DeFi Options Platform Opyn's 'Crab Strategy' Generates 14% Return in Comatose Ether Market

A decentralized finance (DeFi) product that launched earlier this year to help investors profit from a sideways trending market is generating desired results.

The "Crab" strategy, designed by leading DeFi options platform Opyn, is built to make money during bouts of low ether (ETH) price volatility. It has earned 14% returns in U.S. dollar terms and 42% in ether terms since its v2 went live in late July. Ether has dropped 20% since the end of July, however, the cryptocurrency has primarily traded between $1,100 to $1,300 in the past four weeks.

The strategy is yet another example of the DeFi industry helping investors bypass complexities involved with traditional option strategies like "short straddle" often set up by sophisticated market participants during a market lull.

In case of a short straddle, a trader sells bullish and bearish options contracts called call and put on a centralized exchange. If the market stays rangebound, the short straddle makes money. Setting up such multi-leg strategies is easier said than done, as traders must select appropriate levels to buy/sell options and the expiration date and actively manage the position as several factors influence options prices.

In Opyn's crab strategy, users only need to deposit ETH as collateral to start profiting from a comatose market. And investors seem to be piling money into the automated product.

"When Crab v2 went live, the strategy had 888 ETH. Currently, the strategy has 5,378 ETH, a 505% increase in 3 months," Wade Prospere, head of marketing and community at Opyn, told CoinDesk.

it's been a month since I deposited 1 ETH into @opyn_'s Crab Strategy v2, and here are my results - to say I'm impressed is more than an understatement pic.twitter.com/l1IVRqttKL

— edward (@EdwardCWilson) October 17, 2022

Crab's inner working

The crab strategy is built on top of Opyn's Squeeth or squared ether – an index tracking ether's price change to the power of two and allowing buyers to earn more when the market rallies and lose less during price drops in return for hefty funding rates – costs for keeping the so-called power perpetual position open.

After users deposit ETH as collateral, the crab vault combines long ETH with a short (bearish) Squeeth position, creating a market-neutral position.

That allows crab depositors to collect the funding rate – the cost of holding long positions – paid by the Squeeth buyers without having to worry about the risk of a rally in ETH and Squeeth. Due to the attractive payoff, the funding rate paid by buyers is higher than that paid in a standard perpetual futures market and a 2x leveraged long position.

Essentially, the vault is short Squeeth with a hedge.

"The crab strategy allows users to earn funding (yield) from being short Squeeth regardless of whether ETH will move up or down. In other words, Crab v2 is a delta-neutral [market neutral] strategy," Prospere said.

The strategy rebalances every Monday, Wednesday and Friday at 16:30 coordinated universal time to maintain the market-neutral position.

"If ETH price decreases, the strategy sells Squeeth tokens for ETH (meaning it buys more ETH to remain market neutral)," Prospere said. The crab, therefore, stacks ether during the bear market.

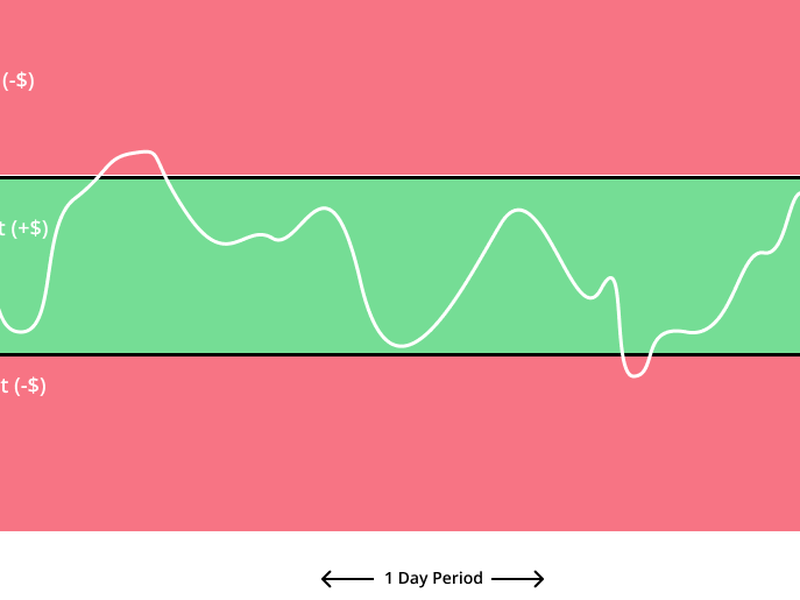

Depositors receive a payoff if ether does not move X% up or down between rebalances. The percentage is determined by the funding rate received from the Squeeth buyers and keeps changing daily.

At press time, the crab strategy promised to pay out if ether did not move more than 4.22% between rebalancing periods.

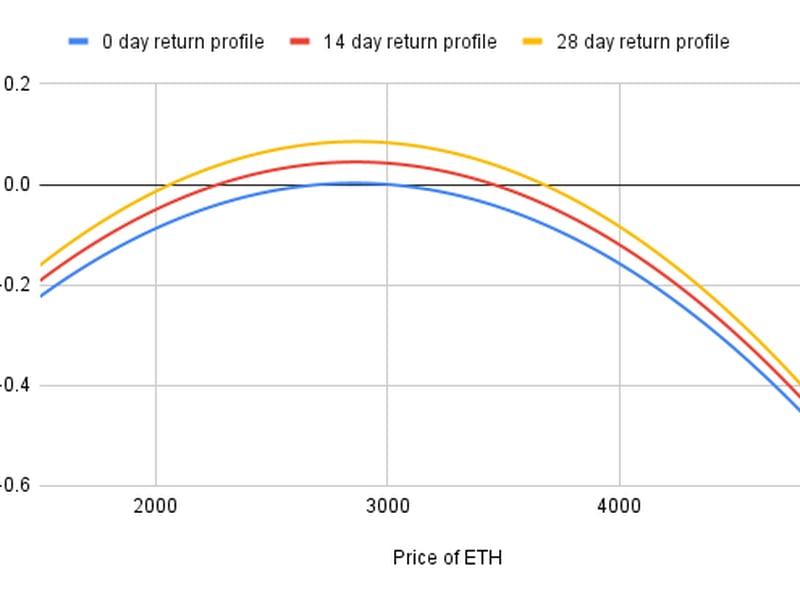

While the one-click strategy to profit from potential consolidation may look appealing to retail investors, it is not without risks. As with short straddle, crab depositors stand to lose money if ether charts a violent price move in either direction.

As the payoff diagram shows, the crab strategy is suitable for sideways market conditions when ether trades relatively stable.

"If ETH moves more than an amount [percentage] that is based on the funding received from the short Squeeth position, the strategy is unprofitable on that day," Prospere wrote in an official explainer.

"If the crab Strategy falls below the safe collateralization threshold (150%), the strategy is at risk of liquidation," Prospere added.

Read: Opyn’s New ‘Squeeth’ Raises Ether Trading to the Power of Two