Bitcoin Liquidity on Binance Plummeted During the ETF Rumor-Induced Market Rollercoaster: Kaiko

Binance has long been the world's largest cryptocurrency exchange by trading volumes. Still, on Monday, traders looking to buy and sell bitcoin (BTC) quickly on Binance were at a relative disadvantage to their peers on Kraken and Coinbase (COIN), according to data tracked by Paris-based Kaiko.

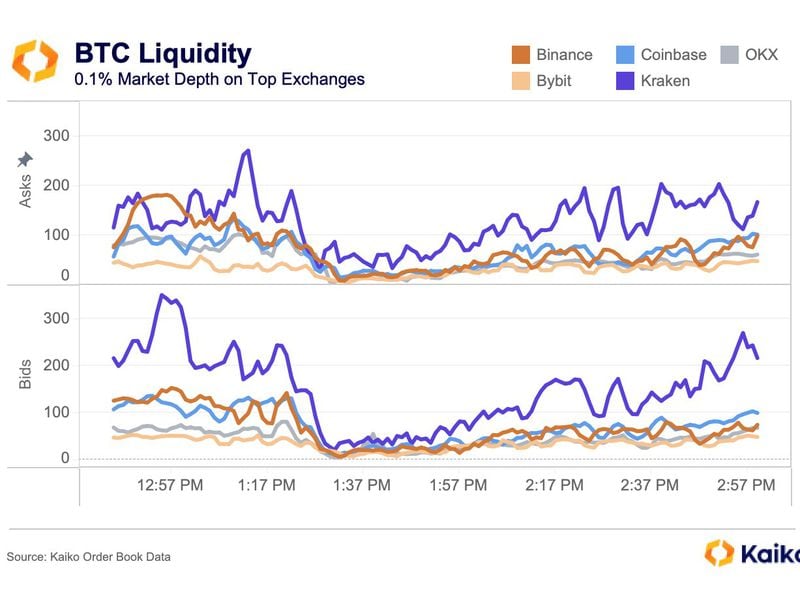

The 0.1% ask depth on Binance, a measure of buy-side liquidity, crashed to just 1.2 BTC ($30,000) from 100 BTC as volatility exploded after a false report of BlackRock's (BLK) spot exchange-traded fund (ETF) approval circulated on social media. The leading cryptocurrency popped 7.5% to $30,000 in a knee-jerk reaction to the rumor, only to give up gains after BlackRock denied the report.

The 0.1% ask depth refers to the number of outstanding purchase orders within 0.1% of the mid-price or average of the bid and ask prices. Ask price is the price at which the seller is ready to sell and bid is the value at which the buyer is ready to purchase.

The higher the bid and ask depth, the easier it is to execute large buy and sell orders at stable prices and the lower the slippage – the difference between the expected price at which a trade is placed and the actual price at which the trade goes through.

The 0.1% depth also dipped as low as 2 BTC on OKX and Bybit, with the average ask across major exchanges falling below 95 BTC.

The broad-based decline in liquidity saw several market participants, including pseudonymous traders exitpump and Omz, lose money due to slippage. Some traders saw slippage as high as 20%.

The chart shows Kraken and Coinbase outperformed Binance and other exchanges during the liquidity meltdown.

The sticky liquidity on the two exchanges likely reflects the relative sophistication of their market makers - entities tasked with creating liquidity in an order book, according to Carey.