Bitcoin Traders Seek Protection From Price Declines as ETF Deadline Looms: Deribit

Traders are seeking protection from a potential bitcoin [BTC] price drop, leading crypto options exchange Deribit’s Chief Commerical Officer Luuk Strijers said Monday.

“Puts are overbought and calls [are] being sold, indicating the market is seeking protection from potential price declines,” Strijers told CoinDesk in an interview.

Put options allow buyers to profit from or hedge against a decline in the asset’s price. Call options allow buyers to profit from price rallies. On Deribit, one options contract represents one BTC.

The one-month BTC call-put skew has flipped negative in the past 24 hours, reaching a low of -2.69% for the first time since Oct. 13, according to data tracked by Amberdata. The one-week, two-and three-month skews have also turned negative to show renewed demand to hedge against bitcoin weakness. Skew measures the difference in demand for calls and puts.

Perhaps traders expect bitcoin to drop in a classic “sell the fact” move following the highly-anticipated SEC approval of spot bitcoin ETFs later Wednesday. Some may be worried about a potential delay in approvals.

The cryptocurrency has rallied over 60% since early October, largely on expectations the U.S. Securities and Exchange Commission (SEC) will greenlight one or more spot ETFs in early 2024. “Buy the rumor, sell the fact,” an old Wall Street adage, represents the idea that traders tend to buy an asset in anticipation of positive news, eventually closing their positions once the news is confirmed.

The so-called spot ETFs investing in bitcoin rather than its futures are widely expected to pave the way for mass adoption, boosting the cryptocurrency’s market valuation.

“We look for $50 billion-$100 billion of inflows into bitcoin ETFs in 2024, opening up the potential for BTC to reach the $200,000 level by the end of 2025,” Standard Chartered said in a note to clients on January 8.

DVOL drops

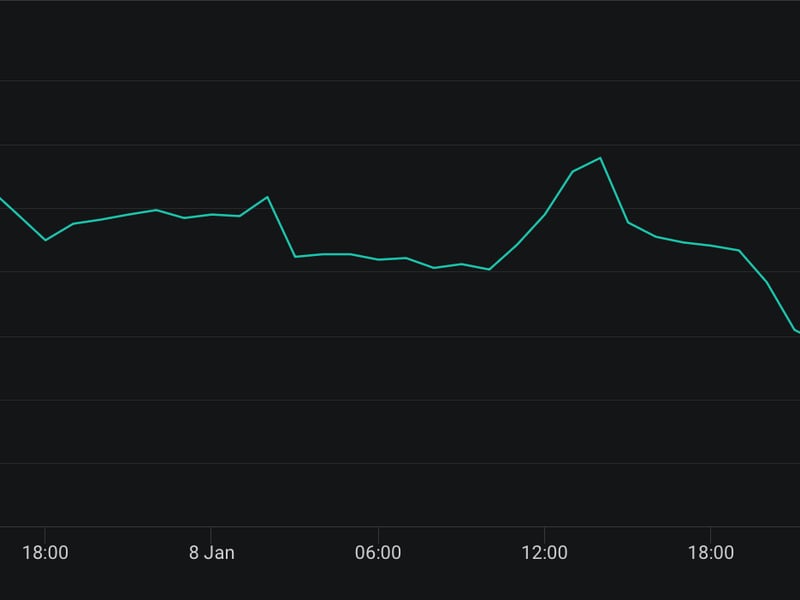

Deribit’s forward-looking bitcoin volatility index (BTC DVOL), which calculates bitcoin’s annualized 30-day implied volatility or expectations for price turbulence over the next four weeks from options data, has declined ten points from 73% to 63% since Monday.

Strijers said that traders have been selling calls and call spreads in January expiry contracts, driving the DVOL.

Note that short-term implied volatility metrics like the seven-day gauge remain elevated above 100 or 50 points above the DVOL, signaling expectations for price turbulence in the immediate aftermath of the SEC decision.