Perpetuals-Focused Decentralized Exchange GMX Surpasses Uniswap in Daily Fees Earned

Decentralized exchange GMX has evolved as a serious competitor to established industry players like Uniswap in the wake of FTX's collapse.

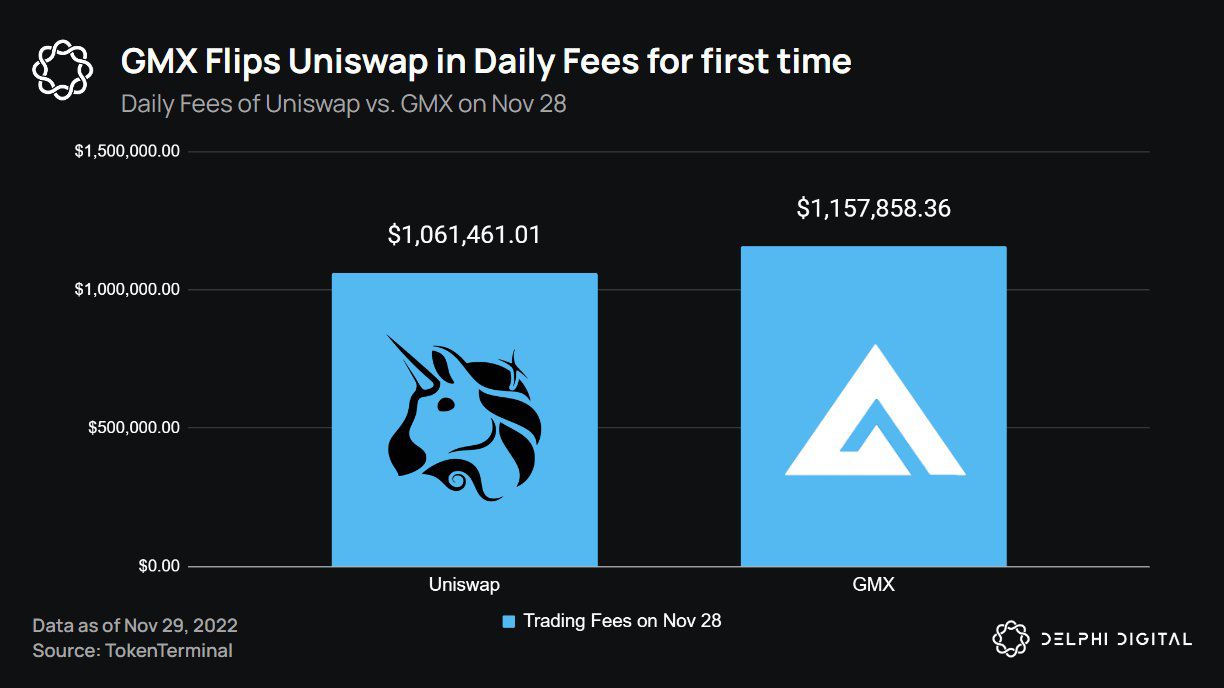

On Monday, GMX earned $1.15 million in trading fees, surpassing Uniswap's $1.06 million for the first time on record, according to data tracked by Delphi Digital.

The decentralized exchange, which allows users to trade perpetuals or futures with no expiry without an intermediary using smart contracts, is perhaps benefitting from a broader shift toward perpetual-focused decentralized platforms triggered by the recent fall of centralized giant FTX.

GMX went live on Ethereum layer 2 solution Arbitrum in September 2021 and debuted on Ethereum-competitor Avalanche early this year. The platform offers relatively low transaction fees and zero price impact or the influence of a single trade over the market price.

Crypto perpetuals trading was first launched by centralized exchange BitMEX in 2016 and later dominated by its rivals Binance and the now-insolvent FTX.

Sam Bankman Fried's exchange FTX filed for Chapter 11 bankruptcy protection on Nov. 11, denting investor confidence in centralized exchanges.

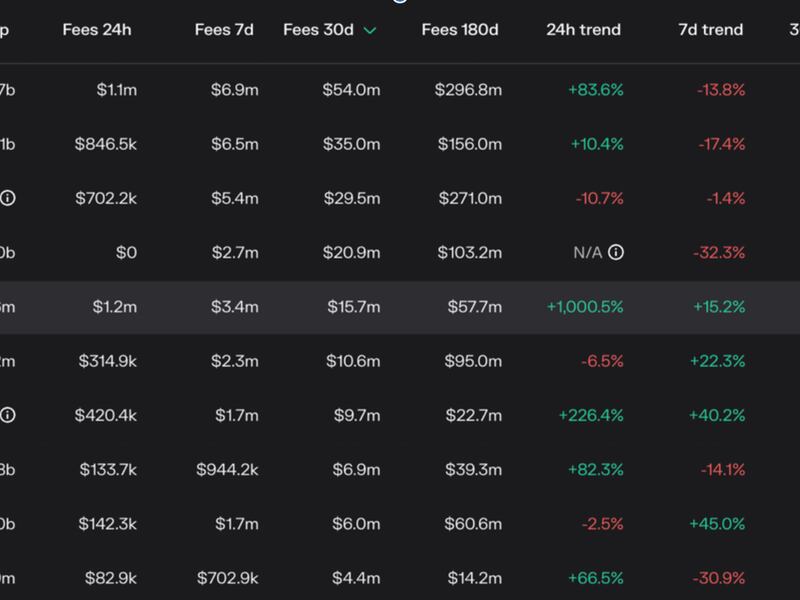

GMX has pocketed $15.7 million in trading fees in four weeks, becoming the fifth-largest decentralized application, ahead of prominent players like dYdX and AAVE, according to data source Token Terminal.

GMX's hosts, Arbitrum and Avalanche, have earned $985,600 and $540,500 in trading fees in 30 days. Uniswap has collected $54 million in trading fees, retaining the industry leadership.

Yet, Uniswap's UNI token has declined by 16% this month, while GMX has gained by 4%.

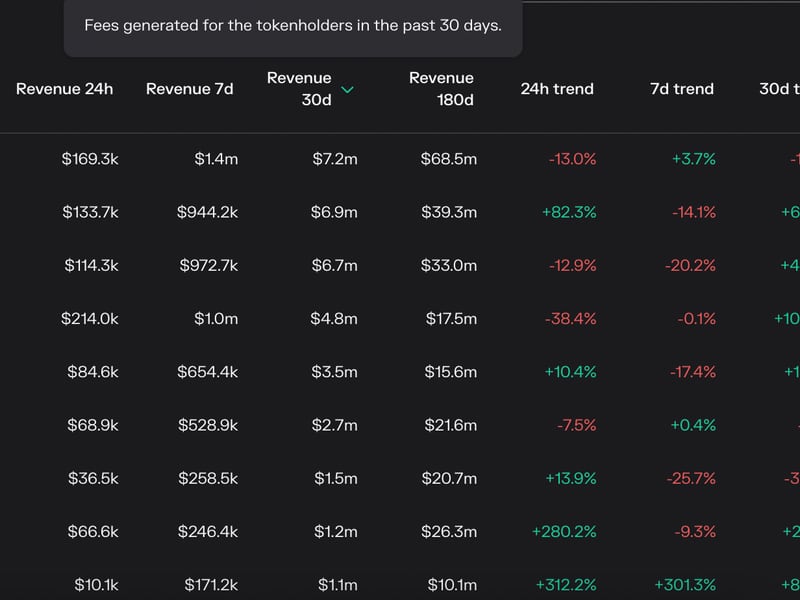

GMX's outperformance probably stems from the fact that the GMX token holders receive 30% of all the trading fees, while the UNI token holders do not receive a share in trading fees.

GMX has distributed $4.7 million to the token holders in the past 30 days, the fourth-largest payout among all decentralized applications.