OKX Publishes Proof-of-Reserves Report Showing $7.5B in ‘Clean Assets’

OKX has $7.5 billion in reserves, and these reserves do not contain its native token, according to a proof of reserves published by the exchange on Thursday.

This is the third proof of reserves OKX has published, but the first to show the exact breakdown of assets.

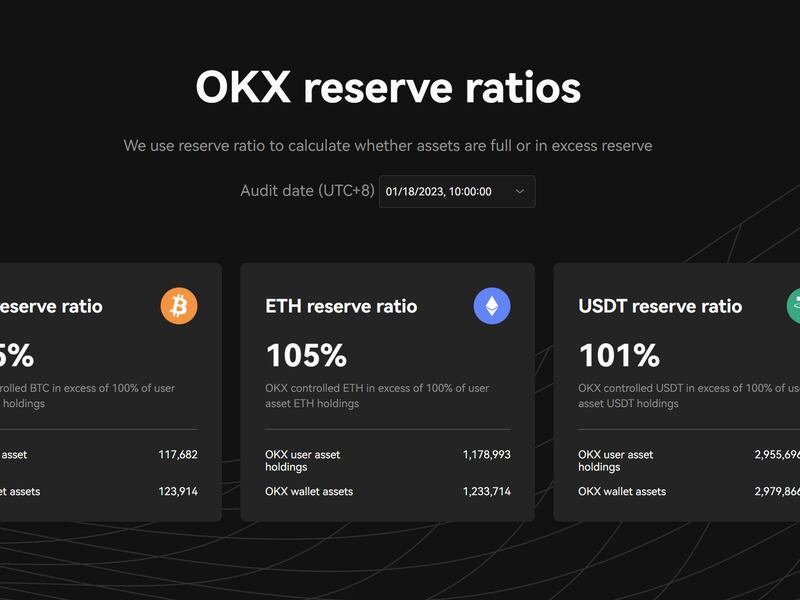

The report shows that the exchange is overcollateralized with a reserve ratio of 105% for bitcoin (BTC), 105% for ether (ETH), and 101% for USDT.

OKX publishing the exact asset mix comes as a response to an CryptoQuant developing a metric to measure the “cleanliness” of reserves. CryptoQuant defines this as how reliant an exchange is on its native token. CryptoQuant’s data shows that OKX’s reserves are 100% clean. Binance, meanwhile, is 87% clean, Bitfinex is 70% clean, and Huobi is 60% clean.

“I personally think everyone will learn a ton over the next six months to a year. We will all stress test each other’s proof of reserves, hopefully in a constructive way,” Haider Rafique, OKX’s Chief Marketing Officer, told CoinDesk in an interview. “We are all going to learn from each other and ask the hard questions - hopefully most venues have good intentions.”

Rafique says that OKX plans to publish its proof-of-reserves report every month. The exchange also plans to launch a bug bounty program allowing developers to “poke” at the report to see if there are any bugs in the system or anything else that OKX needs to address.

A different kind of native token

The so-called cleanliness of reserves is important due to the relationship between the now-bankrupt FTX and its sister company Alameda Research. As CoinDesk reported in November, a material portion of Alameda’s balance sheet was made up of FTT - a synthetic creation of FTX. From this, numerous questions emerged about what was backing Alameda’s ability to trade and invest.

Further, in late December, the U.S. Securities and Exchange Commission said in a complaint against former Alameda executive Caroline Ellison that FTT, and by virtue of the fact other exchange tokens, are investment contracts and thus a security. Ellison isn’t contesting the SEC’s claims as part of her overall guilty plea and is cooperating with prosecutors.

In this complaint, the SEC highlighted that FTX planned to use the funds from the FTT sales to create, promote, and manage the FTX business, with the aim of making FTT an "investment" with potential for profit.

“We’ve never used a native token to finance the company,” Rafique said to CoinDesk. “The native token was never a big part of our business or treasury. Our native token was always designed to engage our most active customers and give them a way to seek discounts through activity on the platform.”

Separation between coin and exchange

While other exchanges have launched their own stablecoins - and with this has come its own set of problems - Rafique says that’s not on the agenda for OKX.

“We don't believe any trading venue, centralized or decentralized, has any business, launching their own asset that gets traded, even a stable asset that people settle in,” Rafique said. “There are many conflicts of interest that exist. It goes back to our philosophy around native tokens. We aren’t building our company around a native token offering.”

Investing with fiat

OKX does operate a venture fund called OKX Ventures, but as Rafique explained, this firm has a separate balance sheet and an executive team that manages it.

And when OKX Ventures invests, it uses fiat currency.

“It’s a very traditional fund with a very traditional format,” Rafique said.