Crypto outlook 2023: What does the new year have in store

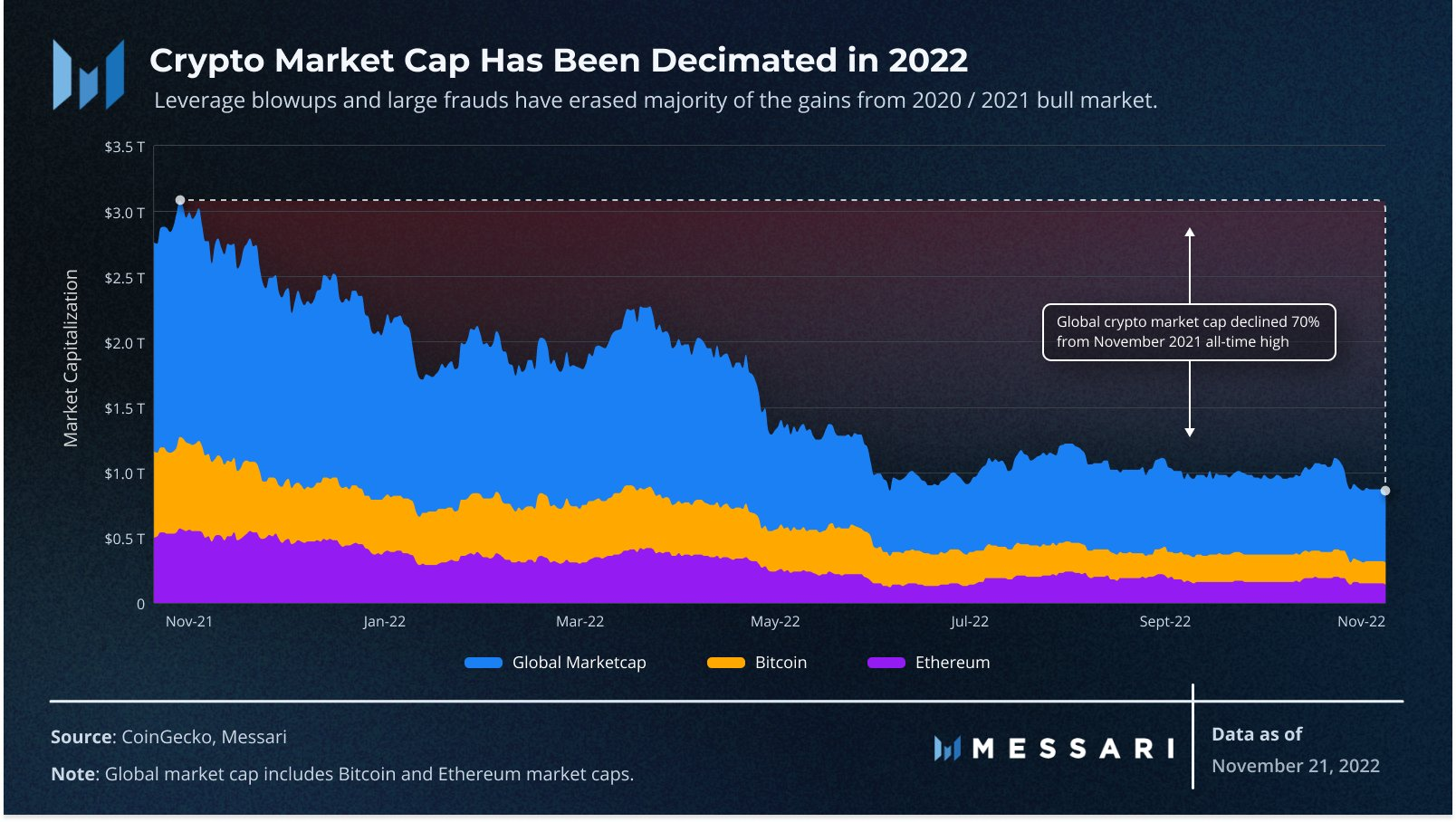

The cryptocurrency market made a U-turn from its all-time highs back in November 2021 and has lost over $2 trillion in market capitalisation since then. Approaching the end of 2022, investors wonder: will the crypto winter end soon and start a new revival cycle, or should we prepare for a crypto ice age?

The total value of the global crypto market has declined by 71% year to date (YTD) from 2.9 trillion to $820 billion as of 29 November 2022, according to CoinMarketCap. The downturn spread across the majority of the top 100 largest cryptocurrencies, with Bitcoin (BTC) and Ethereum (ETH) having lost 65% and 67% of their value, respectively, since the beginning of the year.

What does the crypto market outlook for 2023 hold for investors? Will the broader financial recession impair an already weak market? Let’s see what is in store after FTX’s failure and the crypto market contagion.

Major crypto market disruptions in 2022

What happened to the crypto market? An analysis of the recent drop in crypto prices revealed several major internal and external factors behind it.

Collapse of TerraUSD and LUNA

The first half of 2022 was hit by the crash of the TerraUSD stablecoin and LUNA token. The algorithmic stablecoin depegged from the USD, resulting in a Luna flash crash. Investors, once attracted by 20% returns on UST deposits, began to sell their tokens in a frenzied exit.

In a matter of days, LUNA dropped from $64 to $0.0087, having lost 99.98% of its value. UST, designed to be worth $1, fell to $0.25 in May 2022. It resulted in $40 billion in investor losses and spurred a domino effect among the crypto peers.

The crash forced many large hedge funds and institutions with significant positions in UST and LUNA to liquidate other crypto holdings to procure cash. This caused ripple effects and triggered bearish trends in other altcoins.

Luna and TerraUSD were among the top 10 cryptocurrencies by market cap, when they nosedived. After the collapse, they recovered as a new network Terra Classic and TerraClassicUSD, respectively.

Bankruptcies and frozen accounts

The bankruptcy of cryptocurrency hedge fund Three Arrows Capital followed the market crash. Managing $10 billion in assets at its peak, the fund was unable to repay its loans when the market declined.

In July 2022, a crypto broker, Voyager Digital, which lent funds to Three Arrows, filed for Chapter 11 restructuring. A cryptocurrency lending platform called Celcius Network also went bankrupt after barring its 1.7 million users from withdrawing or transferring funds.

The contagion moved on as Zipmex, a Singapore-based crypto exchange, halted withdrawals from 20 to 22 July and filed for bankruptcy protection. Another Singapore-based platform, Vauld, filed for restructuring on 8 July after suspending withdrawals several days earlier.

FTX fallout and further contagion

The unfortunate series culminated when the third-largest crypto exchange FTX and FTX.US filed for bankruptcy on 11 November 2022. It happened after a sell-off of its native token, FTT, and a large withdrawal volume. Soon after the filing, the exchange was hacked. The attacker stole $477 million worth of tokens from users’ wallets.

FTX restructuring CEO John J. Ray said in a filing: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here”.

Commenting on the FTX fallout, Mike Novogratz, the founder and CEO of Galaxy Digital, said:

The FTX crash caused a domino effect. The cryptocurrency platform Gemini halted withdrawals for its crypto lending Earn program. The news came out after Genesis Global Capital – Gemini’s lending partner – suspended new loans and redemptions.

In a Twitter statement, Genesis said: “FTX has created unprecedented market turmoil, resulting in abnormal withdrawal requests which have exceeded our current liquidity”.

In response to the current liquidity and regulation concerns, top crypto exchanges rushed to demonstrate their reserves. Thus, Coinbase – which is a public company with regular audited financial statements – announced that it’s exploring new crypto-native ways to prove reserves and launched a $500,000 developer grant program to that end.

As part of its commitment to transparency, Binance also rolled out updates to its proof of reserves system.

Is it enough to calm down the investors? Many are preparing for further insolvency as billions of dollars have moved from centralized exchanges to self-custody.

According to Saxo Bank, the number of Bitcoins and Ether on exchanges has declined by 240,000 BTC and 2 million ETH, respectively. Meanwhile, hardware wallet manufacturers such as Trezor and Ledger have seen growing demand since the FTX collapse.

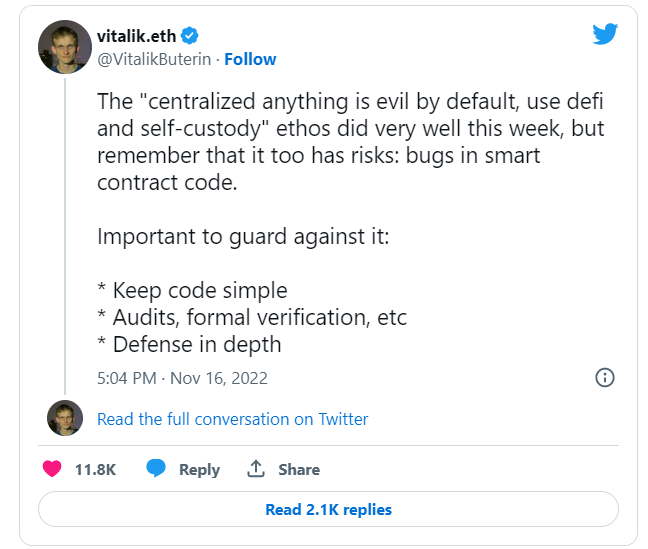

Meanwhile, Vitalik Buterin warned that self-custody also has its risks:

Mads Eberhardt, a cryptocurrency analyst at Saxo Bank, said that if the funds’ outflow to self-custody continues, other companies might face insolvency or liquidity issues.

Factors to consider in cryptocurrency predictions for 2023

Some notorious events and risk factors, which originated in 2022, could affect the cryptocurrency’s long-term outlook.

Risk of a global economic recession

The cryptocurrency market has suffered from uncertainty around the global economy. In some countries, inflation rates reached 40-year highs, forcing central banks to respond with aggressive interest rate hikes. The higher interest rates, in turn, impede economic development and could result in a recession.

Moreover, the global supply chain is stressed after COVID-19 lockdowns, which slowed down global industrial activity. These macroeconomic factors can influence the state of the crypto market in 2023, as cryptocurrencies could be hit hard during periods of economic slowdown.

According to Arcane analysts: “Correlations have been growingly important in the last year due to the complicated macro picture postCOVID. It’s important to be aware of BTC’s, for now, close relationship with U.S. equities and its inverse relationship with the dollar strength index (DXY).”

The IMF warned that contagion might spread among institutional and individual investors, holding both traditional and cryptocurrency assets. Significant crypto losses could incentivize investors to rebalance their investment portfolios, triggering increased market volatility.

Cryptocurrency regulation

The recent FTX collapse spurred debates around the effective regulatory framework for crypto market participants and striking a balance between protecting investors and supporting technological innovations.

The absence of regulation may cause investors to lose their funds and become victims of fraud or poor financial management decisions. Well-thought-out regulation can help cryptocurrency gain traction.

According to the IMF: “They [regulatory frameworks] should establish clear guidelines on regulated financial institutions and seek to inform and protect retail investors. Finally, to be fully effective, crypto regulation should be closely coordinated across jurisdictions”.

According to the US national survey by the Crypto Council for Innovation, 52% of respondents wanted more regulation in the space.

Institutional adoption and sentiment

The investment giant Fidelity, which manages $9.9 trillion in assets, announced in October 2022 its plans to hire 100 new employees to its digital asset unit, bringing the total number of unit employees to 500 people. It is a sign that Fidelity is becoming more bullish on crypto.

The hiring spree defies the layoff trend among many crypto firms, including Coinbase, BitMEX, Galaxy Digital, and Crypto.com. According to Coindesk, almost 25,000 crypto jobs have been lost as of 25 November 2022.

GlobalBlock analyst Marcus Sotiriou said that Fidelity’s opportunistic investments are reassuring: “This suggests that the bigger companies with larger balance sheets, who can weather through the storm, will capitalize on the downfall of others”.

As of May 2022, a total of 61 banks have invested in the cryptocurrency market at least once, according to Blockdata. The most active investors in the blockchain companies were Goldman Sachs, Citigroup, KB Financial Group, United Overseas Bank, and Commonwealth Bank of Australia.

Notoriously, several banks, including Halifax, HSBC, The Co-operative Bank, TSB, Metro Bank, and Virgin Money, have restricted their customers from sending payments to crypto exchanges in response to the crypto contagion, according to research by The Fintech Times.

Starling Bank has restricted crypto operations, explaining: “We always review our position in relation to financial crime. We consider crypto activity to be high risk. We’ve taken the decision to prevent all card payments to crypto merchants and to implement further restrictions on outgoing and incoming transfers”.

Vetle Lunde, a senior analyst at Arcane Research, said cryptocurrency's long-term adoption prospects still look good: “We still see increased institutional interest in crypto, even though we’re still battling bear market depths. A recent Fidelity survey shows that the number of institutional investors that view digital assets as something that should be a part of investment portfolios grew in 2022, and I expect increased institutional market participation as crypto gets a clearer regulatory framework in the EU and U.S.”

Ethereum’s Merge and its implications on the cryptocurrency future

A long-awaited crypto market event – Ethereum’s Merge – occurred in September 2022. Ethereum’s transfer from a proof-of-work to a proof-of-stake consensus mechanism contributes to one of the most significant crypto trends for 2023 – crypto energy consumption.

Elevated electricity consumption has come under scrutiny in recent years. The transition of the second-largest crypto network by market capitalisation to a less energy-consuming mechanism is welcomed by companies and stakeholders focusing on sustainability.

Proof-of-stake migration will enable Ethereum, home to numerous crypto exchanges, lending companies, and NFT marketplaces, to decrease energy usage by 99.95%.

Crypto market predictions 2023

What will happen to crypto in 2023? Commenting on a cryptocurrency prediction for 2023 Anndy Lian, intergovernmental blockchain expert, told XBO:

“I think the market will not recover in 2023. It is just not realistic judging on the overall global economic conditions. But this does not stop crypto from having more adoption.

“Trends to look out for are still NFT, Metaverse, DEX and DeFi. They are all here to stay.”

Although the current crypto sentiment is bearish, Pantera Capital gave a bullish prognosis, expecting Bitcoin (BTC) to recover and hit almost $149k after the next halving due in April 2024. Bitcoin performance often serves as a barometer of the crypto market state in general due to its close correlation with altcoins.

Ark Investment Management CEO Kathie Wood gave the most aggressively bullish cryptocurrency market forecast. In an interview with Bloomberg News, Wood reiterated her target of $1 million for Bitcoin by 2030.

Will crypto go up or down after the recent turmoil? Speculating on surviving crypto winter, Messari said that many investors will “lose faith” and will not manage to withstand a multi-year downturn.

“To make matters worse, the next bear market will be a regulatory nightmare, and we won’t have the bull market vibes to help defend ourselves against all of the consumer protection, fraud and abuse, systemic risk, ESG, and illicit activity FUD that our enemies will throw at us,” the firm said.

On the bright side, Messari expected that “The get rich quick crowd will evaporate, but the next cycle’s unicorns will get built during the doldrums of winter.”

Bitcoin maximalist Michael Saylor, CEO of MicroStrategy, said: "The first decade of crypto experiments was everybody showing you cool stuff, and doing it in the wrong way. The next decade, we build the cool stuff in the right way".

The blockchain data platform Chainalysis believes it is pointless to make any short and medium-term crypto predictions, while the market is so volatile. Still, it is confident that the cryptocurrency market “can weather any storm” in the long run:

“There’s no sugarcoating it: The unexpected potential collapse of an industry stalwart like FTX is a hugely negative development for cryptocurrency, and the resultant chaos in the markets only reinforces that. However, crypto has survived events like this before, emerged stronger, and gone on to reach new highs. We expect asset prices to eventually recover and for cryptocurrency to resume its adoption growth”.

Looking forward to cryptocurrency prediction 2023, it is yet to be seen whether recessionary pressures will mount in the crypto space, or whether BTC, ETH, and their peers will serve as investors’ safe havens. The collapse of several crypto platforms, insolvency and liquidity issues will drag the attention of regulators and hopefully make investors choose only experienced crypto players with sound risk management to trust their funds to. It can bring more high-quality cryptocurrency services and better products to the market.

Check out the live rates of the most popular cryptocurrencies at XBO.com. Note that any analysts’ and third-party predictions can go wrong. Conduct your analysis to make informed trading decisions and build your own expectations about the potential rise or fall of any crypto asset you consider adding to your portfolio.

FAQ:

Will crypto recover in 2023?

Analysts have mixed views on the short- to medium-term cryptocurrency predictions due to the latest headwinds, such as the FTX collapse. However, the long-term cryptocurrency prediction for 2023 and beyond is positive. Analysts almost unanimously agreed that the crypto market can “survive the storm” in the long run.

Where is the safest place to store crypto?

There are multiple options to store your crypto assets, from in-built cryptocurrency exchange wallets to cold wallets, representing hardware devices not connected to the internet. For example, you can store the bulk of your crypto in a cold wallet while keeping a smaller amount in a hot wallet for trading. However, all storages have advantages and disadvantages. Do your own research before trusting your funds to any platform or wallet.

What has caused crypto to crash?

The collapse of TerraUSD and LUNA, FTX fallout and further contagion, and the global economic recession are the core reasons behind the crypto winter of 2022.

Disclaimer: The above does not constitute financial advice. It is only intended for informational and educational purposes.

.png)