Bitcoin's Test of All-Time Highs Means Old Miners Are Cashing Out

- Miners appear to have just sold long-dormant bitcoin, sourced from old block rewards, right when BTC plunged from its record high on Tuesday.

- Given the market's thin liquidity, it could have had an outsized impact on bitcoin's price.

Bitcoin's rapid price ascent during the last month, which culminated in a new all-time high and quick reversal on Tuesday, has meant that some early miners have started selling their old block rewards – putting pressure on bitcoin's price.

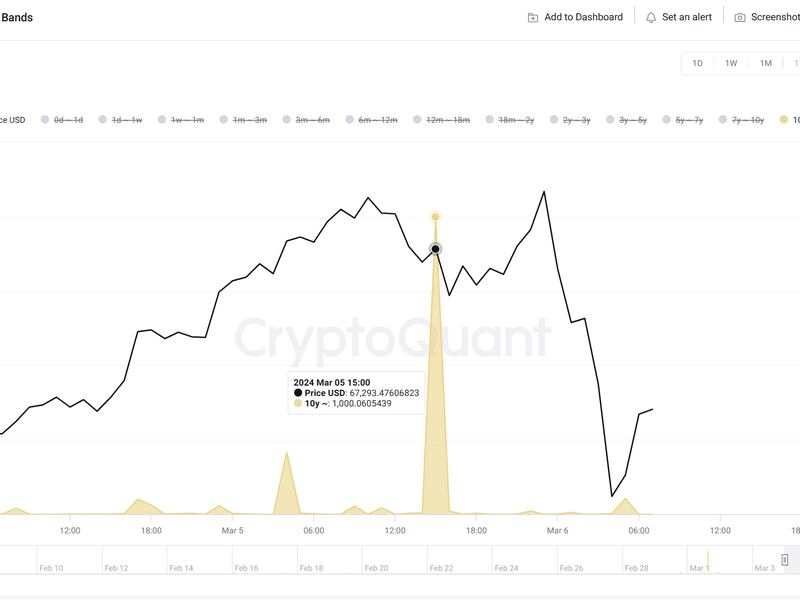

On-chain data spotted by CryptoQuant shows that, just before bitcoin peaked at new highs around $69,000 and then plunged to $62,000 on Tuesday, 1,000 bitcoin worth roughly $69 million were moved to Coinbase by addresses more than a decade old and that the research firm says are linked to miners. (Shifting long-dormant tokens to Coinbase, a large crypto exchange, can be a prelude to selling.)

"Considering that the exchange order book shows 5-10 bitcoins of liquidity for every $100 price change, a sell-off of 1,000 bitcoins is highly likely to trigger a significant price drop," Bradley Park, an analyst at CryptoQuant, told CoinDesk in an interview. "Especially when traders are waiting to enter a short against bitcoin's all-time high like on Tuesday."

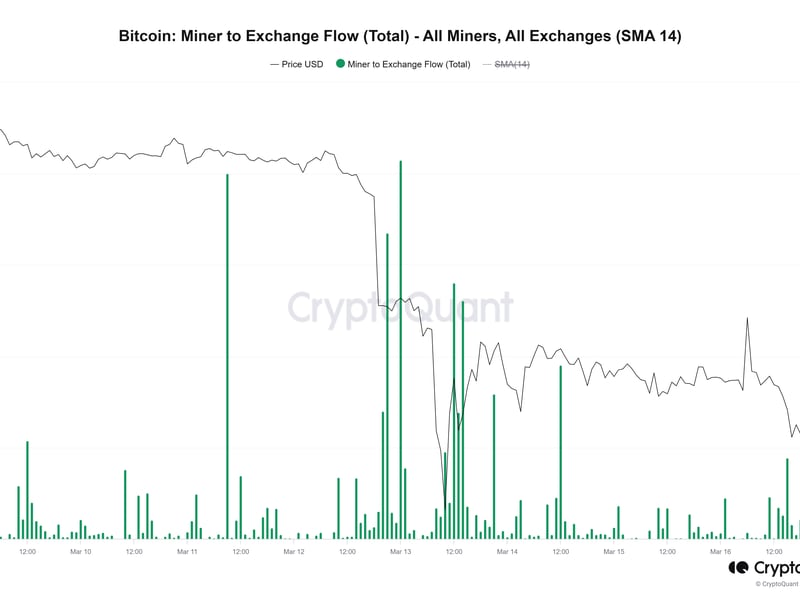

Park said that the recent influx of bitcoin into exchanges reminds him of the sharp increase in BTC inflows that occurred before the 40% price drop on March 12, 2020, as Covid-19 began to rapidly escalate in severity, causing governments around the world to begin lockdowns, forcing a flight to safety for traders.

When that sell-off finally ended, bitcoin had bottomed out at $3,850.

"That time, it was also miners," Park continued.