BNB-Bitcoin Ratio Drops to Lowest Level in Six Months On Paxos-BUSD Drama

BNB, the native token of the Binance-initiated blockchain network BNB Chain, is losing ground against bitcoin (BTC) in the wake of regulatory action against Binance-branded dollar-pegged stablecoin BUSD.

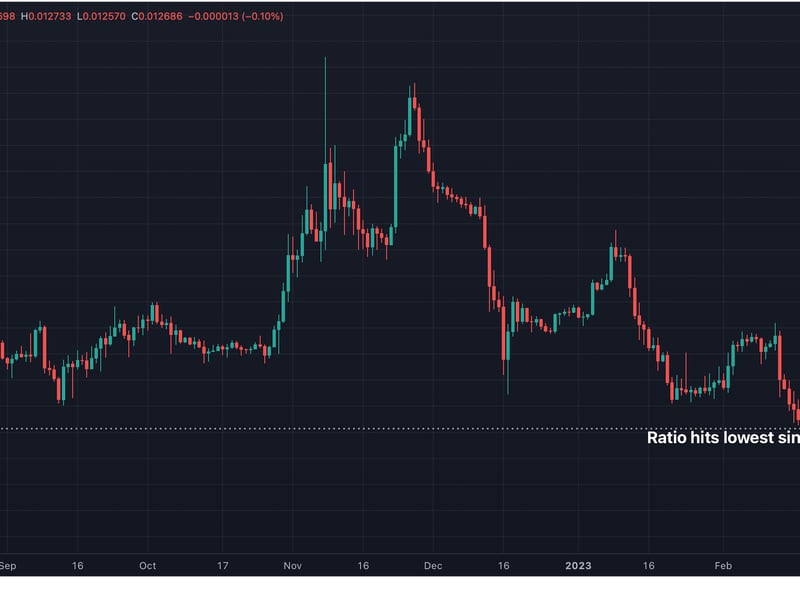

The BNB/BTC ratio listed on Binance, the world's largest exchange by trading volume, slipped to 0.01257 early Tuesday, reaching the lowest since Aug. 2, 2022.

The pair has declined by nearly 13% after the U.S. Securities and Exchange Commission (SEC) said last Tuesday that it is suing Paxos for violating investor protection laws by issuing BUSD, which the regulator deems as an unregistered security. The SEC action was accompanied by an order from the New York Department of Financial Services (NYDFS) asking Paxos to stop minting BUSD.

"BNB token has underperformed the broad market in February as the Paxos-BUSD situation continues to weigh on the exchange, which experienced massive outflows last week," Paris-based Kaiko said in a weekly report. "The BNB to BTC price ratio, which measures the relative performance of the two tokens, fell to its lowest level since August 2022."

The flow of money out of BNB, once touted as a safe haven, and into bitcoin perhaps stems from the belief that the regulatory crackdown against BUSD is actually a move against Binance.

While BUSD is issued and redeemed by Paxos, the stablecoin is marketed by Binance. In September last year, Binance delisted USD coin (USDC), Paxos dollar (USDP) and trueUSD (TUSD) for BUSD.

"Since the NYDFS and SEC specifically called out Paxos for its BUSD product and not Pax Dollar, it’s possible that the enforcement is more about particulars involving BUSD than a broad attack on stablecoins generally," Galaxy Research's Alex Thorn said in a note to clients on Friday. "This indicates that these agencies are particularly targeting Binance rather than stablecoins in general—at least at this time."

If that's not enough, the move by SEC and NYDFS aligns with Binance's recent decision to suspend dollar transfers and its admission of gaps in regulatory compliance. The exchange is now expecting fines for past misconduct.

The ratio peaked in November as the collapse of Sam Bankman Fried's exchange brought increased scrutiny to Binance and other crypto exchanges.

"BNB had mostly outperformed BTC until November 2022, when the ratio started trending downwards as sentiment deteriorated following the collapse of FTX," Kaiko said, adding that the token can be interpreted as a proxy of the exchange's performance.

Per some observers, BNB/BTC's slide represents peak pessimism, often observed at market bottoms.

"Buying BNB here. Think we're close to peak FUD [fear, uncertainty and doubt] and the BNB/BTC ratio shows it," crypto hedge fund Ouroboros Capital said in a tweet thread last week, drawing attention to Binance's increasing market share and growing BNB Chain ecosystem.

1/N: Buying BNB here. Think we're close to peak FUD and the BNB/BTC ratio shows it. @cz_binance and @binance has proven time and time again how they sail through storms to re-emerge stronger and I doubt it will be any different this time. Not investment advise, views are my own. pic.twitter.com/0bZWDFpK4q

— Ouroboros Capital (@OuroborosCap8) February 15, 2023