Crypto Market May See Renewed Volatility as Whales Begin to Accumulate Bitcoin

The crypto market has recently held steady, with bitcoin locked in the narrow range of $16,000 to $18,000 amid lingering macroeconomic uncertainty and FTX contagion fears.

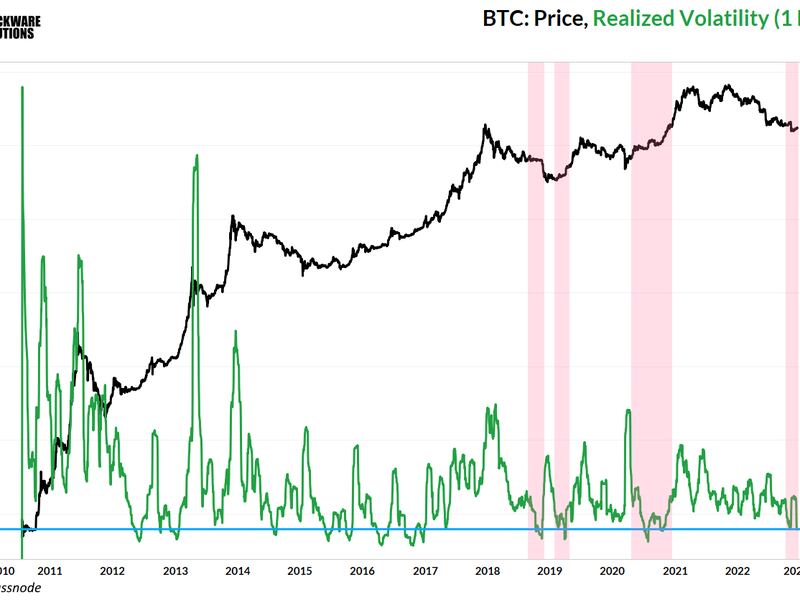

The perplexing tranquility may soon fade, as bitcoin's historical volatility hits levels last seen before the late 2020 bull run and investors with ample capital supply begin to accumulate coins.

"The quiet price action of the past month is illustrated by [bitcoin's] low realized volatility. Not counting the moment leading up to the FTX fallout, which had slightly higher volatility than what we have now, this is the lowest level for realized volatility since Q3 of 2020, just before the last bull run. Prior to that instance, volatility was this low at the bottom of the 2018 bear market," Blockware's weekly report said.

"Calm waters do not last long in bitcoin, so be prepared for a sharp move here shortly," the report added.

Realized volatility refers to the magnitude of daily price movements, irrespective of direction, over a specific period. It's a backward-looking metric, while the implied volatility is forward-looking, revealing options traders' expectations for price turbulence over the coming week/month.

Bitcoin's annualized one-month realized volatility fell to a two-year low of 38% last week.

"Investors should prepare for another swift move soon because smooth sailing does not endure in the crypto market for long," the Dec. 12 issue of Bitfinex's Alpha report said, referring to the ultra-low realized volatility.

The report added that an uptick in implied volatility with an extended period of low realized volatility is followed by wild price fluctuations.

At press time, short-term and long-term implied volatility metrics remain depressed in line with the realized volatility. The low implied volatility means the market is not forecasting a big move.

The situation, however, could change after the holiday season, with traders snapping up options and pushing implied volatility higher relative to historical volatility.

Signs of whale accumulation

The renewed accumulation of BTC by whales, or investors with ample capital supply and the ability to move markets, is another reason to expect some action in the market.

Large wallets have accumulated over 400,000 BTC ($6.73 billion) since the cryptocurrency fell below the June low of $18,000 on Nov. 9, Bitfinex report noted, quoting data from on-chain analytics platform Whalemap.

The white line is bitcoin's daily close price (UTC), and the bubbles' size represents the number of coins accumulated by the whale wallets.

"Over the past week, large or 'whale-styled' wallets have experienced an inflow of over 70,000 BTC. Around 120k BTC was accumulated at the $16,100 level, which offers potential support given the scale of buying," Bitfinex said."

At press time, bitcoin traded flat-to-positive near $16,900, according to CoinDesk data.