Bitcoin's Calm Amid Soaring Bond Market Volatility Points to 'HODLer'-Dominated Crypto Market

Since the early days, cryptocurrencies, including bitcoin (BTC), have been criticized for being too volatile relative to traditional markets and unreliable as a medium of exchange or a store of value.

However, recently bitcoin, the so-called risk asset, has held remarkably steady amid heightened volatility in nearly every traditional market asset, including U.S. government bonds, which are widely regarded as the safest, according to a paper published in the American Economic Review.

With prices stuck between $18,000 to $25,000 since early July, bitcoin's annualized 90-day realized, or historical volatility has crashed from 80% to a 21-month low of 21%, according to data sourced from charting platform TradingView. The cryptocurrency's 90-day implied volatility, or expectations for price turbulence over three months has dropped to a four-month low of 63.7%, according to data tracking platform Laevitas.

Meanwhile, with the Federal Reserve (Fed) hell-bent on raising interest rates to control inflation, the ICE Bank of America Merrill Lynch U.S. bond market options volatility index jumped to 160 last week, the highest since the coronavirus-induced crash of March 2020.

One explanation for bitcoin's relatively calm is that most macro traders sensitive to the Fed policy and traditional market volatility left the crypto market early this year. And the crypto market is now dominated by "HODLers" – investors intending to hold BTC long-term in hopes that the cryptocurrency will eventually evolve as digital gold and a medium of exchange.

"The more short-term macro investors exit the crypto market, the more pricing power they cede to longer-term participants with possibly different investment theses," Noelle Acheson, author of Crypto is Macro Now newsletter, wrote to subscribers on Oct. 4.

Macro traders build a portfolio of multiple assets after assessing central bank and government policies and country-level economic data.

According to Acheson, macro traders swarmed the crypto market after major central banks, including the Fed, opened liquidity floodgates following the March 2020 crash.

"They did not really care about the seizure and censorship resistance, they wanted the upside potential, and because crypto assets were treated as high-risk vehicles, they started to behave as such," Acheson noted.

And because these entities did not believe in bitcoin's stated objectives, they probably exited the market in the early stages of the Fed's liquidity tightening.

The Fed kicked off its rate hike cycle in March. Bitcoin nosedived 56% in the second quarter and Wall Street's benchmark equity index S&P 500 fell by 16%.

The 90-day correlation coefficient between bitcoin and the S&P 500 increased from 0.5 to 0.94 in the second quarter, perhaps a sign of macro traders divesting crypto holdings amid risk aversion in the equity market. The 90-day correlation dipped to 0.44 last month and stood near 0.7 at press time, still elevated but well below the second-quarter high of 0.94.

Acheson added that the recent uptick in correlation does not necessarily mean macro traders are dominating the crypto market again, as "virtually all assets continue to be buffeted by macro and monetary uncertainty."

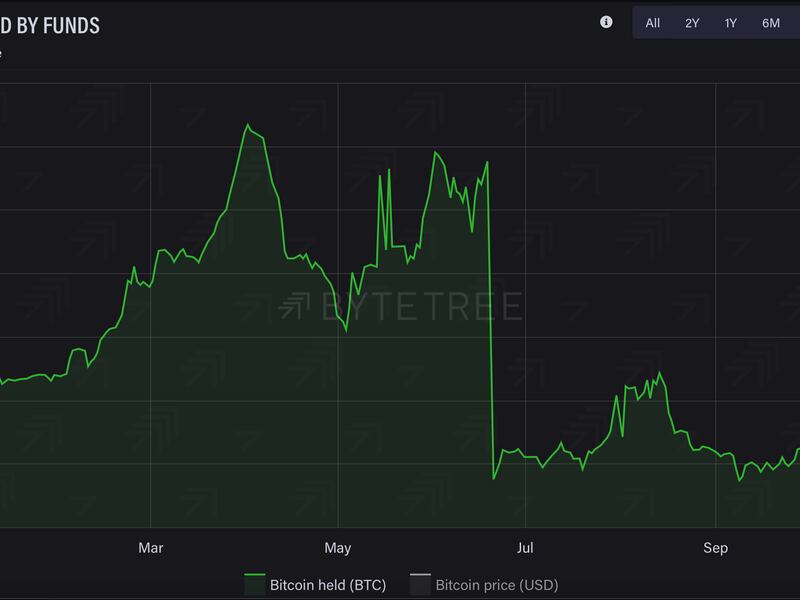

That's evident from the absence of large inflows and outflows from exchange-traded funds and exchange-traded products listed across Europe, the U.S. and Canada.

And if that's not enough, on-chain data shows a continued accumulation, probably by long-term investors. Macro traders and institutions typically prefer to take exposure to bitcoin via alternative investment vehicles like ETFs and regulated cash-settled futures.

"Meanwhile, accumulation has continued. The percentage of BTC that has not moved in over a year is now at the all-time high of over 65%," Acheson wrote.