State of Crypto: Interpreting the Paxos-Binance Tea Leaves

Remember how the U.S. Securities and Exchange Commission’s declaration of war against crypto staking was big news for, like, two days? This week we’re looking at the other big news from last week: Paxos and the Binance USD stablecoin it issues. The SEC has apparently alleged the sale of BUSD violates securities laws, and the New York Department of Financial Services has asked Paxos to cease issuing the token.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Stablecoins as securities

The narrative

So … Paxos, eh? Stablecoin issuer Paxos is tussling with the U.S. Securities and Exchange Commission (SEC) and the New York Department of Financial Services (NYDFS) over the Binance USD stablecoin.

Why it matters

Is this the opening salvo against stablecoins? Or is this more about Binance and a U.S. company’s relationship with the exchange, which doesn’t have a clearly defined headquarters and which has often been seen as a somewhat lawless entity?

Breaking it down

To recap: Last week CoinDesk reported that NYDFS was investigating Paxos. On Sunday the Wall Street Journal reported that the SEC had sent a Wells Notice – a formal declaration saying, “Hey we think this thing you did violated federal securities laws” – to Paxos over BUSD. Somewhere between kickoff of Super Bowl LVII and hungover Eagles fans waking up the next morning, Paxos announced it was suspending issuance of new BUSD at the direction of NYDFS, which published a consumer alert on Monday.

While some are interpreting this as an assault on stablecoins, all signs so far seem to indicate this may be more about Binance and how it’s related to BUSD.

I’ve spoken to a number of individuals over the past few days about this situation, all of whom asked to speak anonymously because of ongoing work with regulators.

What we don’t know:

- How the SEC is going to define BUSD as a security. It seems difficult to square BUSD’s existence with the tenets of the Howey Test – 1) an investment of money 2) in a common enterprise 3) with the expectation of profit 4) from the efforts of others. For one thing, BUSD is a stablecoin. It’s not intended to generate a return in and of itself, and Paxos doesn’t offer a yield-bearing product with BUSD. Another case, the 1990 Reves vs. EY U.S. Supreme Court case, may be a more applicable precedent. There's also the idea that stablecoins may be money market funds. The confounding factor is that both the SEC and NYDFS seem to be focused on BUSD, and not USDP, the other stablecoin Paxos issues.

- What’s happening next on the Paxos front. Paxos has gone out of its way over the past few years to appear as regulatorily compliant as possible, securing state and federal licenses. One could expect the company to settle with the SEC, but the company has now promised to litigate should it come to that. I’ve reached out to Paxos to ask for more information.

- What’s happening next on the Binance front. This is, I think, maybe one of the more pertinent questions. The fact that these actions seem focused on Binance USD rather than Paxos itself strongly suggests Binance may be the actual target here. Making things more interesting, Binance has said it will continue to automatically convert users’ stablecoin holdings into BUSD, even though no new BUSD is being issued. I’ve asked a Binance spokesperson for more information.

What we do know is that the SEC’s so-called crypto crackdown – this week’s Wells Notice, coupled with last week’s Kraken settlement and Wednesday’s proposed rule – is escalating, and the industry is nervous.

Stories you may have missed

- Sam Bankman-Fried’s Super Bowl VPN Use Prompts Government Concern: Sam Bankman-Fried has used virtual private networks at least twice since his arrest, ostensibly to watch football games. The judge overseeing his criminal case later ruled he can no longer use these tools, at least until a hearing this week.

- South Korea’s Crypto Firms Will Have to Self-Regulate Under New Guidance: South Korea published new guidance for crypto companies, which – once adopted – would force businesses to self-regulate, though it does create some clarity for companies looking to issue tokens.

- Crypto's Banking Problem: Industry Needs Access but US Regulators Keep Digital Assets at Bay: Despite its ethos, the crypto industry needs banking relationships to operate. U.S. regulators are circling the wagons around banks now, which could make it more difficult for businesses.

- Restrictive Crypto Rules for EU Banks Confirmed in Published Legal Draft: A draft European Parliament law could, if passed, force banks to disclose both direct and indirect exposure to crypto while also imposing new capital requirements for banks holding crypto assets.

- SEC Proposal Could Bar Investment Advisers From Keeping Assets at Crypto Firms: The U.S. Securities and Exchange Commission plans to introduce a rule Wednesday that would strengthen the rules around the types of entities that registered investment advisers use to hold assets, like crypto.

Senate Banking

The Senate Banking Committee held its first hearing on crypto for 2023 on Tuesday, titled “Crypto Crash: Why Financial System Safeguards are Needed for Digital Assets” and featuring Duke Financial Economics Center Policy Director Lee Reiners, Georgetown Institute of International Economic Law Adjunct Professor and Visiting Scholar Linda Jeng (who’s also general counsel at the Crypto Council for Innovation, though she did not appear in that capacity) and Vanderbilt University Law School Professor Yesha Yadav.

I live-tweeted the hearing; you can catch up here.

The two pieces of news: Senators Elizabeth Warren (D-Mass.) and Roger Marshall (R-Kansas) plan to reintroduce a bill enhancing anti-money laundering and know-your-customer rules around crypto, and Senator Thom Tillis (R-N.C.) is working on a proof-of-reserves bill.

Beyond that, I’m not that sure we learned too much during the hearing. In many respects, it played out typically – skepticism from the committee chair, Senator Sherrod Brown (D-Ohio), a focus on the SEC from the ranking member, Senator Tim Scott (R-S.C.), and largely predictable answers from the witnesses.

The big question, as always, is whether and when Congress will actually start moving a bill. The expectation still seems to be that stablecoins will be the first area Congress actually addresses, though we didn’t hear too much about stablecoins in Tuesday’s hearing.

Moment of Reckoning

For a brief moment in time, a former crypto executive was running one of the U.S. agencies that regulates national banks, the Office of the Comptroller of the Currency.

Under the watch of Brian Brooks, who returned to the crypto industry after he left the OCC, the regulator took an open-armed approach to digital assets. For a while, the OCC encouraged crypto firms to chase charters, and a few of them got provisional access into the ranks of trust banks. With the arrival of President Joe Biden’s more crypto-suspicious appointees, though, the door slammed shut, and since then the FTX debacle released a poisoned cloud into the offices of the U.S. banking agencies – also including the Federal Reserve and Federal Deposit Insurance Corp.

The crypto industry really wants to connect to U.S. banking. It’s the only way companies are likely to fulfill their dreams of mass adoption. But as the Federal Reserve demonstrated when it barred Custodia Bank from the list of its Fed-connected lenders, crypto isn’t yet finding a harbor in the federally regulated industry. That impasse means the wider crypto world is unlikely to soon reach the mainstream status that many hoped for, with its free and reliable flow of regulated transactions.

Crypto took a big step back in 2022, and its damaged reputation among the regulators (who are publicly breathing a sigh of relief that they made it hard for digital assets to get inside banking) and the U.S. lawmakers who have been poised to work on the first major industry legislation will be difficult to overcome by the end of this year.

Also, the federal government isn’t through with its campaign of enforcement actions and prosecutions, which the White House recently egged on. So far, 2023 is shaping up as a moment of reckoning between crypto and the U.S. watchdogs.

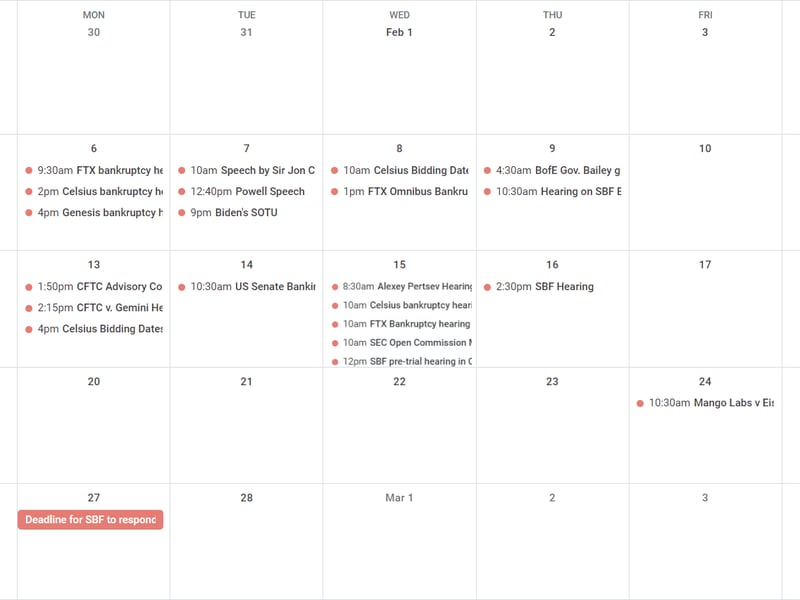

This Week

Monday

- 18:40 UTC (1:50 p.m. ET) CFTC Advisory Committee panel on crypto

- 19:15 UTC (2:15 p.m. ET) CFTC v. Gemini hearing

- 21:00 UTC (4:00 p.m. ET) Celsius Bidding Dates (revised)

Tuesday

- 15:30 UTC (10:30 a.m. ET): The Senate Banking Committee held its first crypto hearing of the year (see above).

Wednesday

- 13:30 UTC (8:30 a.m. ET) Hearing in Tornado Cash Developer Alexey Pertsev’s criminal case in the Netherlands

- 15:00 UTC (10:00 a.m. ET) Celsius Bankruptcy Hearing

- 15:00 UTC (10:00 a.m. ET) FTX Bankruptcy Hearing (See also)

- 15:00 UTC (10:00 a.m. ET) SEC Open Commission Meeting

- 17:00 UTC (12:00 p.m. ET) Pretrial hearing for CFTC v. Sam Bankman-Fried (my guess is, like the SEC case, this case will be stayed).

Thursday

- 19:30 UTC (2:30 p.m. ET) Arguments on Sam Bankman-Fried’s bail conditions

Elsewhere

- (The Air Current) A United Airlines Boeing 777-200 entered a steep dive after takeoff out of Maui, Hawaii, falling to just under 800 feet above sea level from an altitude around 2,000 feet. During the recovery, the plane pulled as many as 2.7 Gs (2.7 times the force of gravity). The National Transportation Safety Board opened an investigation after TAC reported the news.

Tweet