Crypto Markets Today: Bitcoin Clings to $23K, FTX’s Creditor List Revealed

Top Story

It's the list everyone has been waiting for, minus 9.7 million redacted customer names. But the 116-page FTX creditor list, which names companies including Netflix (NFLX) and Apple (AAPL), still paints a comprehensive picture of the now-bankrupt crypto enterprise's reach and the impact of its collapse.

Want to receive our daily markets updates in your email inbox everyday? Subscribe to our First Mover newsletter here.

- FTX owes money to media companies, universities, airlines and charities, among others, a court filing from Wednesday shows. The document was filed by lawyers for the company as part of the bankruptcy proceedings in the U.S. Bankruptcy Court in Delaware.

- Judge John Dorsey, who is overseeing the proceedings, allowed the names of individual creditors to remain sealed for three months at a hearing in early January, but requested a list of institutions that invested in the company to be filed by FTX lawyers.

- Among those listed are media companies including The Wall Street Journal, Fortune, Fox Broadcasting and CoinDesk as well as big crypto firms such as exchanges Coinbase (COIN) and Binance. CoinDesk isn't materially owed anything and is on the list for "technical reasons" over a podcast sponsorship signed in the fall that was never executed, a CoinDesk spokesperson said.

- American Airlines Group (AAL), Spirit Airlines (SAVE) and Southwest Airlines (LUV), as well as Stanford University – where FTX founder Sam Bankman-Fried's parents work as professors – and the university's credit union were also listed in the document.

- The list also names Gisele Bundchen Charitable Giving as a creditor. The Brazilian supermodel and then-husband Tom Brady famously invested in the company, even appearing in one of its Super Bowl ads.

Latest Prices

Bitcoin (BTC): The largest cryptocurrency by market value was recently trading at about $23,000, down 0.6% in the past 24 hours. Still, BTC has rallied almost 40% in January and could be in position for a big move higher if history is any guide, with its recent upswing paralleling the bull revival of mid-2019.

Equities closed up as traders processed the latest U.S. GDP report that showed solid economic growth at the end of last year. The tech-heavy Nasdaq Composite rose 1.7%, while the S&P 500 and the Dow Jones Industrial Average (DJIA) were up 1.1% and 0.6%, respectively.

Token Roundup

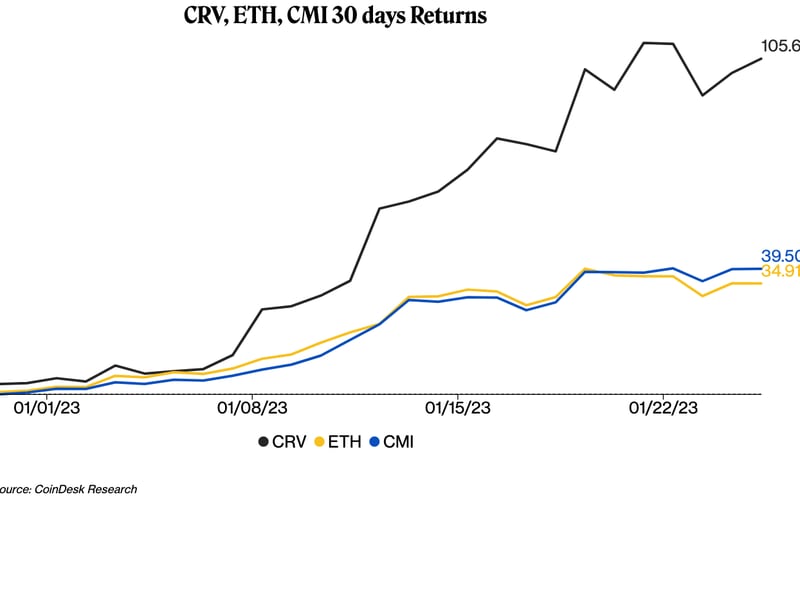

Ether (ETH): ETH was trading flat at about $1,600, roughly flat over the past 24 hours.

Curve DAO token (CRV): Decentralized finance protocol Aave eliminated the bad debt of 2.7 million of CRV from a botched November trade by Mango Markets exploiter Avi Eisenberg, blockchain data on Etherscan shows. CRV is issued as yield farming rewards to liquidity providers on Curve Finance. It was recently trading at $1.05, up 2% for the day.

Conflux (CFX): Based on CoinMarketCap data, the native token of the layer 1 Conflux blockchain recently soared by 106% to trade at around 6 cents Thursday after it announced it had integrated Little Red Book, China's version of Instagram. The integration will allow Little Red Book's 200 million users to be able to display non-fungible tokens (NFT) minted on Conflux on their profile pages.

Crypto Market Analysis: Bitcoin Trades Flat as GDP, Employment Data Signal Mild Growth

By Glenn Williams Jr.

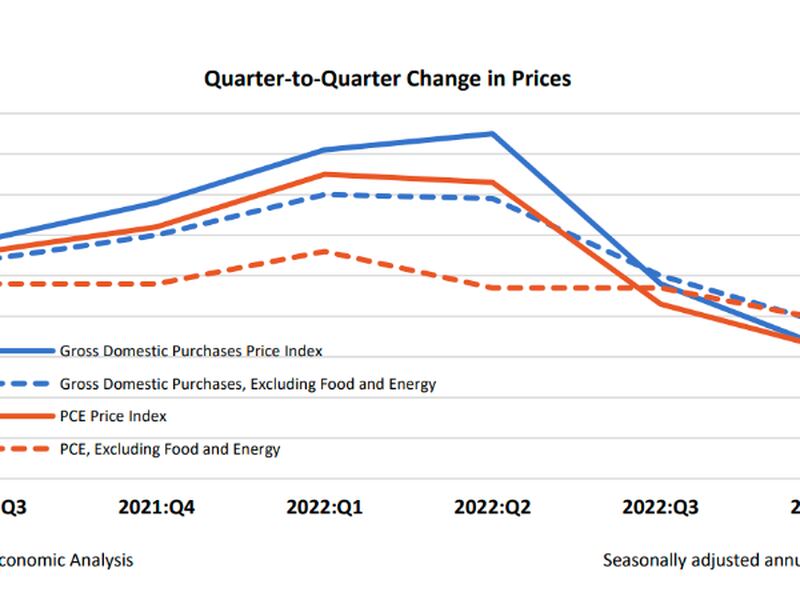

Cryptos' resilience came even as the U.S Commerce Department reported that gross domestic product (GDP) expanded at an annual rate of 2.9% for the fourth quarter of 2022, down from 3.2% in the third, although GDP exceeded expectations for a 2.6% increase.

Financial markets appear to be reacting positively to what they saw in the latest data, including an unexpectedly low number of jobless claims. "Real disposable income," which represents personal income after adjustments for taxes and inflation, increased 3.3%, while the quarter-to- quarter change in gross domestic purchase prices increased 3.2%, down from 4.8% in the third quarter.

Signs of economic slowdown were present in the data as well, as a 2.1% increase in consumer spending arrived below expectations of 2.5%. With consumption accounting for 70% of GDP, investors in risk assets, particularly crypto, will likely be monitoring additional weakness in coming months.

Read the full technical take here.

Trending Post

Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements and a look to the future of bank-issued stablecoins.

Coinbase Fined $3.6M by Dutch Regulator for Failure to Register

Crypto Exchange Mango Markets Sues Exploiter for $47M in Damages

Moody’s Developing Scoring System for Stablecoins: Bloomberg

Crypto Exchange BIT Expands Product Suite With Toncoin Options

Sam Bankman-Fried’s Mother and Brother Not Cooperating With Financial Probe, FTX Lawyers Say

Polygon Q4 Transaction Volatility Fueled by FTX Collapse, ZK Rollup Testing, Nansen Says

UK’s FCA Issues Advice for Crypto Firms After Only 41 of 300 Applicants Win Regulatory Approval