Bitcoin Longs Above $43K in Focus, Analyst Says

The analyst who correctly predicted bitcoin’s [BTC] recent drop to $38,000 now sees levels above $43,000 appropriate for taking fresh bullish bets on the cryptocurrency.

“With reversal indicators suggesting that a tradeable low is in, we should focus on longs. From a risk management perspective, we should re-engage in long positions once bitcoin breaks above $43,000,” 10x Research’s Founder Markus Thielen said in a note to clients Monday.

Thielen’s bullish view is based on the Elliot Wave theory, which assumes that prices move in waves rather than simple patterns, and future movements can be predicted by observing the repetitive wave pattern.

According to the theory, trends progress in five waves, of which, 1, 3, and 5 are “impulse waves,” representing the primary trend. The rest are “retrace waves,” signifying a temporary halt of the primary trend.

According to Thielen, bitcoin has been in a five-wave bullish pattern since early last year, with the recent pullback from roughly $49,000 to $38,500 constituting wave 4 or the temporary retracement. Now, wave 5 has begun and could take prices above $50,000.

“Elliot Wave analysis has also labelled this retracement to 38,522 as wave (4) with a wave (5) projection of 52,671 – potentially by the end of Q1, 2024,” Thielen noted.

The bullish outlook is consistent with the decline in selling pressure from investors taking profits in the crypto investment vehicle, the Grayscale Bitcoin Trust (GBTC). The profit-taking was partially responsible for bitcoin falling into wave 4 correction following the launch of U.S.-based spot ETFs on Jan. 11.

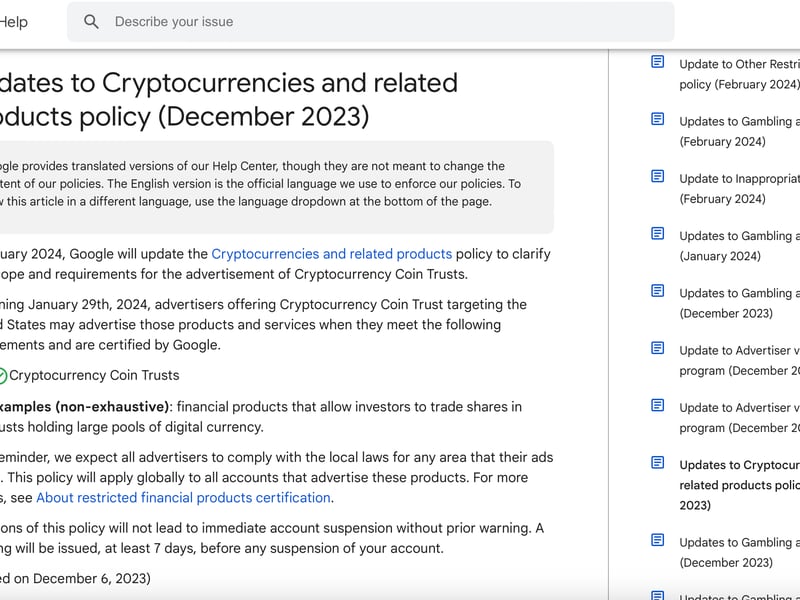

“Potential catalysts for a move higher could center around the diminishing impact that the Grayscale GBTC selling could have on the price of bitcoin, the fact that stocks are making new all-time highs, and Google is allowing Bitcoin & Crypto ETF advertisements from today onwards," Thielen said.

Bitcoin changed hands at $42,160 at press time, representing a 0.3% gain on the day, according to CoinDesk data.