A Record $11B Crypto Options Expiry Looms as BTC Shows Little Volatility

- Bitcoin, ether options worth over $11 billion will expire on Deribit on Friday.

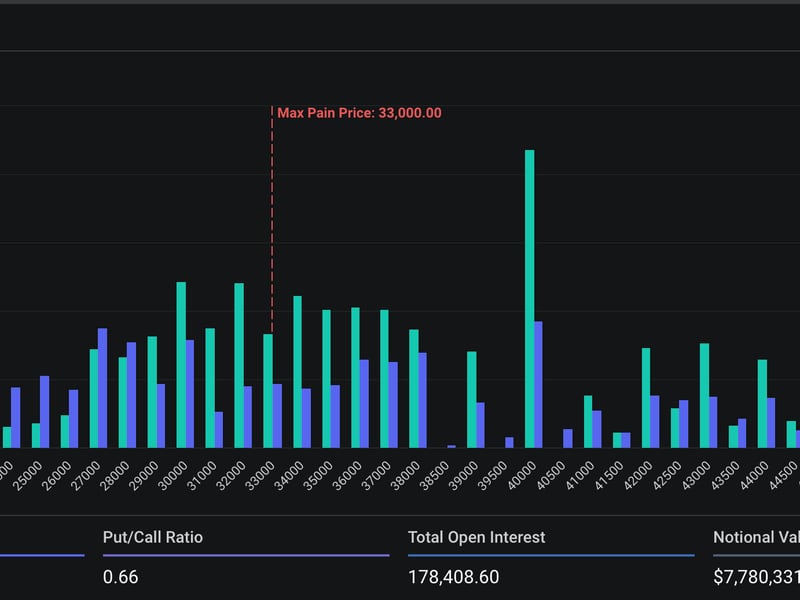

- Both cryptocurrencies are trading well above their "max pain points."

- The market is unlikely to see major volatility ahead of the expiry, one observer said.

Bitcoin [BTC] remains well supported, holding above $40,000 as the clock ticks down to 2023's last quarterly options expiry.

On Friday at 08:00 UTC, a staggering $7.7 billion worth of options tied to bitcoin [BTC] and $3.5 billion of options linked to ether [ETH] will expire on the crypto exchange Deribit.

"The total of over $11 billion marks Deribit's largest expiry thus far, of which almost $5 billion will expire in the money, the largest amount ever as well, potentially resulting in above average hedging and trading activity," Luuk Strijers, the exchange's chief commercial officer, told CoinDesk.

Options are derivative contracts offering the purchaser the right, but not the obligation, to buy or sell the underlying asset at a predetermined "strike" price at a later date, the expiry date. A call offers the right to buy; a put confers the right to sell. On Deribit, one options contract represents one BTC or one ETH. An in-the-money call option is one with a strike price lower than the market rate. For a put, an in-the money strike price is higher than the going rate.

This quarter's 60% upswing in the bitcoin price and ether's 43% gain have investors scrambling to add upside exposure through calls. That explains the record notional open interest for in-the-money call options.

According to Strijers, clients have been rolling their positions from the December expiry to contracts expiring in January and subsequent months, and the process could continue into Friday's quarterly settlement.

"Beyond hedging, we also see clients rolling positions to 2024 expiries and expect to see more of that closer to the expiry as well as afterward," Strijers said. "After the expiration, all eyes and trading activity will be focused on the upcoming ETF decision."

The U.S. Securities and Exchange Commission is said to have set Jan. 10 as the deadline for approving or rejecting an exchange-traded fund (ETF) that invests directly in bitcoin, a so-called spot ETF, rather than one investing in futures tied to BTC. Many industry participants expect it to give the green light to a spot fund, paving the way for continued upside price volatility in the historically bullish reward halving year.

The chart shows notional open interest for the BTC call and put options at various strikes expiring on Friday.

It also shows bitcoin's max pain point (MPP), or the level at which options buyers stand to lose the most on expiry. The theory is that options sellers, typically institutions with ample capital supply, look to push the underlying asset's spot price toward that level to make their counterparties, the buyers, suffer the most. In late 2020 and most of 2021, bitcoin saw volatility in the direction of the max pain point in the lead-up to the expiry, only to resuming the uptrend following the settlement.

Still, market analyst Chang expects prices to remain steady before Friday's expiry.

"BTC MPP is $33,000 and ETH MPP is $1,900, very far from current prices. MPP can provide important points from time to time, but for now, we expect BTC and ETH to move to MPP very little. There is no need to worry much about MPP at the moment. If something like that were to happen, it would only be possible if there was a disaster on Earth," Chang told CoinDesk.

"I plan to keep a close eye on any new options trading tapes after the big options expirations. I also think the market is heading towards the final spark and I expect the last real move to be very soon," Chang said.