Crypto Market Witnesses Odd Relationship Between Bitcoin, Ether Volatility Metrics

For the first time in nearly two years, crypto options traders are implying that the largest cryptocurrency, bitcoin (BTC), will be more volatile than ether (ETH), the second-largest and the native token of the Ethereum blockchain.

That's unusual because ether and alternative cryptocurrencies generally tend to be more volatile than bitcoin, and is reflective of a market squarely focused on macroeconomic issues.

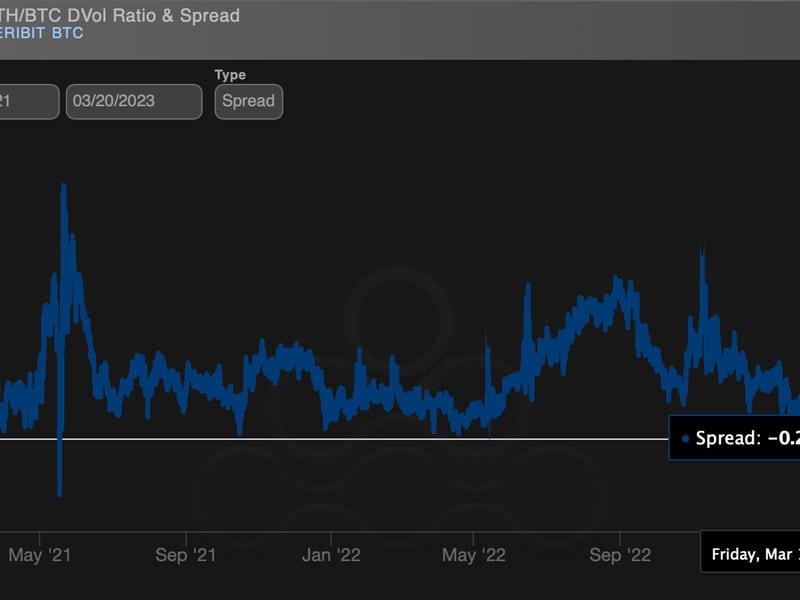

The spread between dominant crypto options exchange Deribit's forward-looking 30-day implied volatility index for ether (ETH DVOL) and bitcoin (BTC DVOL) fell below zero over the weekend, a phenomenon not seen since May 2021, according to data source Amberdata.

Implied volatility refers to the options market's expectations for price swings over a specific period. Options are derivatives contracts that offer the purchaser the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before a specific date.

"Bitcoin is in the spotlight again as cracks in [the] fractional reserve banking system cause distrust in fiat systems," said Jeff Anderson, chief investment officer at quantitative trading firm and liquidity provider Folkvang. "Bitcoin dominance has ripped higher this month as the market scrambles for hard money and protection from impending fiat supply inflation."

Several U.S. banks have gone bust this month, complicating the Federal Reserve's fight against inflation and boosting demand for bitcoin as a haven. The leading cryptocurrency has gained over 20% since the start of March, outperforming ether's 11%, CoinDesk data show.

Bitcoin's dominance rate, or the share in the total crypto market, has increased to nearly 48% from 42%, according to data sourced from the charting platform TradingView. Meanwhile, ether's dominance rate has declined about 1 percentage point to 19% over the past week.

While bitcoin and ether are said to compete as non-sovereign assets, bitcoin has a history of benefiting from banking sector issues and has evolved as a macro asset over the past three years, receiving the most attention from institutions. Meanwhile, the market continues to see ether more as a proxy for overall developmental activity in digital assets than as a haven investment.

"The negative spread is reflective of the two assets increasingly viewed as similar yet different proxies of risk, both markets are much deeper and liquid than the rest of the coins with established use cases," Patrick Chu, director of institutional sales and trading at over-the-counter crypto derivatives tech platform Paradigm, told CoinDesk.

Mean reversion ahead?

Implied volatility (IV) is mean-reverting, meaning that over time it tends to return to its lifetime average.

Sophisticated traders, therefore, buy options or volatility futures when the implied volatility is unusually low and sell options or volatility futures when it is exceptionally high. Implied volatility has a positive impact on options prices.

All this means the ETH-BTC IV spread could bounce back into the positive, boosting the value of ether options relative to bitcoin.

"I do think there is real value in owning ETH variance into the Shanghai upgrade," Anderson said. "The event risk there is underpriced and options appear cheap."

Read more: Ethereum’s Shanghai Hard Fork Now Has Official Target Date