Bitcoin's Correlation to Nvidia Strongest in Over a Year

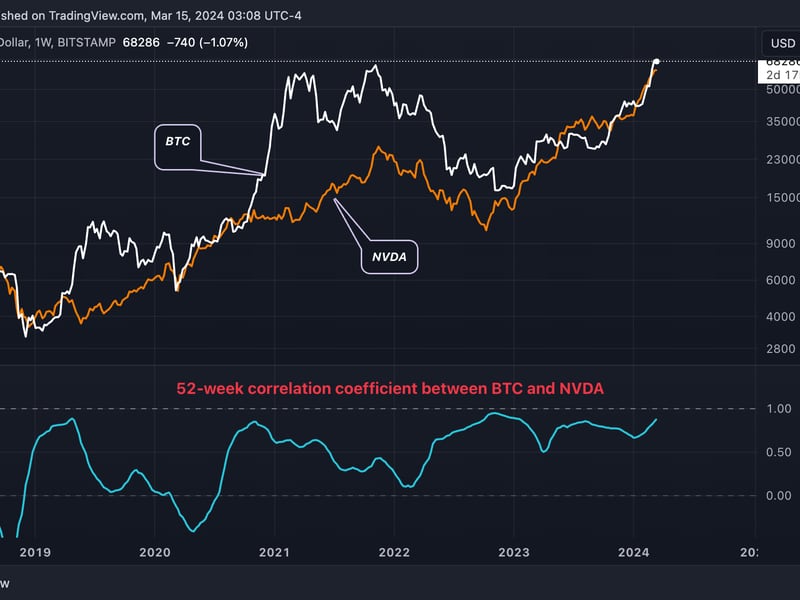

- The 90-day and 52-week correlation coefficient between bitcoin and Nasdaq-listed chip maker Nvidia has risen above 0.80.

- The positive correlation is noteworthy as several analysts believe the surge in NVDA represents an AI bubble that could soon burst.

Bitcoin {{BTC}} continues to move in tandem with Nvidia (NVDA) shares as some analysts question the surge in the Nasdaq-listed chipmaker’s valuations.

The leading cryptocurrency by market value has pulled back over 8% from Thursday’s record high of $73,798. However, prices are still up 60% year-to-date, CoinDesk data shows. Nvidia has pulled back 9% from its lifetime peak of $974 but still boasts a year-to-date gain of 77.5%.

In five years, bitcoin’s market capitalization has jumped to $1.43 trillion from $70 billion. Similarly, Nvidia’s market value has increased to over $2 trillion from around $100 billion.

The growing demand for Nvidia processors from ChatGPT and other generative artificial intelligence (AI) projects has been primarily responsible for the surge in the chip makers’ valuations.

The 90-day correlation coefficient between the two has risen to 0.86, the highest since May 2023, having flipped positive in November, according to charting platform TradingView. The 52-week correlation has been consistently positive since July 2020 and has now risen to 0.88, the highest since January 2023.

A coefficient of over 0.80 indicates that bitcoin and NVDA are highly correlated and tend to move in the same direction.

The statistical relationship is noteworthy, as some market observers, including investment management firm GMO, worry that the AI frenzy is similar to the dot-com bubble burst in 2000.

The launch of ChatGPT in December 2022 helped raise general awareness about artificial intelligence, and the subsequent love affair with AI stocks represents a “bubble within a bubble,” which could start to deflate,” GMO’s Chief Investment Strategist Jeremy Grantham explained in a paper published on Monday. Both bitcoin and Wall Street’s tech-heavy Nasdaq index bottomed out in December 2022.

“Every technological revolution like this [AI] – going back from the internet to telephones, railroads, or canals – has been accompanied by early massive hype and a stock market bubble as investors focus on the ultimate possibilities of the technology, pricing most of the very long-term potential immediately into current market prices,” Grantham noted, calling AI a bubble.

“And many such revolutions are, in the end, often as transformative as those early investors could see and sometimes even more so – but only after a substantial period of disappointment during which the initial bubble bursts,” Grantham added.

Meanwhile, strategists at Citi said AI is the bubble but could last into 2025, according to Investing.com.