Crypto Derivative Volumes Saw Speedy Growth as Prices Rose in January

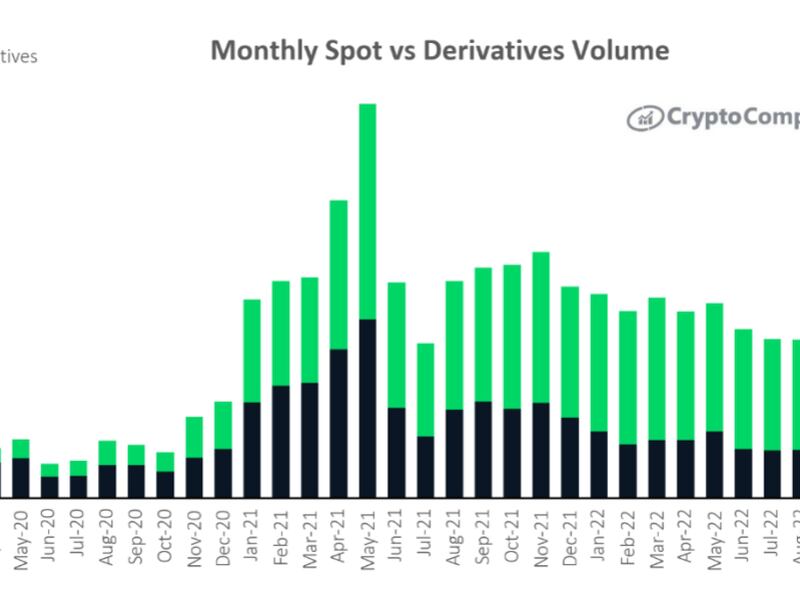

Trading activity increased strongly across the board in January, but derivatives volume grew faster than spot markets, according to data from CryptoCompare.

Derivatives volume in January was up 76.1% from December to $2.04 trillion, the largest percentage increase since January 2021 when volume rose 114%.

Derivatives trading now represents 70.3% of the entire crypto market, up from 68% in December, according to CryptoCompare data.

The large trading activity increase came alongside big gains for the world’s largest cryptocurrencies by market capitalization, with bitcoin (BTC) and ether (ETH) up 40% and 32%, respectively, in January.

“This suggests that price increases were driven by derivative market speculation rather than spot market accumulation,” said CryptoCompare in its report.

With $1.26 trillion in volume, Binance continued as the largest derivatives exchange in January, followed by Bybit which had a 115% increase to $301 billion (the only integrated derivative exchange with triple-digit, month-on-month growth). Bybit recorded its highest-ever market share in derivative markets at 14.6% in January.

Though not keeping up with derivatives, spot markets also witnessed large volume gains in January, with CryptoCompare’s AA- or A-graded exchanges posting a 67% jump in trading activity. Binance, Coinbase and Kraken were the top exchanges in terms of spot volume.