futures mean the token could debut with a market capitalization of $547.5 million. The market cap is determined by multiplying the circulating supply with the going market price. Meanwhile, ENA's fully diluted market value (FDV) could be over $10 billion. The FDV uses total supply to calculate the market value.

The double-digit surge in the ENA prelaunch futures likely resulted from Binance announcing a launchpool for users to stake their BNB and FDUSD farm ENA tokens. Binance launch pool, often called a centralized yield farming service, is a popular way for users to participate in early-stage projects.

“The @ethena_labs prelaunch market on Aevo is up 20% on the back of their Binance Launchpool announcement,” Aevo said on X.

ENA farming on Binance launchpool will start on March 30 at 00:00 UTC and be open for three days. The leading cryptocurrency exchange will list ENA on April 2, allowing trading in ENA/BTC, ENA/USDt, ENA/BNB, ENA/FDUSD and ENA/TRY pairs.

Aevo’s pre-listing perpetual futures are similar to “I owe you” or IOU futures offered by some exchanges. Once the token goes live, the pre-listing perpetuals reference the token’s spot price and collect funding rates from traders to keep perpetuals in sync with the spot price.